Blog

Planify Feed

Fino Paytech achieves growth momentum in FY25

Link copied

Fino Paytech achieves growth momentum in FY25

05 September 2025

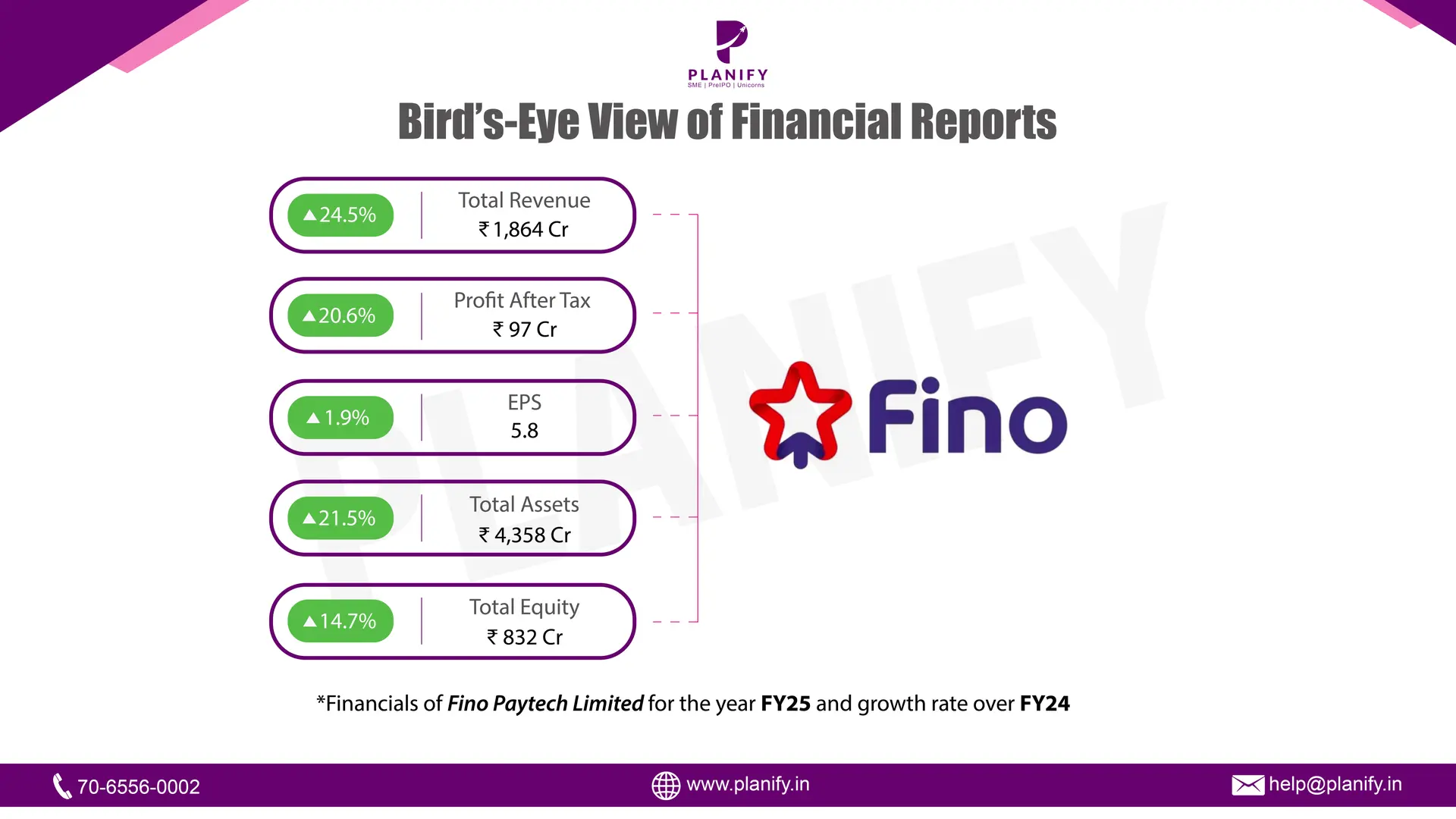

- Financial Performance (FY25 vs FY24): Despite a weaker FY24, the company delivered solid growth on a consolidated level while also turning profitable on a standalone basis in FY25. On a consolidated basis, total income grew by 24.5%, reaching ₹1,864 Cr in FY25 versus ₹1,497 Cr in FY24. Profit Before Tax (PBT) rose 44.0%, to ₹115 Cr from ₹80 Cr. Net Profit (PAT) stood at ₹97 Cr, up 20.6% from ₹81 Cr. EPS improved to ₹5.8 (basic) from ₹5.7, and to ₹5.7 (diluted) from ₹4.6, showing stable earnings momentum despite a marginal increase in equity base. On a standalone basis, the company posted a small revenue decline, with total income at ₹19.4 Cr, down 3.8% from ₹20.2 Cr in FY24. However, PBT turned positive at ₹4.2 Cr, compared to a ₹8.4 Cr loss last year. PAT also improved to ₹3.1 Cr, against a ₹7.2 Cr loss in FY24, reflecting cost control. EPS recovered to ₹0.29 from -₹0.69, highlighting a turnaround at the entity level.

- Operational Metrics (FY25 vs FY24): Consolidated net profit margin came in at 5.2% (vs 5.4% in FY24), a marginal dip due to higher employee and finance costs. Operating profit margin improved slightly to 15.7% from 15.3%, showing efficiency gains at scale. Standalone margins improved meaningfully, with net margin at 16% in FY25 compared to a negative margin last year. This was driven by a sharp reduction in other expenses (₹4 Cr vs ₹16 Cr in FY24). The consolidated balance sheet remains strong, with total assets at ~₹4,359 Cr

- Strategic Developments: Subsidiary Fino Payments Bank was the main growth engine, delivering ₹18,471 Cr revenue and ₹925 Cr PAT in FY25. Smaller subsidiaries such as Fino Trusteeship Services (₹0.4 Cr PAT) were profitable, while FFPL Finserv (₹0.6 Cr loss) and Fino Financial Services (₹0.01 Cr loss) had minimal impact. No dividend was declared for FY25, as the board chose to retain earnings despite strong consolidated profitability. The company issued 2,695 equity shares under ESOPs. Continued investments in financial inclusion and Aadhaar-based authentication services strengthened its ecosystem.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.