Blog

Planify Feed

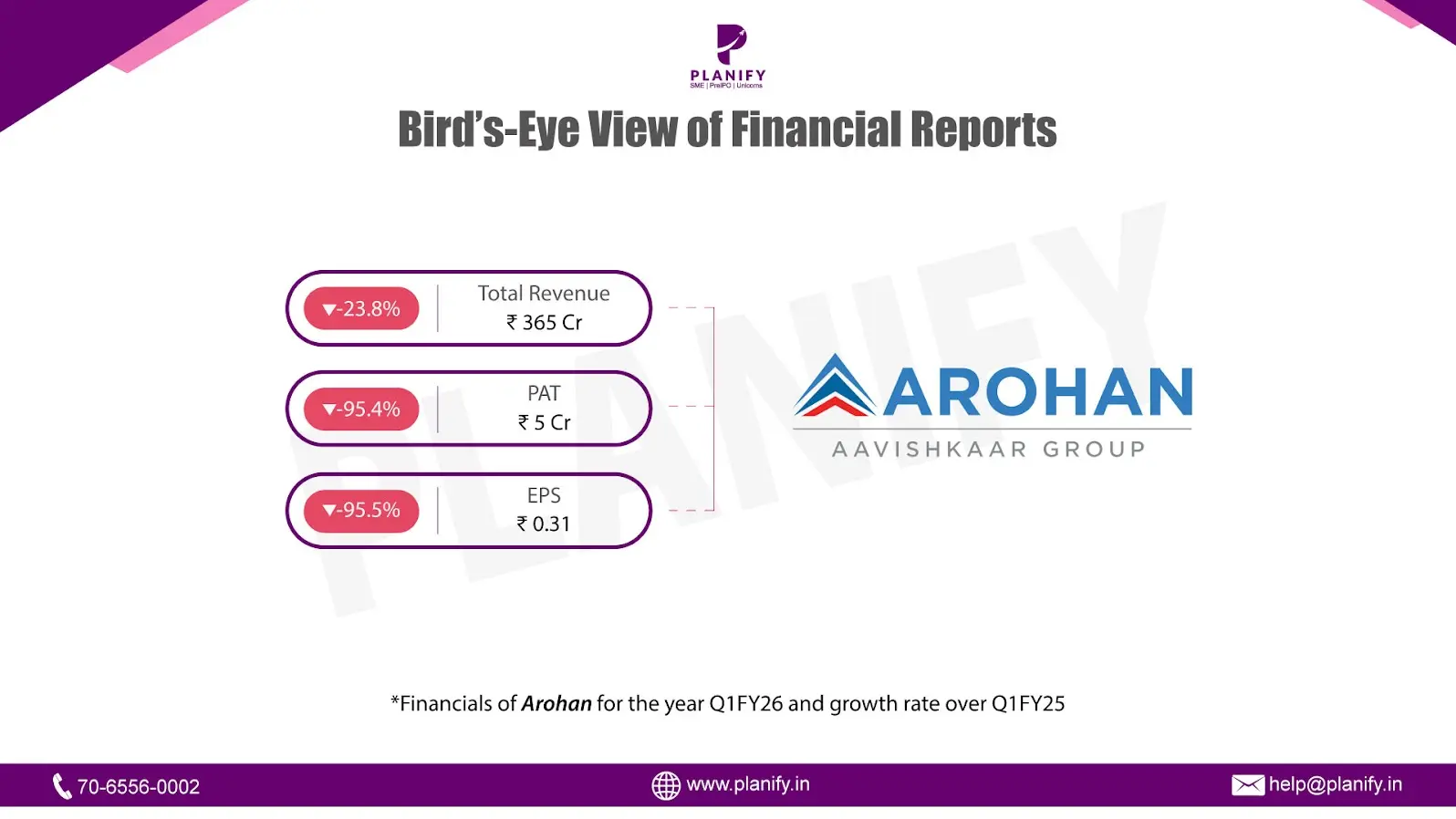

Arohan Struggles in Q1FY26 with Rising Credit Costs

Link copied

Arohan Struggles in Q1FY26 with Rising Credit Costs

19 August 2025

- Financial Performance (Q1 FY26 vs Q1 FY25): In Q1 FY26, Arohan Financial reported total revenue of ₹365 Cr, a decline of 23.8% YoY from ₹479 Cr in Q1 FY25, primarily due to lower interest income and a steep drop in non-interest income. Finance costs fell by 28.5% YoY to ₹126 Cr from ₹177 Cr, but impairment on financial instruments surged to ₹103 Cr, compared to ₹40 Cr in Q1 FY25, reflecting higher credit stress. Profit Before Tax (PBT) stood at ₹6 Cr, down sharply by 95.5% YoY from ₹139 Cr in Q1 FY25. Profit After Tax (PAT) also contracted drastically to ₹5 Cr, a decline of 95.4% YoY from ₹104 Cr last year. Earnings Per Share (EPS) fell to ₹0.31, compared to ₹6.83 in Q1 FY25.

- Operational Metrics (Q1 FY26 vs Q1 FY25): Net Profit Margin: Dropped to 1.3%, from 21.7% in Q1 FY25, underscoring profitability pressure. Gross NPA (GNPA): Stood at 2.61%, slightly up from 2.30% in Q1 FY25, showing deterioration in asset quality. Net NPA (NNPA): Rose to 0.71%, compared to 0.55% last year. Provision Coverage Ratio (PCR): Weakened to 73.16%, from 82.35% in Q3 FY25, showing reduced buffer against credit losses. Capital Adequacy Ratio (CAR): Healthy at 36.6%, providing strong capitalization. Loan Book (Total Assets): Total debts to total assets ratio at 68.9% indicates moderate leverage, with net worth of ₹2,017 Cr, reflecting a stable equity base.

- Strategic Developments: Q1 FY26 was challenging for Arohan Financial, as revenues contracted and profitability was severely impacted by rising impairment costs and weaker non-interest income. The increase in NPAs highlights ongoing asset quality stress, which, coupled with a dip in provision coverage, points to rising risks. However, the company maintains a robust capital adequacy ratio, offering resilience to withstand shocks. With the RBI’s recent lifting of lending restrictions (January 2025), Arohan has resumed disbursements, which should aid loan book growth and revenue revival in the coming quarters. The key focus areas going forward will be improving asset quality, tightening cost structures, and regaining market confidence to restore profitability momentum.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.