Care Health Insurance Limited

23 December 2025

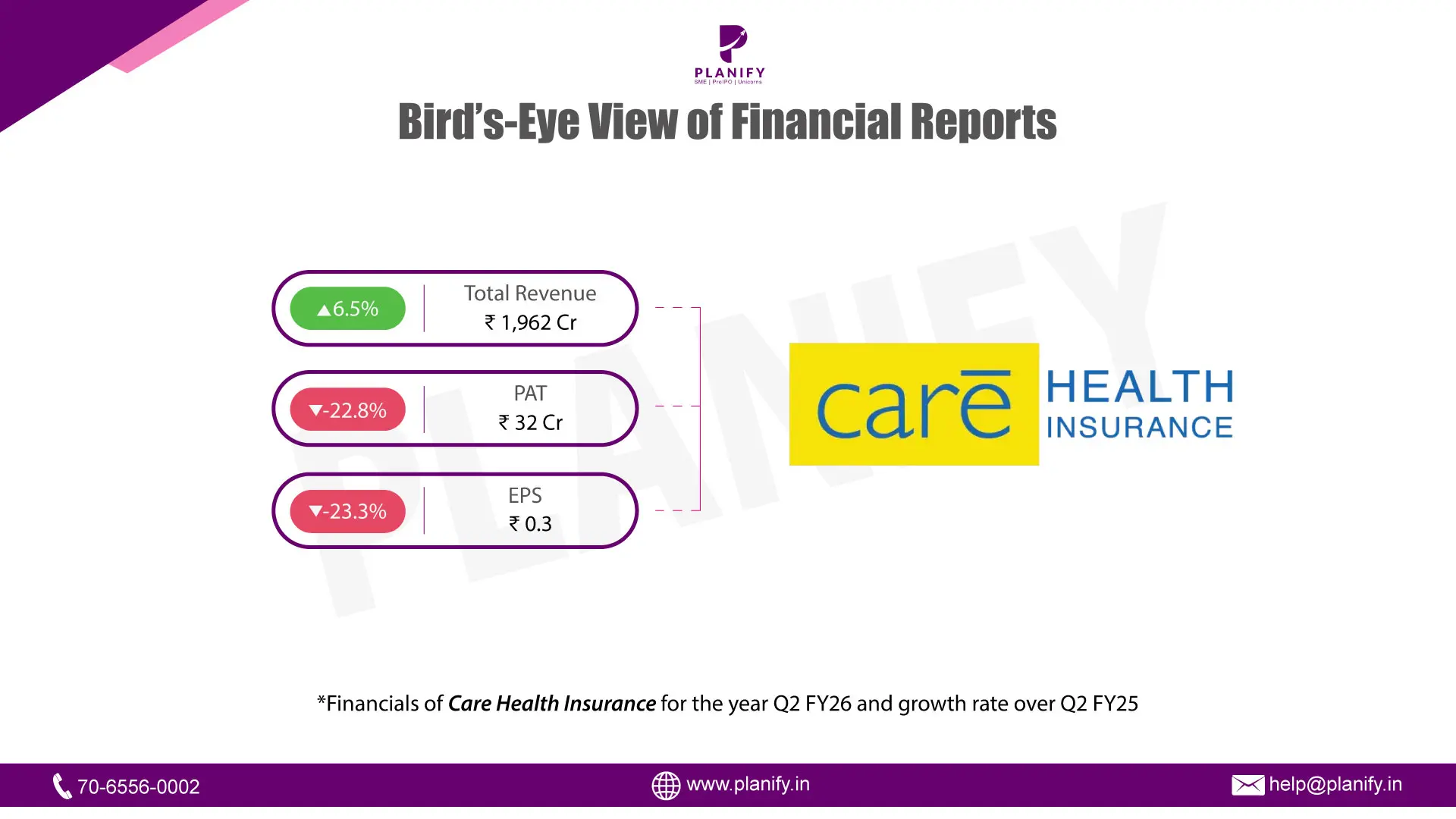

Financial Performance (Q2 FY26 vs Q1 FY25): Care Health Insurance reported a mixed financial performance in Q2 FY26, with total revenue growing by 6.5% to ₹1,961.6 crore, compared to ₹1,842.3 crore in Q1 FY25. Despite the top-line growth, profitability came under pressure. Profit After Tax (PAT) declined by 22.8% to ₹32.1 crore, compared to ₹41.56 crore in Q1 FY25. Consequently, Earnings Per Share (EPS) decreased by 23.3% to ₹0.33, from ₹0.43 in the reference period. The growth in revenue indicates continued business momentum, while the contraction in PAT suggests potential impacts from higher claims or operational costs during the quarter.

Operational Metrics (Q2 FY26): Operational performance highlights a significant scale of operations. The company reported a total policy count of 1,00,30,733 during the current year, indicating a massive customer base. Claims volume was also substantial, with 8,31,150 claims registered. Service efficiency remained a key strength; policy-level complaints stood at a low 0.81 per 10,000 policies, and claim-related complaints were 47 per 10,000 claims. The grievance redressal mechanism was highly effective, with 100% of the 254 pending complaints being less than 15 days old, ensuring zero backlog beyond the regulatory timeline.

Strategic Developments: The company continues to strengthen its market position with a focus on scaling its policy issuance and managing high claim volumes efficiently. The data reflects a strategic emphasis on customer service quality, evidenced by the low complaint ratios and swift grievance resolution. While specific capital initiatives for the quarter were not highlighted in this disclosure, the operational stability suggests a continued focus on long-term sustainability and trust-building within the health insurance sector. The disparity between revenue growth and profit decline may point to a strategic decision to absorb higher claim costs to maintain market share or service standards.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.