Axis Max Life Insurance Ltd

23 December 2025

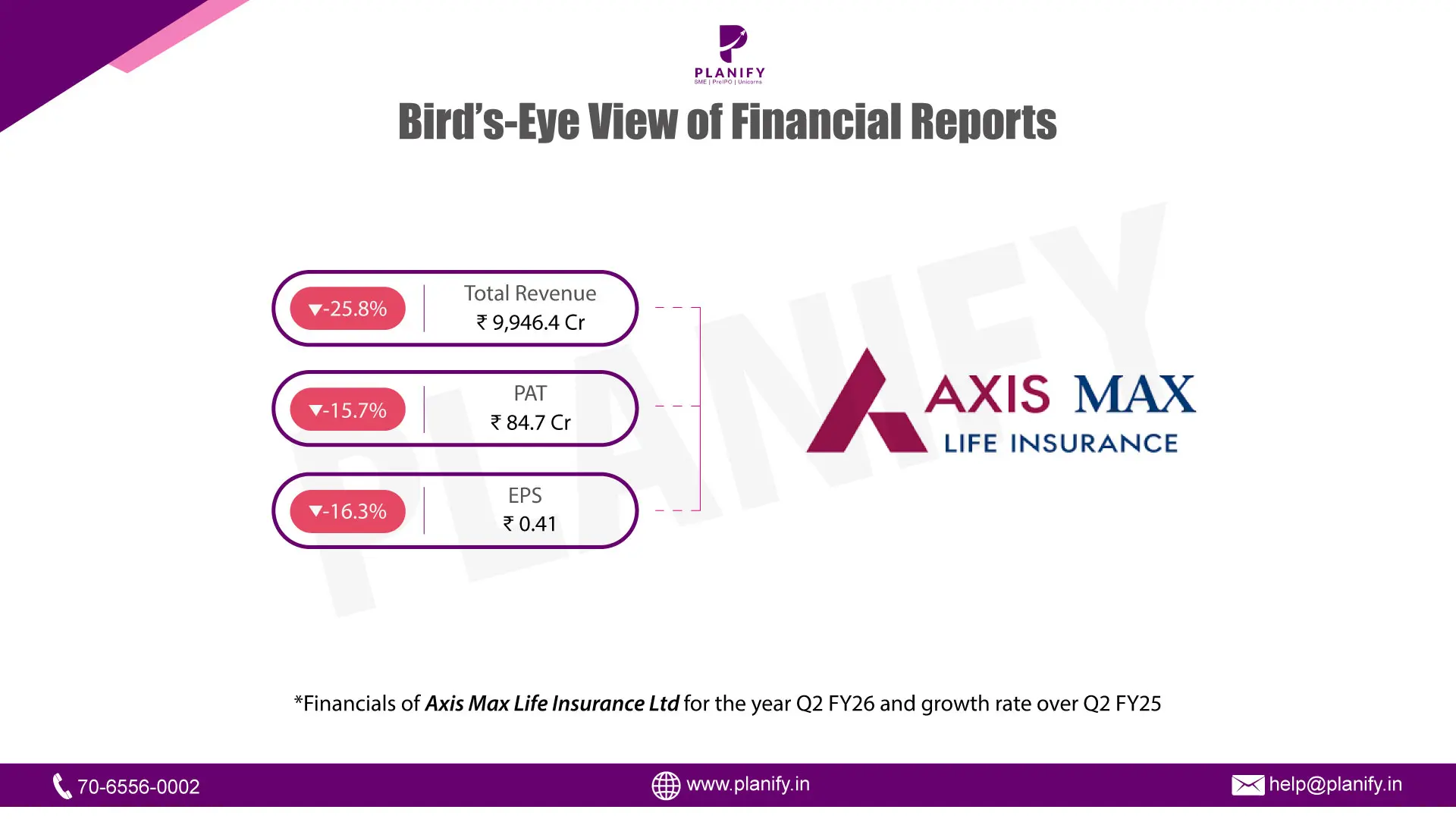

Financial Performance (Q2 FY26 vs Q2 FY25): Axis Max Life Insurance Ltd reported a weaker financial performance in Q2 FY26, with total revenue declining by 25.8% year-on-year (YoY) to ₹9,946.4 crore, compared to ₹13,408.6 crore in Q2 FY25. The decline was primarily driven by lower premium income along with a sharp moderation in investment-related income during the quarter. Profit After Tax (PAT) declined by 15.7% YoY to ₹84.7 crore from ₹100.5 crore in the corresponding quarter last year. Earnings Per Share (EPS) also declined by 16.3% YoY to ₹0.41, compared to ₹0.49 in Q2 FY25.

Operational Metrics (Q2 FY26 vs Q2 FY25): In Q2 FY26, Axis Max Life Insurance recorded a stable net retention ratio of 97.8%, marginally lower than the 98.0% in Q2 FY25. The conservation ratio showed general improvement across several categories, with Non-Linked Participating Life rising to 84.3% from 83.0% and Non-Linked Non-Participating Life increasing to 88.2% from 86.2%. Total net benefits paid for the quarter increased to Rs. 483,374 lakhs in Q2 FY26, up from Rs. 420,463 lakhs in the previous year's second quarter.

Strategic Developments: During the quarter, the company faced a challenging operating environment marked by subdued insurance demand and volatile financial markets. Performance continued to be influenced by slower premium growth and lower investment income. While near-term results were impacted by operational and earnings pressure, the company’s established market presence and diversified product portfolio provide longer-term business stability.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.