Tata Capital’s $2 Billion IPO—Will India’s Hottest NBFC Deliver Market-Breaking Returns?

Oct 2, 2025

When a Tata Group company comes to the markets, investors pay attention. And when that company is Tata Capital, the financial services arm of the $150-billion conglomerate, the buzz naturally turns into a roar. Tata Capital is all set to raise nearly $2 billion (₹15,512 crore) through its IPO, making it one of the largest ever in India’s NBFC space. But behind the excitement lies a tricky question: will this much-anticipated listing turn into a blockbuster like Tata Technologies, or will lofty valuations weigh it down?

At its core, Tata Capital is not a bank but a non-banking financial company (NBFC). It lends across retail and SME segments, offering everything from home loans, vehicle financing and personal loans to small business lending and structured corporate credit. In recent years, it has scaled rapidly, building a loan book of over ₹2.2 lakh crore and positioning itself as one of India’s largest NBFCs. The company’s biggest advantage is brand trust. For millions of borrowers, the Tata name carries credibility and reassurance, a factor that helps in winning customers even in highly competitive lending categories.

Tata Capital IPO Details

Tata Capital has been classified as an upper-layer NBFC by the Reserve Bank of India, which mandates such entities to list shares within three years of classification. While the regulatory deadline was September 2025, the listing is being timed for early October, with anchor allotments opening October 3 and the public offer window slated from October 6 to October 8.

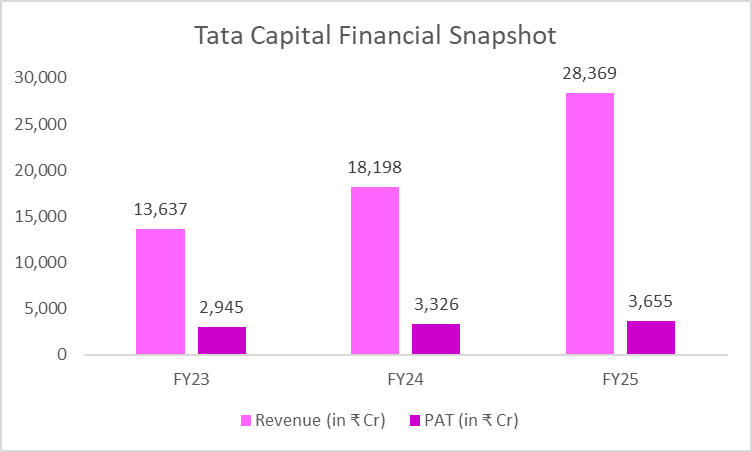

Tata Capital Financial Performance

The IPO comes at a time when Tata Capital’s financials have shown strong momentum. Profits have risen sharply, with FY25 net profit estimated at around ₹3,600–3,655 crore, almost double from three years ago. Revenues too have surged past ₹23,000 crore, while return on equity has held at a healthy 17–18%, comparable to the best in the industry. Even so, there are pressures building under the surface. Funding costs have risen, and as an NBFC, Tata Capital depends on market borrowings instead of retail deposits. That makes it vulnerable to interest rate cycles, a risk investors must keep in mind.

Comparative Pricing & Valuation: Tata Capital vs. Peers

The valuation, meanwhile, has been the talking point. In the unlisted market, Tata Capital shares have been trading in the ₹700–1,000 band, buoyed by hype and limited supply. But the IPO price band of ₹310–₹326 per share surprised many. On the face of it, this looks conservative, For many investors, this feels like 70% value erosion; and still values the company at over ₹1.3 lakh crore.

The company is the largest Core Investment Company (CIC) in the country, with a market capitalization of approximately ₹2.8 lakh crore. In terms of valuations, the company is trading at a price-to-earnings (P/E) ratio of 82x, which is significantly higher compared to its peers, whose median P/E ratio is 30.1x. Furthermore, based on the price-to-book (P/B) ratio, the company is trading at 9.9x, while the median P/B ratio for its peers is 3.9x. This indicates that the company is highly overvalued.

One of the biggest talking points around Tata Capital’s IPO has been its price band, which came as a shock to investors tracking the stock in the unlisted market. Shares that were actively changing hands in the grey market at nearly ₹1,125 per share are now being offered in the IPO at a much tighter band, creating a mismatch in expectations. On Planify platform, we had already issued and suggested a sell rating to investors citing stretched valuations at those levels. This divergence highlights a recurring theme in India’s IPO landscape where unlisted market enthusiasm often runs ahead of the valuations set by investment bankers, only to be realigned once the official price band is declared.

But the truth also lies that in the fact that the unlisted market often runs on scarcity and speculation, while IPO pricing must be grounded in earnings, risk profile, and peer benchmarks. Tata Capital’s discount reflects a reset in valuations across the NBFC space, where regulators and investors are demanding more conservative pricing.

The company’s fundamentals are solid with a ₹2.3 trillion loan book, spread across retail, SME, and corporate lending, and the strong backing of the Tata Group. Yet, there are risks that justify a cautious price:

Rising risk in the loan book: Stage-3 bad loans have inched up to ~1.9%.

Weaker provisioning: Coverage ratio has fallen to ~58.5% in FY25 from 77% earlier.

Unsecured lending exposure: 21% of loans are unsecured, which adds to credit risk.

High real estate exposure: About one-third of the book is linked to property markets, which can be cyclical.

In this context, the IPO is being set at an appealing price to guarantee widespread involvement and stability post-listing.

In simple terms: the discount isn’t a gift but it’s a hedge against risk. Existing unlisted shareholders may feel the pinch, but for new investors, the IPO offers entry at realistic valuations with room for upside if the company delivers on growth.

Compared with peers, Bajaj Finance still trades at a premium because of its superior return ratios, while L&T Finance trades lower but with slower growth. Tata Capital sits in the middle, offering growth potential at a valuation reset that seems more sustainable than the grey-market frenzy suggested.

There are genuine risks. A part of Tata Capital’s portfolio is in unsecured lending, which can turn risky if the economy slows or defaults rise. Competition in retail and SME finance is heating up, with giants like Bajaj Finance and HDFC Bank aggressively chasing the same customers. And while Tata Capital has diversified well, integrating acquisitions such as Tata Motors Finance and maintaining credit discipline as it scales further will be a challenge.

Yet, there are equally strong positives. The company operates with an asset-light model, focuses on project and customer execution, and leverages the larger Tata ecosystem for growth opportunities. Its wide and extensive diverse distribution network ensures reach throughout urban and semi-urban India, while its diversified loan book reduces dependence and reliance on any single category. Most importantly, the Tata brand provides an intangible significant edge in terms of gaining customer acquisition and trust, something competitors often struggle to replicate.

Conclusion

For investors, the IPO is a trade-off between hype and reality and it represents a balance between excitement and actuality. On one hand, Tata Capital represents exposure to India’s growing credit story, led by one of the most trusted business groups. On the other, valuations are not cheap, and growth will have to remain steady to justify the premium. If the company can sustain loan growth above 20%, control asset quality, and expand margins, the stock could replicate Bajaj Finance’s long-term wealth creation story. But if execution slips or credit costs rise, the high expectations baked into the IPO could turn into a drag.

In the end, Tata Capital’s IPO is more than a fundraising event. It is a landmark in India’s NBFC sector, a test of how much premium investors are willing to pay for brand, scale and growth. The unlisted market may have set lofty benchmarks, but the public markets will judge the company by its ability to deliver quarter after quarter. Listing day may bring excitement, but the real story will be written in the years ahead.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.