API Holdings Ltd. – FY25 Consolidated Financial Performance Review

17 September 2025

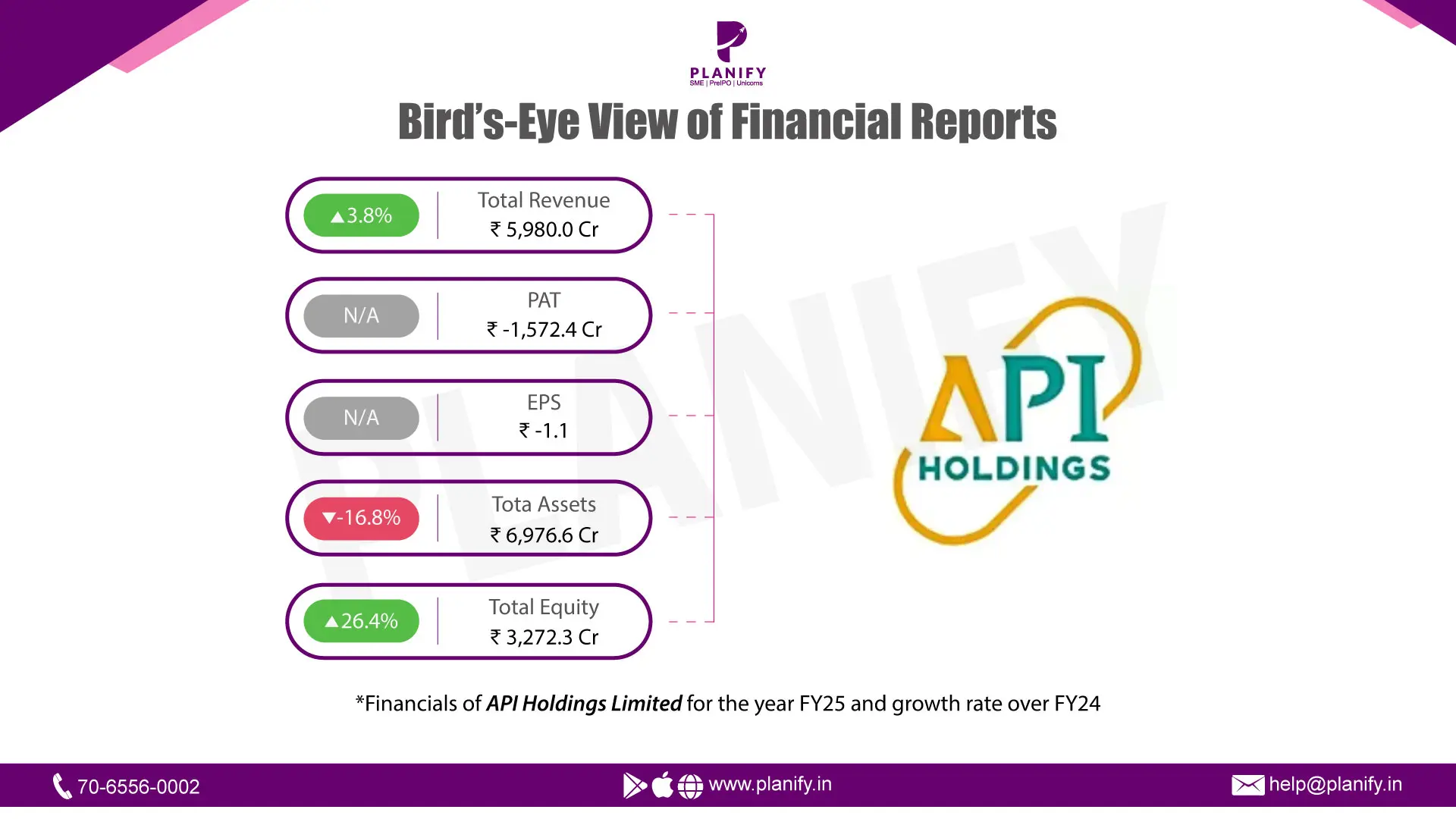

Financial Performance (FY25 vs FY24): API Holdings posted a modest 3.8% YoY growth in total income to ₹5,980 Cr in FY25, up from ₹5,759 Cr in FY24, driven largely by revenue from operations which increased to ₹5,872 Cr (+3.7% YoY). However, the revenue expansion was offset by cost pressures. Total expenses rose to ₹7,209 Cr, almost flat (-0.6% YoY) compared to ₹7,255 Cr in FY24, but remained structurally higher than income, leading to continued operating losses.

Loss before exceptional items and tax stood at ₹1,220 Cr, a marginal improvement versus ₹1,495 Cr in FY24 (narrowing by 18.5% YoY). Exceptional losses of ₹296 Cr in FY25 (vs ₹977 Cr in FY24) further weighed on earnings. As a result, PAT stood at -₹1,572 Cr, compared to -₹2,534 Cr in FY24, indicating a reduction in net losses by 37.9% YoY.

On the balance sheet front, total assets contracted by 16.8% YoY to ₹6,977 Cr from ₹8,390 Cr in FY24, reflecting lower cash balances and a reduction in current assets. Total equity improved by 26.4% YoY to ₹3,272 Cr (vs ₹2,588 Cr), aided by capital infusion despite continuing losses. Borrowings fell sharply to ₹2,234 Cr from ₹4,098 Cr (-45.5% YoY), improving leverage.

Operational Metrics (FY25 vs FY24): Net margin improved to -26.3% in FY25 from -44.1% in FY24, reflecting better cost absorption despite remaining loss-making.

Finance costs declined significantly by 30.5% YoY to ₹506 Cr, in line with lower borrowings.

Employee benefit expenses increased 29.9% YoY to ₹908 Cr, suggesting continued investment in workforce and expansion.

Cash & cash equivalents dropped 63.7% YoY to ₹119 Cr (vs ₹328 Cr), signaling reduced liquidity.

Goodwill impairment was lower at ₹175 Cr (vs ₹583 Cr in FY24), reducing the exceptional drag on bottom line.

Strategic Developments:

FY25 marked a year of stabilization for API Holdings. While revenue growth remained modest, the company succeeded in narrowing losses meaningfully through reduced exceptional charges and deleveraging of its balance sheet. The decline in borrowings and finance costs points to conscious efforts to strengthen financial stability.

However, profitability remains elusive as cost structures (employee and other operating expenses) continue to run ahead of revenue. The contraction in total assets, largely due to lower cash balances, underscores the need for fundraising and efficient working capital management to support operations.

Going forward, the company’s path to profitability will hinge on scaling revenues meaningfully while keeping expense growth in check, further optimizing financing costs, and monetizing its digital healthcare ecosystem. The demonstrated ability to narrow net losses in FY25 provides some comfort, but sustained execution will be critical before an IPO or external fundraise can be justified.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.