Pace Digitek Receives SEBI Clearance for ₹900 Crore IPO

Sep 13, 2025

India's telecommunications and digital infrastructure story has entered a new chapter. The Securities and Exchange Board of India (SEBI) has indicated nod for the initial public offering (IPO) of Pace Digitek Limited, which paves the way for the 900 crore issue. This development comes at a time when India is expanding its 5G network and laying the foundation for future technologies such as IOT, Edge Computing and AI-run connectivity.

The Company at the Heart of India’s Fiber Revolution

Pace digitek business is deeply embedded in everyday connectivity. The company specializes in the telecom infrastructure services, providing an end-to-end solution in fiber optic deployment, maintenance and energy-related assistance systems. Reliance Jio and Bharti Airtel aggressively scale their 5G networks, demand for backbone infrastructure such as fiber, towers and energy management has significantly increased, providing a strong tailwind for players such as Pace Digital.

The firm has constantly developed as a major service provider for India's telecom backbone, not only working with telecom giants, but also for energy and utility to customers. Its diversification in energy solutions align with India's telecom infrastructure pushing towards renewable power integration, combining another growth lever.

Financial Performance and Growth Momentum

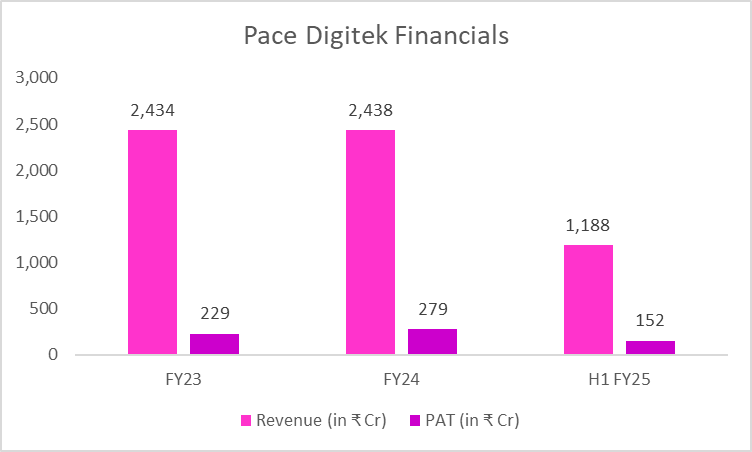

The financial expansion of Pace Digitec underlines its stable expansion. On a consolidated basis, the company reported revenue of ₹2,438 crore in FY24, which is widely stable in FY23 compared to ₹ 2,434 crore. Speaking about profit after tax (PAT) marked a year-on-year increase of 21% as profit has surged from ₹229 crore in FY23 to ₹279 crore in FY24. Currently, In H1 FY25, the revenue reported at ₹1,188 crore, showing a strong momentum and potential with a profit of ₹ 152 crore.

Even in its standalone books, profitability shows strengthened, with PAT increased from ₹170 crore in FY23 to ₹233 crore in FY24. Margin expansion highlights the company's ability to optimize the cost and occupy the value despite the environment of a competitive industry.

In the unlisted pre-IPO market, Pace Digitek share price currently trades at around ₹230, implying a P/E multiple of ~14.4x based on FY25 EPS of ₹16. Based on its expected ~₹4,104 crore IPO valuation, the company would be priced at about 15x earnings and ~2x sales.

The Pace Digitek IPO size of ₹900 crore will partly go toward debt reduction, working capital, and expansion of service capabilities. Based on preliminary reports, the company could be valued at ₹4,000–4,100 crore post-listing. At this valuation, Pace Digitek would trade at about 18–22x its earnings and around 2x sales.

For context, large telecom tower and infra companies such as Indus Towers trade at 12–14x earnings, though their growth is slower. Pace Digitek, with its dual play in telecom and energy services, can potentially command a premium if it sustains double-digit profit growth and continues aligning with India’s 5G and energy transition roadmap.

Pace Digitek IPO Details

What sets Pace Digitek apart is how it intends to deploy IPO proceeds. Nearly ₹630 crore is earmarked for expanding BESS projects through its subsidiary Pace Renewable Energies, while the remainder will be used for general corporate purposes. With data usage surging and renewable penetration rising, energy storage is extremely anticipated to be a significant constraint or bottleneck for both telecom and grid networks. If planned effectively and executed exactly accordingly, this move could diversify revenue streams beyond lumpy and inconsistent EPC contracts and deliver more stable, long-term cash flows.

Industry Context: Riding the Digital India and 5G Wave

India has rapidly enhanced fiber optic connectivity to support the rollout of the 5G network, in which telecom operators have invested billions in spectrum and network deployment. Nevertheless, as of today, the fiberization of India's telecom towers is only 35% compared to more than 80% in advanced markets.

This gap represents a massive growth opportunity. Companies like Pace Digitek, which provide the “last-mile” and backbone services in fiber deployment, are positioned to benefit directly from this expansion. Moreover, as data consumption in India continues to climb, currently the world’s highest per user will only increase the pressure on operators to expand the capacity, maintaining the long -term demand for infrastructure services.

Risks and Challenges

No IPO is without risks. Pace Digitek’s fortunes are tied closely to telecom operators’ capex cycles. Any slowdown in 5G rollout or price wars between telcos can affect the demand for infra services. Additionally, the company works in a competitive location where pricing pressure is common.

Another risk is execution: laying fiber and managing energy systems at scale require strong operational efficiency, and delays or cost overruns can eat into profitability.

Pace Digitek: A Bet on India’s Connectivity Future

Despite risks, the larger narrative remains favorable. India is building the backbone of its digital economy—fiber optic cables, towers, and energy solutions are its arteries. The government’s Digital India mission, push for BharatNet, and private sector investments in 5G are converging to create a multi-year growth story for telecom infrastructure.

For investors, Pace Digitek’s IPO offers exposure to this structural theme. Its scale, profitability, and positioning make it a differentiated play compared to larger, slower-moving incumbents.

Conclusion

The SEBI clearance for Pace Digitek’s ₹900 crore IPO marks more than just another listing. It signals investor appetite for companies that form the invisible backbone of India’s digital economy. If Pace Digitek can deliver and provide sustained revenue growth, capitalize on India’s fiber and 5G expansion, and manage execution risks effectively then presenting it has the potential to reward long-term investors handsomely. For now, the IPO looks like a calculated bet on India’s connectivity future where telecom and energy converge to power the next phase of digital growth and development.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.