Blog

Planify Feed

BVG India: Strong FY25 Growth and Renewed IPO Plans

Link copied

BVG India: Strong FY25 Growth and Renewed IPO Plans

28 October 2025

Financial Performance (FY25 vs FY24)

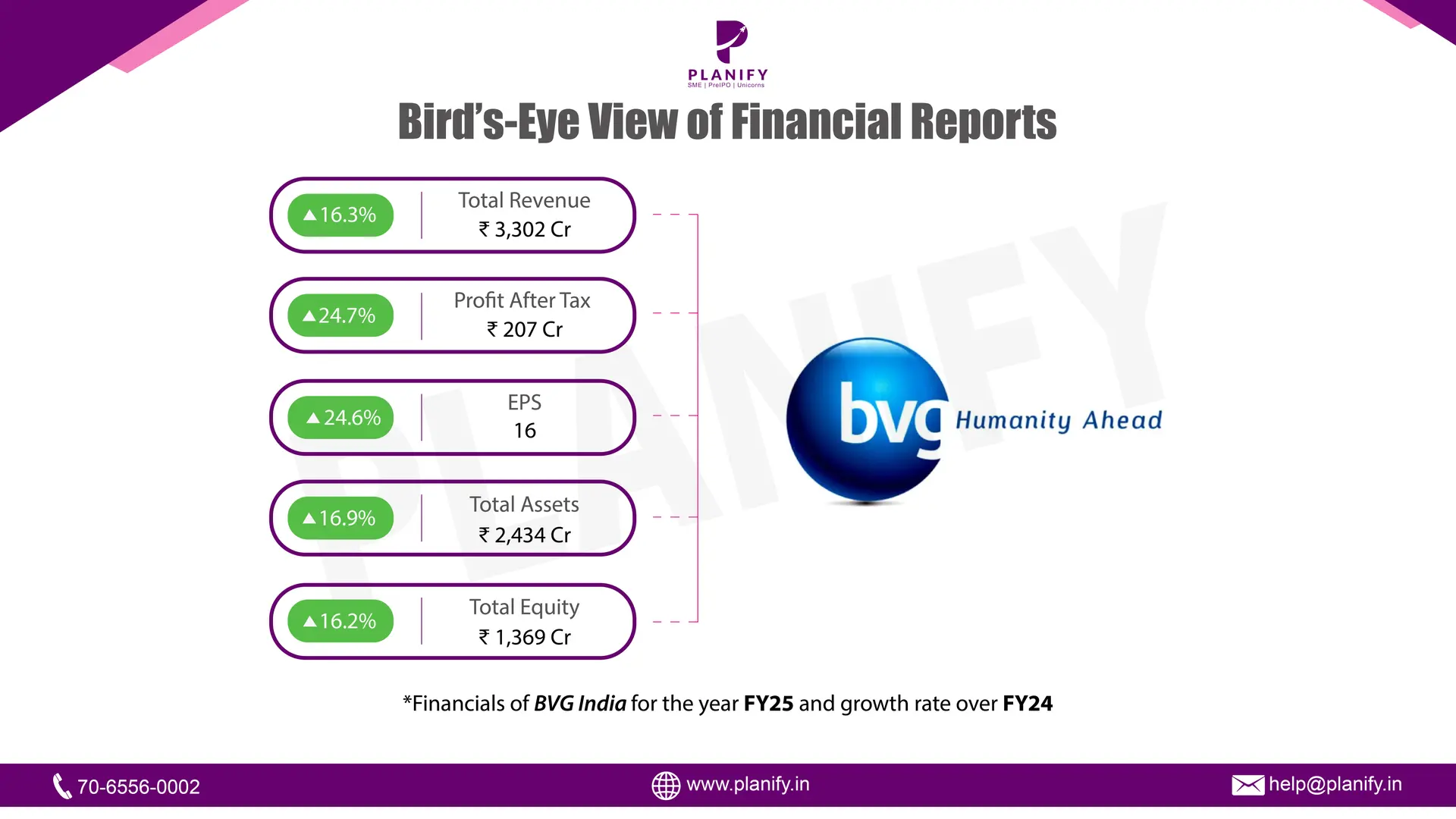

- In FY25, BVG India Limited delivered robust growth in revenue and profitability. Total Income rose 16.7% YoY to ₹3,319.54 crore in FY25 from ₹2,844.85 crore in FY24, driven by strong performance in its facility management and emergency response services verticals. Revenue from Operations increased 16.3% YoY to ₹3,301.80 crore from ₹2,839.38 crore, reflecting healthy execution across both public and private sector contracts.

- Profitability showed consistent improvement — Profit Before Tax (PBT) grew 15.0% YoY to ₹260.95 crore compared to ₹226.93 crore in FY24, while Profit After Tax (PAT) rose 24.6% YoY to ₹207.21 crore from ₹166.22 crore last year.

- EBITDA stood at ₹364.14 crore in FY25, up from ₹347.04 crore in FY24, implying an EBITDA margin of 11.0%, compared to 12.2% in FY24, reflecting moderate cost inflation during expansion. Net Profit Margin improved marginally to 6.7% from 6.5%, underlining effective cost management and operating leverage.

- The company maintained a healthy balance sheet with a Return on Capital Employed (ROCE) of 19.37% and Return on Equity (ROE) of 17.44% in FY25, indicating continued financial strength and efficient capital utilization.

Strategic Developments

- Business Diversification: Expanded its presence in emergency medical response, mobile veterinary services, and infrastructure facility management across national highways and airports.

- Technology Enablement: Introduced AI-based solutions like BVG Lens (workforce management) and Optick (AI attendance and compliance) to enhance productivity and service quality.

- Subsidiary Growth: Subsidiaries such as BVG Security Services and BVG Skill Academy contributed strongly to overall performance.

- Human Capital Development: Strengthened its training ecosystem through collaboration with NSDC, and launched BVG Global Skillforge Solutions for international skill placements.

IPO Update

- BVG India Limited, backed by private equity firm 3i Group, has re-filed its Draft Red Herring Prospectus (DRHP) with SEBI after four years, aiming to raise funds via an Initial Public Offering (IPO).

- As per the latest DRHP, the company plans to raise ₹300 crore through a fresh issue of shares and an offer-for-sale (OFS) of up to 2.85 crore shares by existing shareholders. Major selling shareholders include Promoter Hanmantrao Gaikwad and investors Strategic Investments FM (Mauritius) Alpha and Strategic Investments FM (Mauritius) B, affiliates of the 3i Group.

- Earlier, BVG India had filed its DRHP in September 2021 for a smaller issue size (₹200 crore fresh issue and 16.98 lakh shares OFS), which was later returned by SEBI in March 2023. Promoters currently hold 58.74% of the company, while public shareholders — led by Strategic Investments Alpha (21.89%) — own the remaining 41.26%.

Outlook

- BVG India concluded FY25 with its highest-ever total income and profit, driven by expanding service offerings, efficient operations, and steady demand across facility and emergency management services. With investments in technology, workforce skilling, and diversification across infrastructure and healthcare projects, the company is well-positioned to capture long-term opportunities in India’s organized facility management and integrated service outsourcing market.

- The upcoming IPO is expected to further strengthen its balance sheet, enhance visibility, and provide liquidity to early investors — positioning BVG India for the next phase of growth and market leadership.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.