Indian E-Commerce Giant Meesho Targets ₹52,500 Cr Valuation in December IPO

Nov 26, 2025

India’s consumer internet story is entering a new phase, and Meesho has quietly positioned itself at the heart of it.

In India’s value-commerce and e-commerce universe, Meesho began as a modest WhatsApp-reseller marketplace, serving tier-2 and tier-3 consumers. Now as Meesho prepares for its much-awaited IPO in December 2025 the company is seeking a valuation of nearly ₹52,500 crore making it one of the largest, largest listings in India's digital commerce history.

The company plans to raise ₹4,250 crore through fresh issue and additional shares through an offer for sale (OFS) from early stage investors.

Meesho's strength lies in its deep penetration into categories such as homewares, kitchenware and fashion, fashion and its seller empowerment approach to bring micro-entrepreneurs and small sellers online. This seller-first ecosystem creates network effects that differ from the inventory-intensive logistics-focused models of some competitors: Meesho relies heavily on third-party sellers' light working capital structures and a suite of tools designed to improve discoverability and conversion for small merchants.

Meesho IPO: Use of Proceeds

Reportedly, the ₹4,250 crore fresh issue will be used to: (a) build cloud and technology infrastructure (AI and recommendation systems), (b) scale marketing and customer acquisition, and (c) support product development and strategic M&A. These are typical for a scale-up aiming to lock in market share and raise lifetime value.

IPO Lead Managers: Kotak Investment Banking, JPMorgan, Axis Capital, Citi and Morgan Stanley are the book running lead managers.

Who’s selling and who backs Meesho?

Meesho’s cap table includes marquee global and domestic investors: SoftBank, Prosus, Peak XV, Elevation Capital, WestBridge and others. Several of these are expected to partially exit via the offer-for-sale, making this a liquidity event for late-stage backers as much as a capital raise for the company.

What Makes Meesho’s IPO Stand Out?

India’s next wave of e-commerce growth is coming not from premium shoppers, but from the 200–300 million middle-class and lower-middle-class users who transact frequently at low ticket sizes.

Meesho sits exactly in that sweet spot.

Its strength lies in:

- High repeat behaviour

- A vast, hyperactive seller ecosystem

- Strong penetration in non-metro India

- Improving cost-to-serve metrics

- A low-cost business model built for high volume

Meesho captured roughly 23-25% market share in the home, kitchen & furnishing e-commerce segment as of June 30 2025.

The firm processed 1.3 billion orders and had over 187 million annual transacting users as per its DRHP.

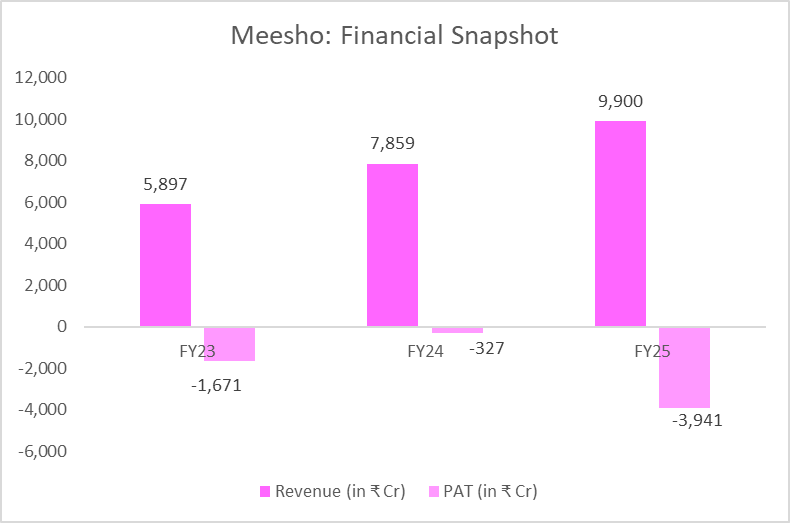

Although still running losses (FY25 saw losses widen to ~₹3,941 crore due in part to one-off costs), the fresh IPO proceeds are targeted at scaling cloud infrastructure (~₹1,390 crore), AI/ML hiring (~₹480 crore) and brand marketing (~₹1,020 crore).

What is the price of Meesho IPO unlisted shares?

Till the time IPO hype hit the market and during this time of pre-IPO phase Meesho unlisted shares are already actively trading in the private-pre-IPO market.

Currently, Meesho share price in unlisted market is around ₹2,408 per share.

The price has risen steadily in 2025 as expectations of the December IPO grew stronger. Historically, pre-IPO markets tend to price in both FOMO and future growth but they also offer an early indicator of investor sentiment. In Meesho’s case, the sentiment has been clearly bullish.

Meesho IPO: Risks and Concerns

Meesho faces intense competition from deep-pocketed incumbents that can subsidise scale for long periods, and price wars or seller incentives could compress margins. Logistics costs returns and high unit costs of servicing low-cost orders all put constant pressure on profitability. The execution risks of technology investments are real: large capital in AI and cloud must result in measurable conversions retention and LTV improvements or the capital will seem unaffordable. Guess what? Finally, broader market sentiment and macroeconomic changes can quickly recalibrate consumer tech valuations so timing is a non-trivial factor for investors considering participation.

For investors analyzing this IPO the practical checklist is straightforward: review the final prospectus for accurate disclosure of the GMV run rate consolidated profitability trends and revenue mix and margin factors; Clarify the use of revenue and the management of KPIs , KPIs that you will use to measure progress; It monitors fundamental investor demand and the ultimate price band that sets expectations for overall market performance.

Conclusion

Meesho's proposed valuation of ₹52,500 crore and significant re-raising makes it one of the largest , largest consumer IPOs in India in 2025. You know what? The story is based on a compelling transition: from a fast-growing unprofitable market , to a scalable monetizable platform that can defend stocks against corporate giants while improving unit economics. The final prospectus in the coming weeks pre-fund or Pre IPO allocations and price band will determine whether the market rewards Meesho's growth narrative with the target valuation.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.