Blog

Planify Feed

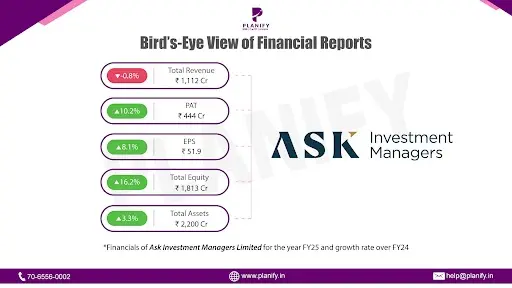

ASK Investment Managers Posts Modest FY25 with Flat Revenues

Link copied

ASK Investment Managers Posts Modest FY25 with Flat Revenues

25 August 2025

- Financial Performance (FY25 vs FY24):ASK Investment Managers reported a mixed performance in FY25. Total income declined slightly by 0.8% to ₹1,112 Cr, compared to ₹1,121 Cr in FY24. This dip was mainly due to lower revenue from operations (₹1,038 Cr vs ₹1,063 Cr last year, down 2.2%), though other income rose 27.9% to ₹75 Cr. Profit Before Tax (PBT) fell by 16.7% YoY, from ₹515 Cr in FY24 to ₹429 Cr in FY25. However, due to lower tax outgo, Net Profit (PAT) improved 10.2% YoY, reaching ₹444 Cr versus ₹403 Cr in FY24. This reflects strong bottom-line resilience despite weaker top-line growth. On a per-share basis, EPS grew 8.1% YoY from Rs.48 per share in FY24 to Rs.52 per share in FY25.

- Operational Metrics (FY25 vs FY24): Margins showed some stress during the year. The operating margin declined as expenses grew faster than revenues – total expenses were up 12.8% YoY at ₹683 Cr vs ₹605 Cr in FY24. This was largely due to higher employee costs (+18.4%), finance costs (+87.3%), and depreciation (+59.6%), reflecting investments in expansion and digital infrastructure. For FY25, the net profit margin stood at ~40%, up from 36% in FY24, helped by a one-time tax adjustment reducing tax liability. However, operating efficiency weakened somewhat, and cost-to-income ratio increased, indicating pressure on operating leverage. On the balance sheet side, ASK strengthened its equity base – net worth rose to ₹1,8135 Cr in FY25 from ₹1,560 Cr in FY24 (+16.2%), while total liabilities declined to ₹386 Cr from ₹569 Cr. The debt-to-equity ratio improved sharply to 0.21x from 0.36x, showing strong financial discipline.

- Strategic Developments: In FY25, ASK Investment Managers focused on strengthening its business model and expanding its offerings. The company received SEBI’s in-principle approval to launch its own mutual fund, marking a significant milestone in diversifying its product portfolio. It also restructured subsidiaries by acquiring ASK Alternatives Managers Pvt. Ltd. and infused ₹250 Cr into ASK Wealth Advisors to support future growth. On the shareholder front, the company declared two interim dividends totaling around ₹222 Cr, reinforcing its commitment to returns. Employee alignment was strengthened through ESOPs and ESARs, while operations expanded with new offices across 27 locations, enhanced NRI platforms in Singapore and Dubai, and international AUM growth through its UCITS platform. These steps reflect ASK’s strategy of scaling up while maintaining strong financial discipline. However, tracking revenue momentum and margin stability will be crucial, as expense growth is outpacing top-line growth.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.