Tata Capital IPO Update: DRHP Filing Triggers 6.2% Surge in Tata Investment Shares

Jul 25, 2025

The financial corridors are abuzz as Tata Capital, a pivotal arm of the esteemed Tata Group, advances its initial public offering (IPO) process with renewed vigor in 2025.

The recent catalyst particularly with the submitting of its updated Draft Red Herring Prospectus (DRHP) with Securities and Exchange Board of India (SEBI) has not only signaled development for the Tata capital IPO but additionally sparked a significant and notable 6.2% rally in Tata Investment shares, which holds a strategic stake in Tata Capital.

This recent event embarks and highlights investor sentiment and confidence along with anticipation surrounding the upcoming public debut, marking a substantial milestone within the Indian NBFC (Non-Banking Financial Company) landscape.

Tata Capital IPO Details

Tata Capital has been preparing for market listing for a long time and finally going to list certainly one of the biggest IPOs in India’s financial offerings arena in 2025, with the planned IPO Structure to raise about ₹17,200 crore through the combination fresh issue and offers for sale (OFS).

This great capital infusion aligns with regulatory mandates that require large NBFCs to get listed by the period of timeline mandated by September 2025. The fresh issue could bolster Tata Capital’s came this far and showcased extreme potential to increase its loan book and penetrate underserved markets, in particular in SME segments, at the same time as the OFS will see Tata Sons and International Finance Corporation (IFC) offloading a combined substantial stake.

Tata Capital Share Price Reaction

The significant surge in Tata Investment stocks, which rallied 5-6% following information of the DRHP submitting, displays the market’s optimism about Tata Capital's valuation and listing potential. Tata Investment Corporation presently holds approximately 2.15% stake in Tata Capital, making it a right away beneficiary of the IPO buzz and excitement all around.

The ripple effect across Tata institution shares clearly demonstrated the impact of the upcoming IPO on the broader Tata ecosystem, attracting significant upcoming attention towards the planned IPO from institutions and investors alike.

Digging deeper into the valuation dynamics, the Tata capital unlisted shares experienced a top notch price journey leading to early 2025, surging from around ₹300 in 2022 to a peak of approximately ₹1,050-1,100 in early 2025, driven via robust pre-IPO sentiment and regulatory expectations. However, publishing the DRHP submission and revised valuations, these unlisted shares have seen a correction to about ₹875-900 levels, indicating a 30% markdown from their height.

Parallelly, the Tata capital unlisted share price within the grey market has been ranging between around share price ₹900 to ₹1,100 in mid-2025, reflecting the continued anxiety among bullish anticipation and valuation pragmatism created notable investment spark. The gray market remains an essential indicator, representing investor sentiment earlier than the real information about the IPO price band is introduced.

The Tata capital grey market price as a consequence offers a real-time glimpse into secondary market perceptions, which presently suggest a mild tempering compared to its in advance exuberance.

Tata Capital operates as a diversified NBFC with strong backing from Tata Sons, which owns ~ 88.6% stake, and other Tata group companies holding an additional 7%. The company’s portfolio spans retail and SME lending, commercial finance, wealth and investment banking, private equity, and sustainable finance solutions, positioning it well within the growing credit demands of India’s economy.

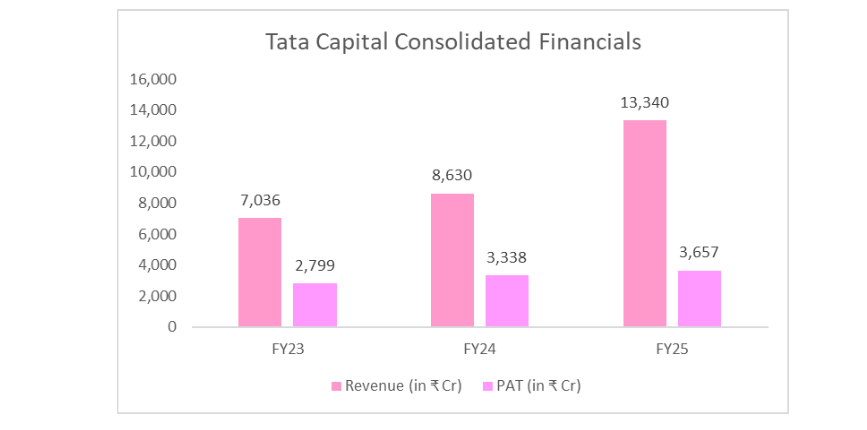

With assets under management (AUM) reported at ₹2.2 lakh crore in FY25 and a consistent net profit surge to ₹3,657 crore, Tata Capital exhibits robust financial health despite some rising non-performing assets (NPAs).

On the valuation front, the saga becomes even more compelling. The Tata capital unlisted shares witnessed meteoric rises between 2022 and early 2025, soaring nearly threefold from ₹300 to over ₹1,000, propelled by speculators and pre-IPO investors banking on Tata’s growth promise. Yet, the IPO price band, tentatively pegged around ₹400, has sent ripples of caution through these unlisted avenues. This sizable markdown presents a clear signal: the public market listing will come at a conservative P/E ratio that weighs operational fundamentals over speculative frenzy.

Early investors betting at unlisted heights now see a reset—a classic example of how public market discipline tempers private enthusiasm. For informed investors eyeing the Tata capital pre IPO phase, this recalibration serves as a crucial lesson in patience and prudence.

Outlook as the IPO Approaches

Tata Capital grey market pricing remains a high-risk, high-reward space—cautious traders may prefer to stay close to IPO pricing levels.

Tata Capital had rolled out its rights issue at ₹343to serve as a strong valuation anchor for both listed and unlisted markets.

In the ongoing outlook and market sentiment investors should keenly follow the Tata Capital share price evolution and for this it is essential to recognize that the true price discovery process unfolds post-listing. The grey market and unlisted share prices offer first-rate insights, regularly leading headline market expenses by months, however the public market will in the end validate valuations through transparent demand and supply for dynamics.

The coming quarters should witness heightened volatility but also big possibilities for long-term price advent and crucial advancement is needed as Tata Capital unlocks new capital, expands lending, and benefits from greater marketplace scrutiny.

Conclusion

In essence, Tata Capital’s IPO journey represents a blend of legacy, regulation, and market ambition. The 6.2% significant recent surge in Tata Investment shares post-DRHP filing isn’t just a percentage point rise rather above that it signals potential and specifically indicates renewed investor faith in Tata Capital’s forthcoming public market transformation.

As grey market prices oscillate and unlisted share valuations recalibrate, knowledgeable informed investors have to carefully stabilize enthusiasm with financial discipline. The Tata Capital IPO isn't merely a transaction; it is an emblematic case of India’s evolving capital marketplace story—in which investment tradition meets disruption, and where patient investing may also acquire great rewards.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.