Is Fabtech’s Rs 230 Crore IPO Your Next Pharma Jackpot?

Sep 29, 2025

India’s IPO market has been buzzing with activity this year, and the next one on the block is Fabtech Technologies, a cleanroom and turnkey solutions provider for pharma and biotech companies. The company is securing over ₹230 crore through a fresh issue IPO route, with the price band set at ₹181–191 per share. The issue opens and the start date would fall on September 29, 2025 and closes on October 1, 2025.

So, what does Fabtech actually do? It is not a company that produces drugs. Rather, this unique setting creates a cleanroom, HVAC system, modular walls, flooring, and complete installations that pharmaceutical producers and biotechnology companies require to adhere to stringent regulatory requirements. With more than 90% of its revenue coming from pharma and healthcare customers, Fabtech has made a place in this highly regulated industry.

Core Business: The company provides end-to-end solutions for pharmaceutical, biotech and healthcare industries. This includes commissioning, designing, engineering, procurement equipment, installation, testing and commission of complete production facilities.

Global Reach: As of mid-2025, Fabtech had successfully executed projects in over 62 countries, including Saudi Arabia, Nigeria, the USA, and Bangladesh. This global appearance brings variety to its revenue sources and taps in the growing demand for infrastructure of drugs worldwide.

Integrated model: By offering "One-stop-shop", the company reduces the execution risk for its customers, which can increase strong customer relationships and repeat business.

Asset-light model: The company follows an asset-light business model, which focuses on project management and execution, purchasing equipment from concerned institutions and third-party suppliers.

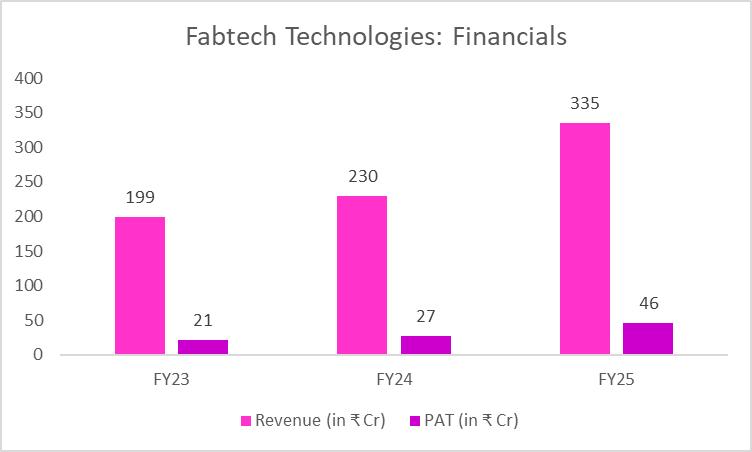

Fabtech Technologies: Financial Performance

Fabtech's financial strong growth highlights, with the revenue growing from ₹199 crores in FY23, has increased to ₹335 crores in FY25, and in the same period the profits after tax surged and consistently improved from ₹21 crore to ₹46 crore. Referring to better operating efficiency, the margin has expanded continuously from 10.6% to 13.7%. However, there is a matter of concern: its cash conversion cycle has increased from 45 days to 85 days in FY22 in FY23. This indicates that a large part of the capital is now bound in the receivable and inventory, which indicates the working capital-intensive nature of the business. While the speed of development looks solid, it will require strict control over cash flow to avoid stress of liquidity to maintain it.

Pointers to keep in mind:

Revenue & Profit Volatility: The company experienced a decline in revenues in FY24 compared to FY23. For example, revenue dropped ~22% from ~₹125.10 crore in FY23 to ~₹97.99 crore in FY24. Also, PAT dropped in the same period.

Heavy Working Capital Requirement: A substantial portion of the IPO proceeds is being allocated to working capital. Also, dependence on advances, receivables etc will matter.

Customer Concentration: The company seems to have a significant portion of revenue tied to a limited number of customers.

Reliance on Related Parties / Suppliers: Some of Fabtech’s procurement is from related entities, and the acquisition of Kelvin Air Conditioning/Ventilation Systems is part of the IPO use of funds.

HVAX Technologies, A Peer Analysis

To understand Fabtech’s trajectory, it helps to look at HVAX Technologies, a more established player in the cleanroom and HVAC space. HVAX has taken a more measured growth path, with steady revenues, stronger balance sheet discipline, and predictable cash flows. While it doesn’t deliver the same high growth as Fabtech, its ability to manage working capital better has made it a stable mid-cap story.

This contrast is telling: Fabtech is the fast-scaling challenger, hungry for growth but exposed to liquidity stress. HVAX, on the other hand, is the steady incumbent, trading at more mature valuations with lower execution risk. For investors, Fabtech’s bet is essentially on whether it can grow like HVAX without stumbling over its aggressive pace.

Valuation Perspective

Fabtech Technologies Ltd's post-IPO market capitalization is estimated to be ~₹849 crore. This valuation is based on the company's projected and estimated share price post-listing, which is expected to be around ₹191 per share at the upper end of the IPO price band.

The IPO comprises a portion of fresh issue of 1.21 crore equity shares, which is aggregating to ₹230.35 crore. After the issue, the total number of shares outstanding is expected to be around 4.45 crore.

At the upper price band, the IPO values Fabtech at roughly ₹849 crore market cap post-listing, depending on subscription and demand. On FY25 earnings of ₹46 crore, that translates into a P/E multiple of ~18–19x and a Price-to-Sales ratio of ~2.7–3.0x. This reflects a reasonable valuation for a company in the biopharma engineering space.

Conclusion

Fabtech's IPO provides exposure to investors for an important niche in Pharma and Biotech Infrastructure. With strong revenue growth, to improve profitability, and to expand global reach, basic fundamentals seem to be promising. But investors must weigh the risks of project lumpiness, working capital pressure, and premium valuation before calling it a “jackpot.”

If Fabtech sustains its trajectory and executes well, it may just turn this IPO into one of the more interesting pharma-adjacent plays of 2025.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.