Blog

Planify Feed

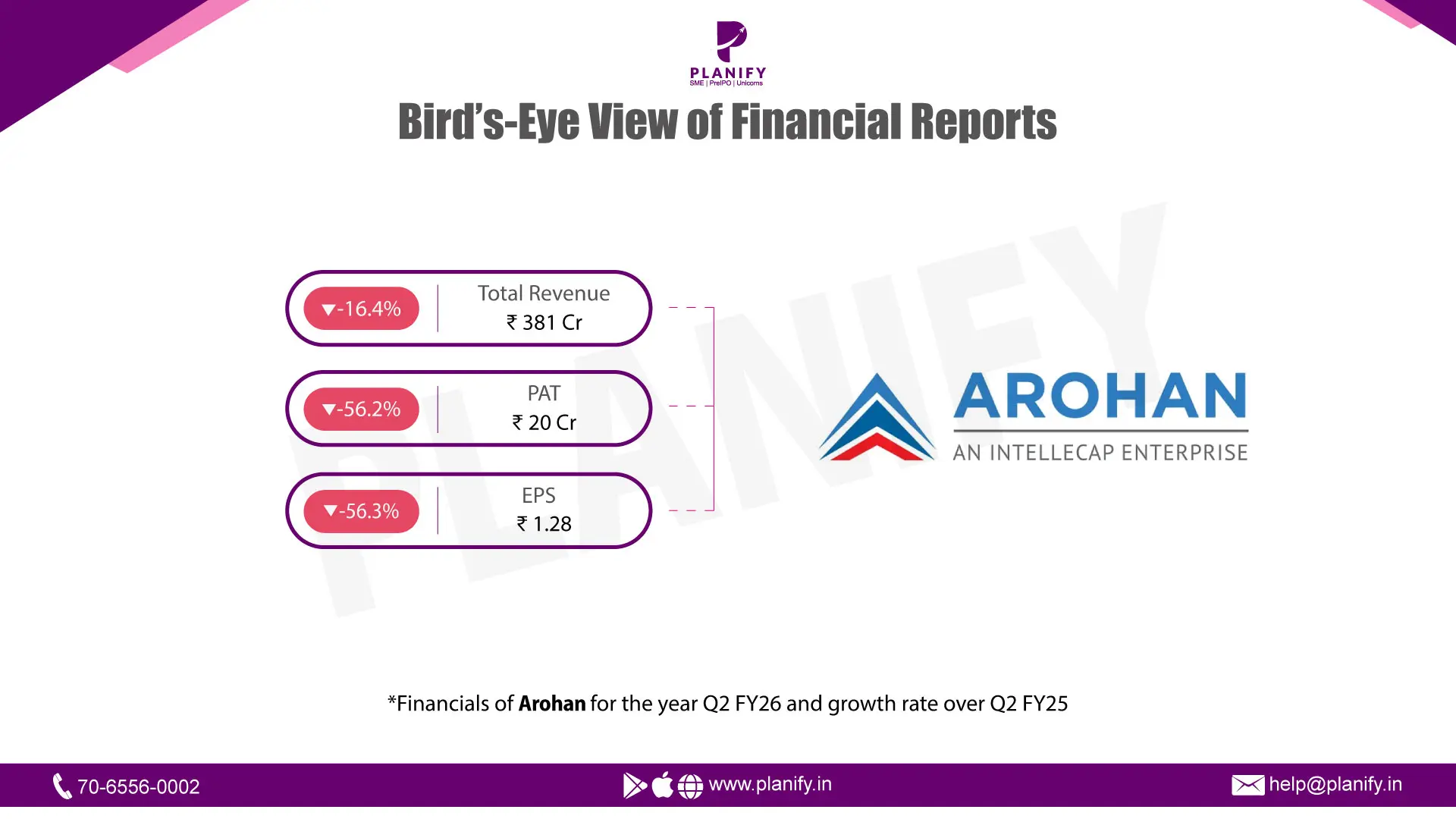

Arohan Struggles in Q2FY26 with Weak Growth and Rising Credit Stress

Link copied

Arohan Struggles in Q2FY26 with Weak Growth and Rising Credit Stress

22 November 2025

- Financial Performance (Q2FY26 vs Q2FY25): In Q2 FY26 Arohan Financial reported total revenue of ₹381 crore, down 16.4% YoY from ₹456 crore in Q2 FY25. Interest income fell to ₹342 crore, down 19.4% YoY from ₹424 crore, while fees and other non-interest income also moderated. Finance costs declined to ₹128 crore, down 23.6% YoY, offering some relief, but impairment on financial instruments remained elevated at ₹95 crore (down 4.2% YoY). Profit before tax (PBT) came in at ₹26 crore, down 56.6% YoY from ₹59 crore, and profit after tax (PAT) was ₹20 crore, down 56.2% YoY from ₹45 crore. Basic EPS for the quarter fell to ₹1.28 from ₹2.93 a year earlier (down 56.3%).

- Operational Metrics (Q2FY26 vs Q2FY25): Gross Stage-3 (GNPA) ratio was 2.0%, up from ~1.5% a year ago, and Net Stage-3 (NNPA) ratio was 0.52% (vs 0%), indicating a deterioration in asset quality. Provision Coverage Ratio (PCR) stood at 74.5%, lower than earlier peak levels but still providing a material cushion. Capital adequacy remained strong at 34.5%. Loan book (loans on balance sheet) was ₹5,622 crore as at Sept 30, 2025, marginally down 1.5% versus Mar 31, 2025 (₹5,705 crore), while total assets rose to ₹7,117 crore (up 3.3% vs Mar 31, 2025). Net worth was ₹2,054 crore, up 1.4% sequentially.

- Strategic Developments: Arohan’s Q2 results show weaker revenue and sharply lower profitability driven by sustained credit costs and softer interest/fee income. The moderation in finance costs helps, but elevated impairments keep returns depressed. The slightly higher GNPA and lower PCR versus prior peaks mean asset-quality improvement must be watched closely. On the positive side, the company’s capital adequacy is strong and total assets are steady; with RBI’s earlier lifting of lending restrictions, Arohan can normalize disbursements — this should support loan-book recovery and revenue traction over coming quarters, provided underwriting and collections are tightened and operating costs are managed.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.