Bolzen & Mutter Limited – FY25 Consolidated Results Review: Strong Growth Momentum, Leverage Rising

16 October 2025

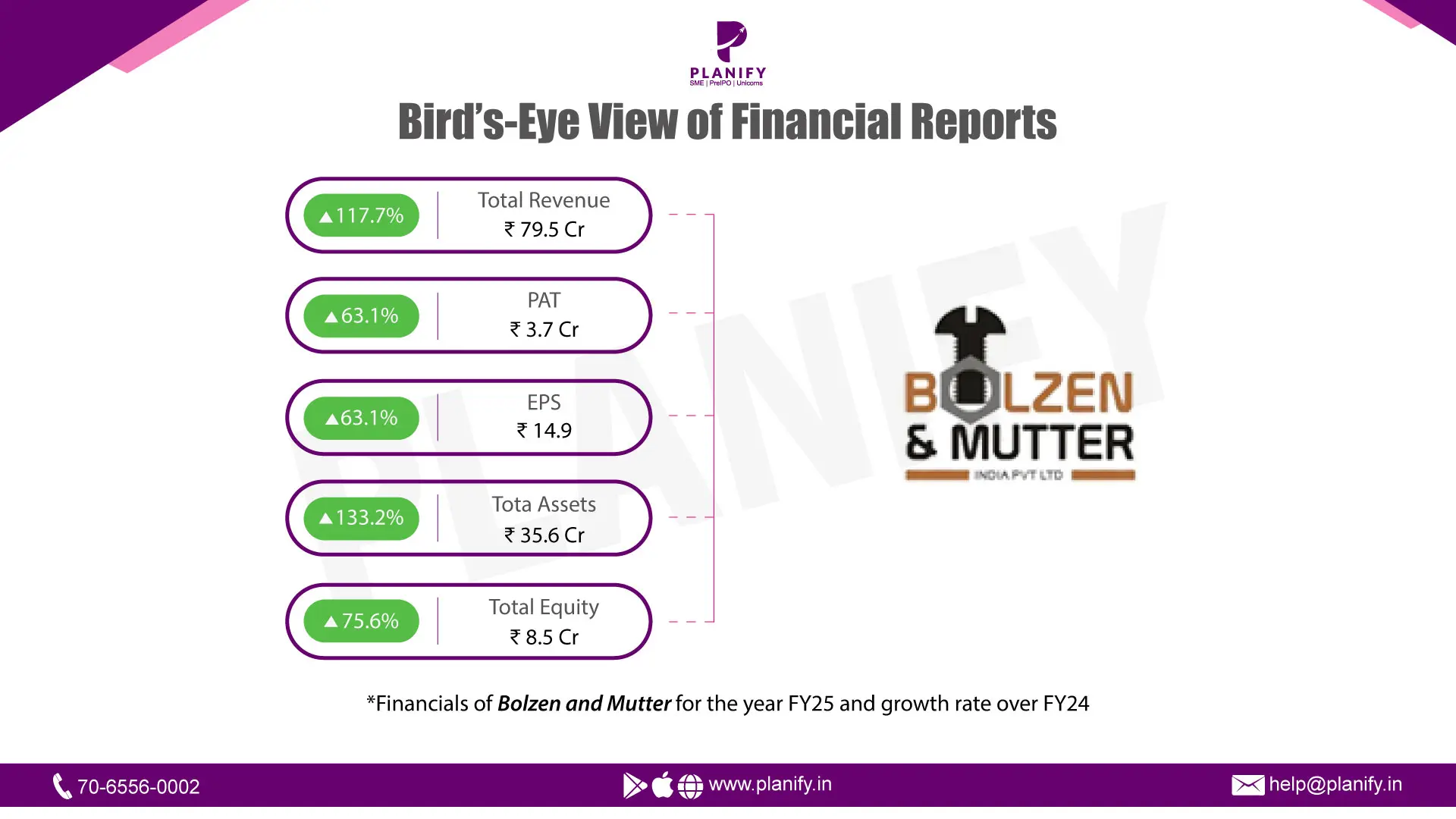

Financial Performance (FY25 vs FY24): Bolzen & Mutter Limited delivered a robust performance in FY25 with total income rising 117.2% YoY to ₹79 Cr, up from ₹36 Cr in FY24. The sharp revenue growth was driven by higher operational income from its core business, which grew 115.0% YoY to ₹78 Cr.

Total expenses surged 123.2% YoY to ₹74 Cr, primarily led by a steep increase in material consumption (+150.1% YoY), employee costs (+173.1% YoY), and other expenses (+39.4% YoY).

Despite the cost escalation, Profit Before Tax (PBT) grew 54.3% YoY to ₹498.2 Cr, reflecting strong operating leverage and scale benefits.After accounting for taxes and deferred tax adjustments, Profit After Tax (PAT) rose 63.1% YoY to ₹3.7 Cr, compared to ₹2.2 Cr in FY24. Earnings per share (EPS) increased to ₹14.9 from ₹9.1, a healthy 63.1% YoY growth, reflecting solid bottom-line expansion.

Operational Metrics (FY25 vs FY24): Total assets nearly doubled (+133.2% YoY) to ₹36 in FY25 from ₹15 Cr in FY24, driven by higher plant & equipment and receivables, suggesting expansion in capacity and scale.

The loan book (long-term + short-term borrowings) expanded sharply by 181.5% YoY to ₹19 Cr, indicating aggressive leveraging to fund business growth.

Trade payables also rose 88.3% YoY to ₹5 Cr, suggesting higher procurement activity and scaling up of operations. However, this has also elevated working capital intensity.

The company’s net profit margin declined slightly to 4.6% in FY25 from 6.1% in FY24, reflecting strong revenue growth offset by higher input costs and interest burden

Strategic Developments: FY25 marked a transformative year for Bolzen & Mutter, with rapid revenue expansion supported by scaling in manufacturing and operations. However, the aggressive rise in borrowings (+135%) indicates dependence on external leverage, which could pressure margins and liquidity if not managed prudently.

While profitability improved materially, the significant jump in total liabilities suggests higher financial risk. The absence of visible credit stress (no NPAs reported) is positive, but the company must ensure prudent capital allocation and tighter working capital management.

Going forward, Bolzen & Mutter’s focus should be on: Strengthening balance sheet health by optimizing debt levels, Improving cost efficiency to sustain margins, and Enhancing operational cash flow to fund future expansion internally.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.