Urban Company’s ₹1,900 crore IPO to open on September 10; sets price band at ₹98-103 per share

Sep 8, 2025

India’s IPO market has seen an intensity of listings in 2025, but only a handful come from the emerging technologies sector. The upcoming Urban Company IPO is one such rare opportunity. Scheduled to open on September 10, 2025, the issue is set to raise the issue of 1,900 crores, with a price band fixed between ₹98 and ₹103 per share. The IPO has instantly become the talk of the town and a matter of excitement due to the company's unique business model and strong investor curiosity.

From UrbanClap to Urban Company

In 2014, the urban company, established by Abhiraj Singh Bhal, Raghav Chandra, and Varun Khaitan, began as UrbanClap, with homes with services such as plumbers, electricians and beauticians. Over the years, the platform has developed as a complete-stack provider of home services integrating training, technology, financing and product support for its partner network.

Today, Urban Company deals and operates in more than 60 Indian cities and has expanded internationally; gaining exposure into the United Arab Emirates, Singapore and Saudi Arabia. Its services cover home repair, cleanliness, spa treatment, equipment servicing and painting. The company keeps itself in position as India's reply to global gig-economic platforms, but with emphasis on quality, trust and customer retention.

What Makes Urban Company Stand Out?

The biggest differentiator lies in its full-stack model. Unlike pure marketplaces such as JustDial or OLX, Urban Company controls multiple aspects of the service experience right from partner onboarding and training to pricing and quality control. This creates higher trust among customers and a steady stream of repeat demand.

It also allows the company to scale revenue faster, since partners are more closely tied to the platform. In FY24, Urban Company reported ₹1,500+ crore in revenue, with annual growth above 30%. Losses have narrowed over time as the business benefits from scale. This makes the IPO not just a fundraising event but also a validation of its maturing financial profile.

Urban Company IPO Structure and Key Details

The proposed Urban Company listing date, scheduled for 17th September 2025, will soon test the market’s real appetite for this rare tech IPO in a year marked by limited high-growth listings. The Urban Company IPO will raise ₹1,900 crore as per total issue size through and that usually categorised as two parts:

This IPO Comprises fresh issue of ₹472 crore in order to fund expansion, technology, and marketing purposes.

Offer for Sale (OFS) of ₹1,428 crore by early investors including Accel, Elevation Capital, Tiger Global, and Vy Capital.

At the upper price band of ₹103, the company’s valuation is expected to touch ₹14,790 crore (close to $1.8 billion). The lot size for this issue is considered as 145 shares, translating into a minimum investment required for the IPO of about ₹14,935.

IPO Open Date | September 10, 2025 |

IPO Close Date | September 12, 2025 |

IPO Allotment Date | September 15 2025 |

Urban Company IPO Listing Date | September 17, 2025 |

Grey Market Premium Buzz

No IPO conversation in India is complete without a mention of the grey market. The Urban Company GMP (Grey Market Premium) has been reported at around ₹19–20 per share. That suggests a possible mark of around 18–24% listing gain over the upper price band of ₹103.

Other market trackers sources show a slightly lower range of ₹10–15 per share, which still signals healthy demand. As always, GMP is an unofficial indicator and not a guarantee. But the consistent buzz reflects strong investor appetite, particularly for a consumer-tech brand with established visibility. In the unlisted market, the Urban Company share price currently trades in the ~₹90–₹96 range, a figure that highlights both investor interest and the perceived value ahead of the public listing.

Institutional Interest: A Key Signal

Before the IPO, SBI Mutual Fund acquired a significant stake from Tiger Global at around ₹103 per share, effectively endorsing the price band. This move has been interpreted as a vote of confidence by one of India’s largest domestic institutions.

When long-term funds take positions at IPO prices, it often calms concerns about overvaluation. For Urban Company, this could reassure investors that its financials and growth prospects justify the valuation.

Urban Company: Financial Performance

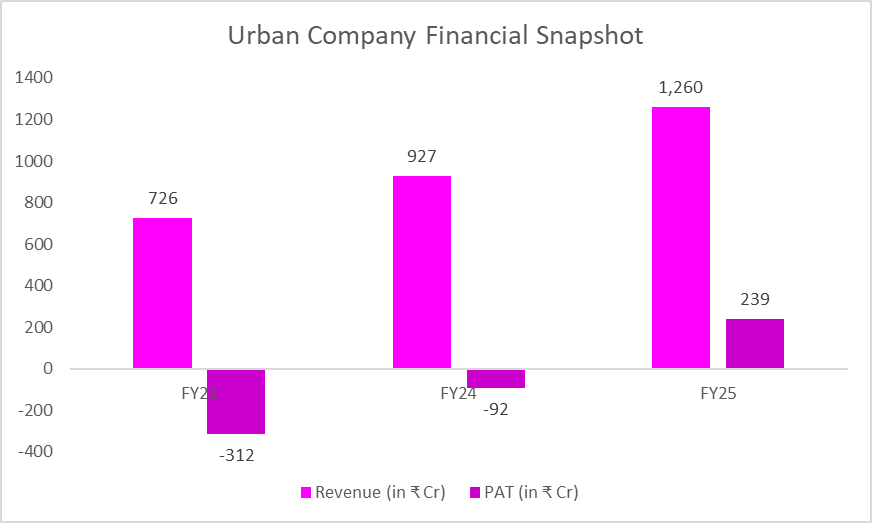

Urban Company’s financials highlight a mix of growth and ongoing transition toward profitability. The platform earns commissions and fees on partner services, with margins improving due to better utilization of fixed costs.

Risks to Keep in Mind

Every IPO has come with its risks, and Urban Company is no exception that counts. Investors should weigh these associated risks against the growth potential before committing to the issue.

Dependence on Discretionary Spending: Services like grooming, spa, and painting are tied to consumer demand cycles. A slowdown in urban spending could impact revenues.

High Competition: Startups like Housejoy and traditional offline players compete aggressively in certain categories.

Regulatory Environment: Gig worker protection laws or compliance burdens could raise costs.

Conclusion

The Urban Company IPO marks a defining moment for India’s growing home services sector. According to its DRHP, the company has consistently expanded its service portfolio, strengthened its technology backbone, and created a strong network of professionals in metros and tier-2 cities. With the increasing demand for a proven business model and organized care at home or home services, the urban company is well deployed to occupy market share in an area that is still largely unorganized.

While the Urban Company share price in the unlisted market (₹90–₹96) and the strong Urban Company GMP showcasing optimism for near-term means short period listing gains, the true prospects and real possibilities lie in its ability to scale sustainably, improve profitability, and maintain leadership in a competitive space. Investors should evaluate both the growth opportunities in regards to key strong potential areas and the risks highlighted in the DRHP before making a decision.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.