Blog

Planify Feed

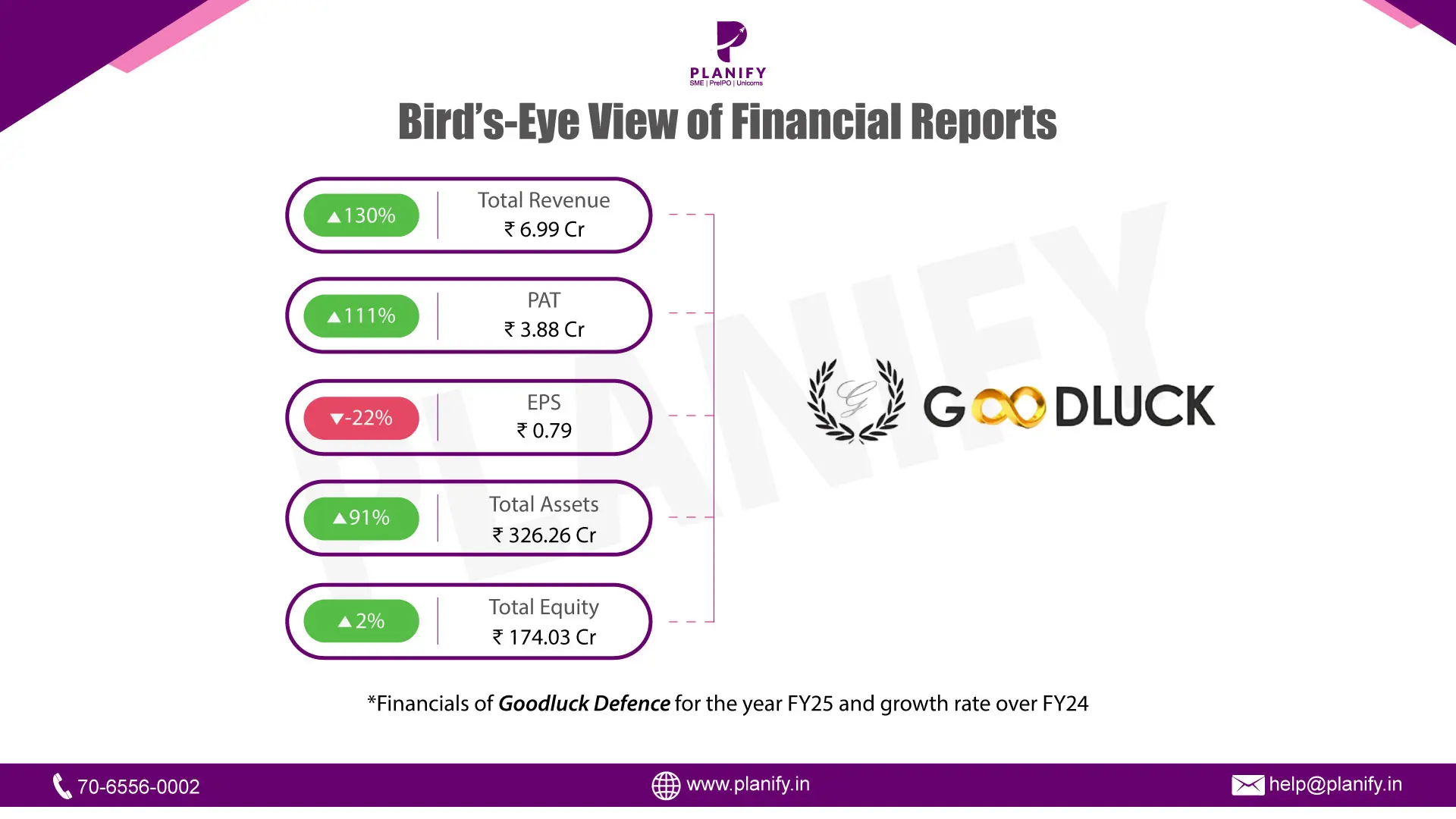

Goodluck Defence: Strong Growth with Mixed Shareholder Impact

Link copied

Goodluck Defence: Strong Growth with Mixed Shareholder Impact

02 September 2025

Goodluck Defence’s FY25 performance reflects exceptional revenue and profit growth, showcasing its operational strength and expanding scale.

- Revenue: In FY25, Goodluck Defence reported a total revenue of ₹6.99 crore, reflecting an impressive 130% year-on-year growth over FY24. This surge underscores the company’s robust top-line momentum, indicating that its operations and market presence have expanded significantly compared to the previous year.

- Profitability & EPS: The company’s profitability also saw a sharp improvement, with Profit After Tax (PAT) rising to ₹3.88 crore, a growth of 111% year-on-year. However, despite this robust bottom-line growth, the Earnings Per Share (EPS) declined by 22% to ₹0.79.

- Assets & Equity: On the balance sheet side, total assets increased substantially to ₹326.26 crore, marking a 91% rise over the previous year. In contrast, total equity grew modestly by just 2% to ₹174.03 crore. The sharp rise in assets compared to equity suggests that the company relied more heavily on borrowings or external liabilities to fund its expansion, indicating a higher leverage position.

- Goodluck Defence delivered outstanding revenue and profit growth in FY25, underscoring its strong operational performance and accelerating scale of operations. However, the decline in EPS and disproportionate asset-equity growth raises caution around shareholder returns and leverage. Sustaining profitability while balancing capital structure will be critical for driving long-term value.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.