Vikram Solar IPO: ₹1,500 Cr Issue Gets SEBI Approval; Know Date, Price and Apply Process

Aug 14, 2025

In a landmark moment for India’s burgeoning renewable energy sector, Vikram Solar is set to launch its highly anticipated Initial Public Offering. The company has officially received SEBI's nod, and the vikram solar ipo date has been finalized, marking a pivotal moment for both the company and the broader solar industry. This article provides a comprehensive and insightful analysis of the IPO, covering its key details, market sentiment all around the solar module manufacturer, Vikram Solar IPO. Let’s deep dive into the recent developments and upcoming exploration of the company’s growth story, IPO structure, financial health, and what the future may hold for the Vikram Solar share price.

Vikram Solar Key IPO Details

The Vikram Solar IPO is all set to begin and finalized to open for subscription from August 19 to August 21, 2025. This book-built and constructed issue pursuits to raise a total of ₹2,079.37 crore, which includes a fresh issue of ₹1,500 crore and an Offer for Sale (OFS) of ₹579.37 crore through its promoters. The enterprise has set a price band of ₹315 to ₹332 per equity share. Investors can thoroughly make due diligence processes then apply for minimum 45 shares, which translates to a minimum starting bare investment of ₹14,940 at the upper price band. The proceeds from the fresh issue are strategically earmarked for a new solar cell and module production facility, a move that is anticipated to seriously increase the company's manufacturing capacity and marketplace presence.

About Vikram Solar

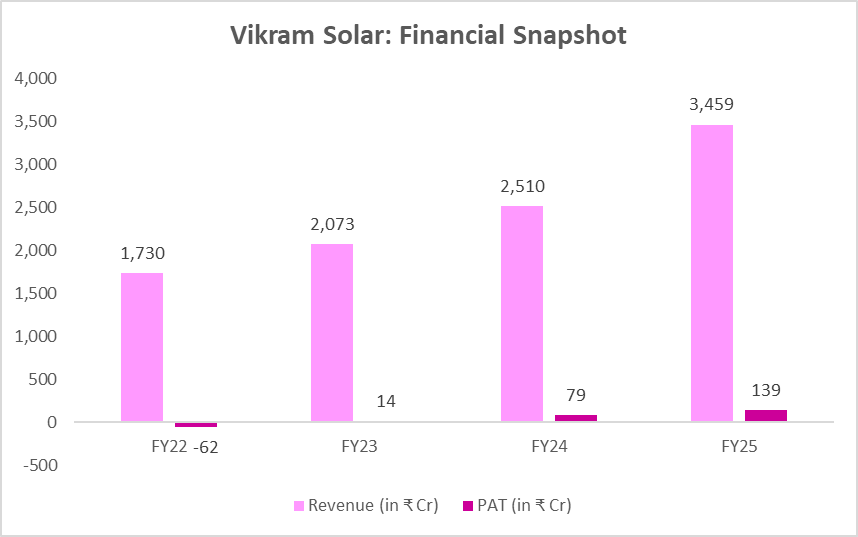

Vikram Solar is considered one of India's largest and recognized well known solar photovoltaic (PV) module manufacturers. With over 15 years of industry experience in, the company has set up itself as a Tier-1 producer, presenting high-performance PV modules and presenting complete EPC (Engineering, Procurement, and Construction) services globally. Its financial performance has shown a robust boom trajectory, with a significant growth in sales and a sharp development in profitability in recent financial years. As of FY25, the business enterprise reported a revenue of ₹3,459.53 crore and a net profit of ₹139.83 crore, reflecting a robust business model and operational performance. The organisation’s deep understanding and robust R&D capabilities offers it a competitive side in a surprisingly high dynamic market.

Market Buzz: GMP and Investor Sentiment

The market sentiment around the IPO is a critical indicator for potential investors. The vikram solar grey market price (GMP) is currently reported to be around ₹65-₹70 per share. Based on the upper price band of ₹332, this translates to a potential listing gain of over 20%. This strong GMP suggests a healthy demand for the Vikram solar share in the unlisted market and indicates that investors are confident about the company's future prospects.

While the GMP is a crucial parameter and indicator to get insights and ideas about the given IPO, it is important to remember that it is not a guarantee of listing performance. The actual vikram solar share price on the day of listing will be determined by real market demand. Furthermore, the vikram solar unlisted share price that was being traded prior to the IPO provided a base for this premium, reflecting the market’s early valuation of the company. The robust grey market premium, coupled with strong fundamentals, points to a positive reception from the public.

Conclusion

The Vikram Solar IPO represents a compelling investment opportunity in a sector poised for exponential and surging growth. The company operates in the fast-increasing solar industry, driven via international sustainability goals and favorable government policies. Its strong financials, giant manufacturing capability, and an impressive order book all propose a robust commercial business model.

However, a balanced view is vital. The industry is highly capital-intensive, and the organisation's success is tied to its potential to manage debt and effectively execute its enlargement further expansion plans. The IPO's valuation, as indicated by using a high P/E ratio in comparison to some competitors, could be a factor of attention for investors.

Ultimately, this IPO is exceptionally appropriate for investors with a long-term vision and perspective who consider the future of renewable energy and are willing to invest in a marketplace leader. While the high GMP hints at potential short-term profits, the actual value lies in the enterprise's long-term growth tale. It is a stock to be watched closely, however a thorough evaluation of your own financial goals and risk tolerance is vital before deciding to apply.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.