Acko General Insurance Ltd

23 December 2025

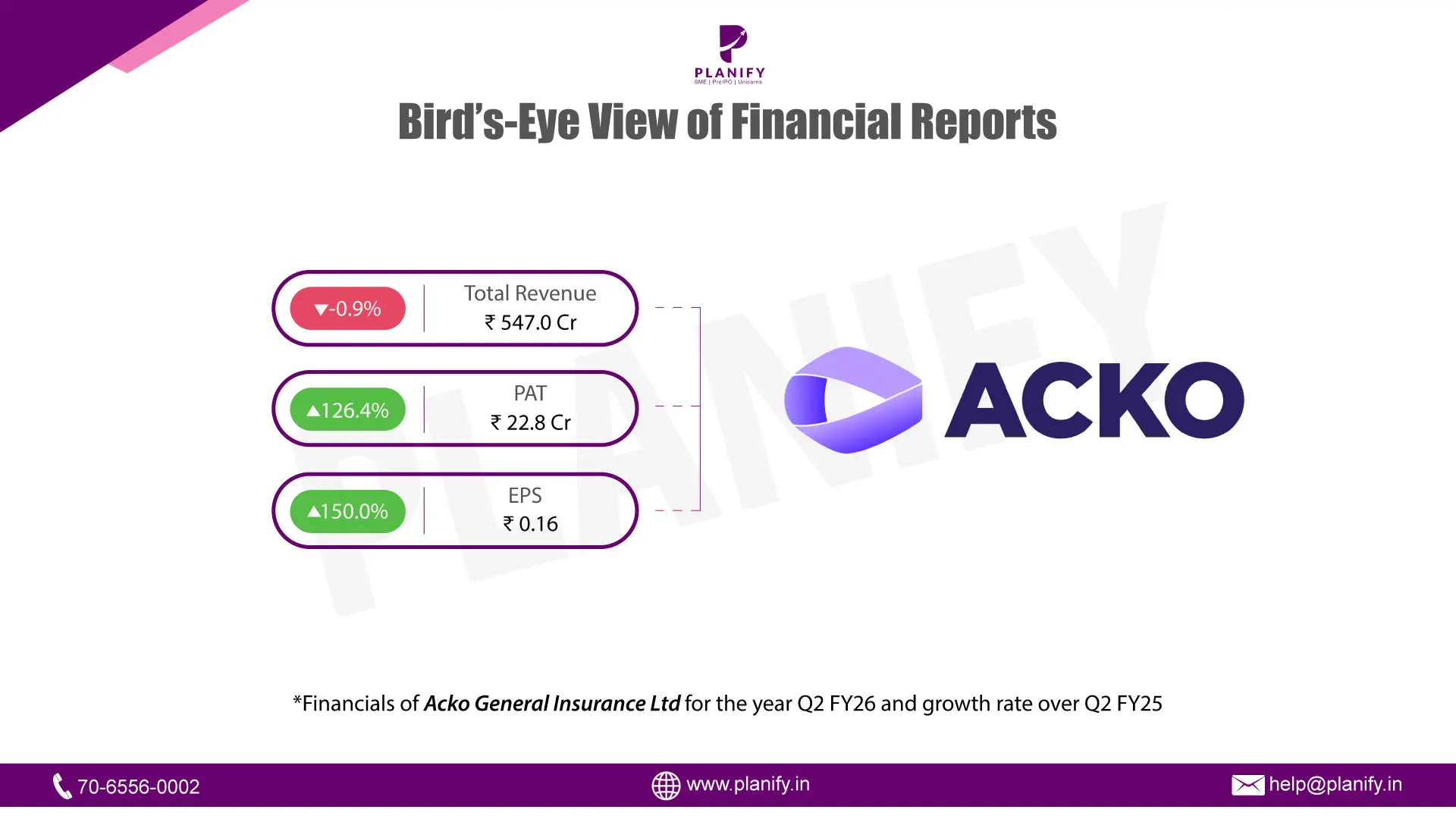

Financial Performance (Q2 FY26 vs Q2 FY25): Acko General Insurance Ltd reported a marginally weaker topline performance in Q2 FY26, with revenue declining by 0.9% year-on-year (YoY) to ₹547.0 crore, compared to ₹552.0 crore in Q2 FY25. Despite the slight drop in revenue, profitability improved sharply during the quarter, with Profit After Tax (PAT) turning positive at ₹22.8 crore versus a loss of ₹86.1 crore in the same period last year, reflecting a 126.4% YoY improvement. Earnings Per Share (EPS) also improved significantly to ₹0.16 in Q2 FY26 from a negative ₹0.32 in Q2 FY25, marking a 150.0% YoY increase, indicating a strong turnaround in operating and underwriting performance.

Operational Metrics (Q2 FY26 vs Q2 FY25): Operational performance reflected better cost management and underwriting efficiency during the quarter. The solvency ratio stood at 2.29 times, well above the regulatory requirement, compared to 2.43 times in Q2 FY25. The net retention ratio remained stable at 76.17% compared to 74.83% in the previous year.

Strategic Developments: During the quarter, Acko continued its focus on product diversification, launching new retail and group health products such as Acko Health II and Acko 360 Protect. The company maintained a digital-first approach, with Direct Business (Online) contributing significantly to the total premium of ₹62,167 lakhs for the quarter. Despite higher claims reported in some segments, the claims settlement ratio remained a priority, and the reduction in management expenses to gross premium ratio (35.93% vs 52.63%) supports long-term sustainability.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.