Pace Digitek IPO Opens Soon—Is This the Biggest Listing of 2025 at ₹208–219 Per Share?

Sep 26, 2025

The IPO season in India is heating up, and among the offerings drawing attention is Pace Digitek Ltd. The company, which operates in telecom passive infrastructure and energy projects, is set to open its public issue from September 26 to September 30, 2025, with a price band of ₹208 to ₹219 per share. With a fresh issue size of around ₹819.15 crore, this is one of the larger IPOs of late but by no means the biggest of the year.

While ₹819 crore is a large offer, there have been larger IPOs in 2025. This is mid-large size. It’s not in the “mega IPO” league. For investors, it’s one of the more interesting tech, infrastructure, and energy hybrid IPOs, but it doesn’t beat the biggest fund raise of the year.

Company Profile and Business Overview

Founded in 2007, Pace Digitek is a multi-disciplinary solutions provider with a strong foothold and domain presence in the telecom passive infrastructure, energy, and ICT sectors and various regions it has diversified offering across several key areas, comprises:

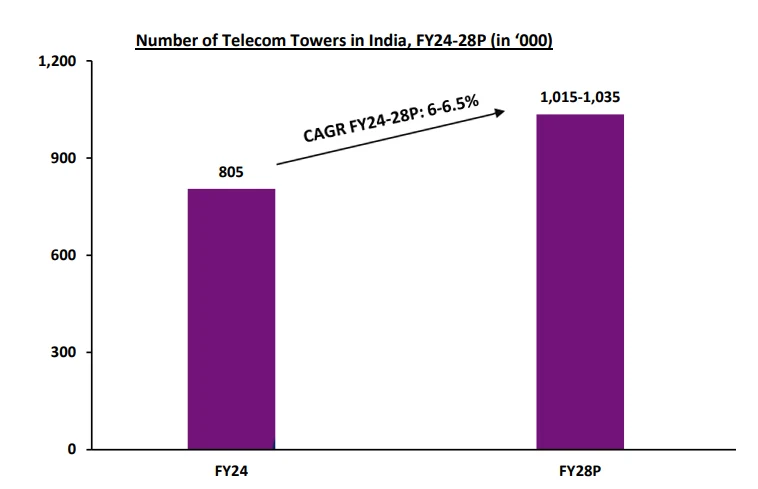

Telecom Infrastructure: This domain segment provides solutions for telecom towers and optical fiber cables (OFC).

Energy Solutions: Offering renewable energy solutions like solar power systems and lithium-ion battery energy storage systems (BESS).

ICT: Engaging in projects for smart cities, surveillance, and agritech.

The company has a global appearance, which has operated in India, Sri Lanka, Bangladesh, Myanmar, Philippines and various African markets. Paes Digitek's business model is based on both the manufacture and supply of products and undertakes large -scale engineering, procurement, and construction (EPC) projects. As of March 31, 2025, the company had a robust order book of ₹7,633.6 crore.

Pace Digitek IPO Details

The issue is priced between ₹208–₹219 per share with 3.74 crore equity shares being offered making the gross raise about ₹819.15 crore. The company plans to use ₹630 crore of the net proceeds for capital expenditure (notably in BESS and infrastructure expansion), with up to 25% of proceeds and making plans that company proceeds in operations reserved for general corporate uses. Pre-issue, the promoters held ~84.1% stake; post-issue, promoter shareholding is expected to dilute to ~69.5%.

IPO Open Date | September 26 2025 |

IPO Close Date | September 30 2025 |

IPO Allotment Date | October 1 2025 |

IPO Listing Date | October 6, 2025 |

Issue Size | ₹819.15 Cr |

Price Band | ₹208 - ₹219 per share |

Lot Size | 68 shares |

Financial Performance

Pace Digiteck has shown strong financial growth, especially in recent years.

Revenue from operation: In FY23, revenue increased from ₹503.20 crore to ₹2,438.78 crore in FY25. This significant jump was primarily driven by large public sector telecom projects.

Profit After Tax (PAT): In FY23, from ₹ 16.53 crore to ₹ 279.10 crore in FY25, it increased to a significant increase in profitability.

The company's financial health is also reflected in its major performance indicator (KPI) for FY25, such as a return of 23.09% equity (ROE) and an Ebitda margin of 20.71%, which is stronger than the industry average.

Pace Digitek IPO Opportunities

Strong Order Book: ₹7,600+ crore in confirmed orders offers a long runway. That means there's momentum and visibility.

Margin reform: Despite the flat revenue growth between FY24 and FY25, the company has greatly improved profitability. High margins suggest better cost control, scale benefits or high price contracts.

Growth via Energy Infrastructure: BESS and energy-related works are areas of increasing government / private interest (renewables, storage). Pace Digitek’s investments here may pay off, especially if projects deliver well.

Low Leverage & Healthy Financial Ratios: Lower debt levels and decent ratios like ROCE, ROE help reduce risk compared to highly leveraged peers.

Pace Digitek IPO: Risks and concerns

Flat Revenue Growth from FY24 to FY25 suggests current operations may hit a plateau unless new contracts scale up. Profit growth is good, but sustaining it depends strongly on order conversion and project execution.

Public sector dependence means policy change, payment delays, risk for regulatory approval. Government contracts often come with slow cash flow.

Execution risk in large capital projects like BESS: Setup delays, supply chain deficiency, cost overrun, or regulatory hurdles (permit, approval) may erode estimated profits.

Conclusion

Paes Digitek's IPO offers an attractive risk-reward proposal to investors that lead to India's strong telecom infrastructure and increasing importance of energy storage. A strong order book (by March 2025 ~ ₹7,634 crore) extends to both telecommunications and energy segments, and a track record of improving profitability (21% increase in net profit in FY25), the company enters public markets with real substances.

Nevertheless, the way forward is not without challenges. Its heavy dependence on government contracts and a concentrated customer base, long-appropriate, and execution risk factors in capital-intensive projects (especially BES and solar units) are invested. Investors should look closely.

At the pricing band of ₹ 208-219, the assessment looks appropriate and is not more aggressive given the company's capacity. Does Pace Digitek become one of the standout listings of 2025, eventually depending on how well it distributes on its big project backlog, enhances its energy business, and maintains margin under competitive pressure. For long -term investors with a tolerance to infrastructure and project risks, an IPO is worth a serious form. For others seeking quick listing benefits, cautiousness can be taken.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.