AV Thomas released its financials for FY25

11 August 2025

Financial Performance (FY25 vs FY24):

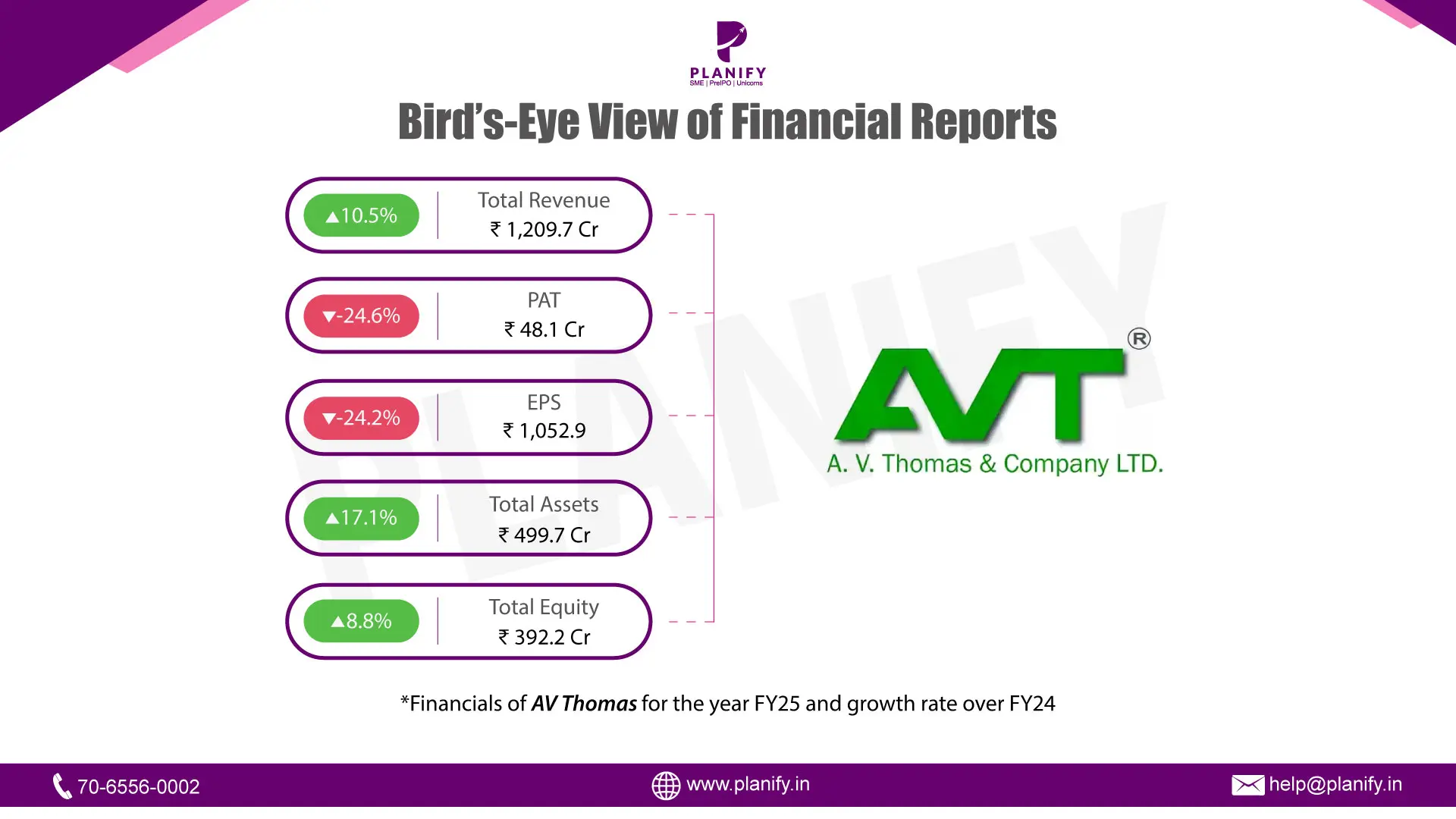

AV Thomas delivered a steady topline in FY25, with consolidated revenue from operations rising 10.4% YoY to ₹1,191 Cr (vs. ₹1,079 Cr in FY24). Total income (including other income) grew 10.5% YoY to ₹1,209 Cr (vs. ₹1,094 Cr).

However, operating performance softened: (vs. ₹82.4 Cr), with margins contracting to 5.8% (vs. 7.6%). PBT declined 22.8% YoY to ₹66.5 Cr (vs. ₹86.2 Cr), and PAT dropped 24.6% YoY to ₹48.1 Cr (vs. ₹63.8 Cr). Net margin compressed to 4.0% (vs. 5.9%). EPS moderated to ₹1,052.9 (vs. ₹1,388.8).

Segmental Performance (FY25 vs FY24):

- Plantation Products (tea, rubber, spices): Revenue rose 6.8% YoY to ₹612 Cr (vs. ₹574 Cr). Segment results declined to ₹49 Cr (vs. ₹57 Cr), with margin compression to 7.9% (vs. 10.0%).

- Consumer Products (packaged foods, beverages, value-added): Revenue grew 13.6% YoY to ₹531 Cr (vs. ₹467 Cr). Segment results slipped to ₹30 Cr (vs. ₹38 Cr), with margins narrowing to 5.7% (vs. 8.1%).

- Others: Revenue jumped 22.6% YoY to ₹4 Cr 8(vs. ₹39 Cr). Segment results turned positive at ₹1.2 Cr (vs. loss of ₹0.6 Cr), indicating improving traction in ancillary operations.

- Revenue Mix: Plantations contributed 51.4% of operating revenue (vs. 53.2% in FY24), Consumer Products 44.6% (vs. 43.3%), and Others 4.0% (vs. 3.6%). This reflects faster growth in Consumer Products but with thinner margins.

Operational Metrics (FY25 vs FY24):

Operationally, profitability lagged topline growth due to cost inflation and higher finance charges. Total expenses rose 12.7% YoY to ₹1,136 Cr (vs. ₹1,007 Cr), outpacing revenue growth. Segment results declined across core businesses: Plantation Products’ profit dropped 15.4% to ₹49 Cr (vs. ₹57 Cr), with margins contracting to 7.9% (vs. 10.0%), while Consumer Products’ profit fell 19.6% to ₹30 Cr (vs. ₹38 Cr), margin narrowing to 5.7% (vs. 8.1%). The “Others” segment turned profitable at ₹1.2 Cr (vs. a ₹0.6 Cr loss in FY24).

At the consolidated level, EBITDA declined 16.2% to ₹69.0 Cr (vs. ₹82.4 Cr) and EBITDA margin contracted to 5.8% (vs. 7.6%). PBT fell 22.8% YoY to ₹66.5 Cr (vs. ₹86.2 Cr), and PAT declined 24.6% to ₹48.1 Cr (vs. ₹63.8 Cr). PBT margin contracted to 5.6% (vs. 8.0%), while net margin fell to 4.0% (vs. 5.9%). Finance costs rose sharply to ₹3.5 Cr (vs. ₹1.5 Cr), further pressuring profitability.

Growth Outlook

Looking ahead, growth will be anchored by the Consumer Products division, while the Plantation segment remains exposed to commodity volatility. The near-term focus must be on margin recovery and improved cash conversion, given FY25 pressure on both segments. With a conservative capital structure and healthy liquidity, AV Thomas has sufficient headroom to fund expansion, invest in brand-building, and pursue premiumization, positioning it well for sustainable, profitable growth in FY26 and beyond.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.