Blog

Planify Feed

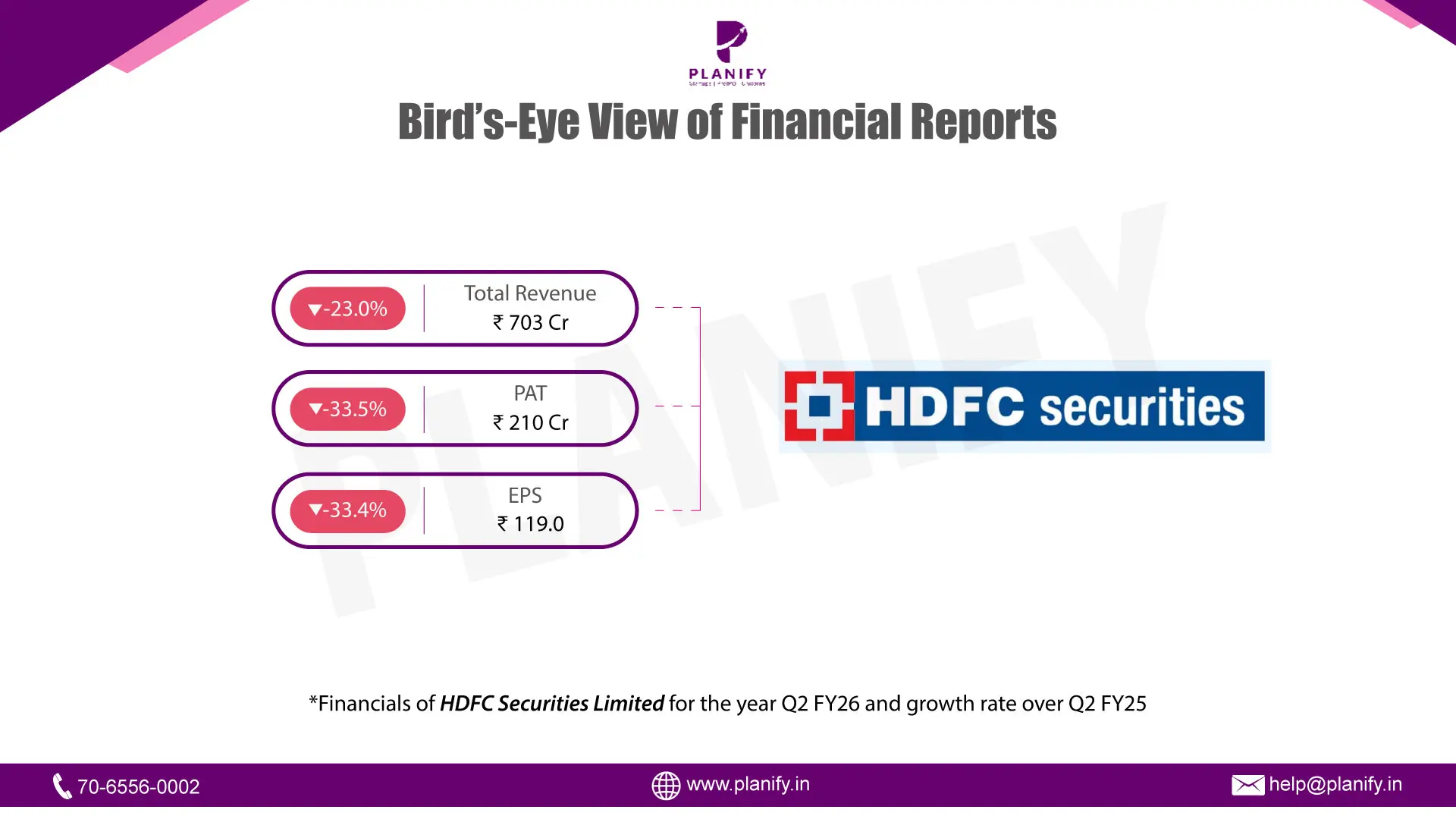

HDFC Securities Posts Weaker Q2FY26 Results

Link copied

HDFC Securities Posts Weaker Q2FY26 Results

22 December 2025

- Financial Performance (Q2 FY26 vs Q2 FY25): HDFC Securities reported a weaker financial performance in Q2 FY26, with total revenue declining by 23.2% year-on-year (YoY) to ₹701 crore, compared to ₹913 crore in Q2 FY25. The decline was mainly due to lower fees and commission income along with losses on fair value changes during the quarter. Profit Before Tax (PBT) fell by 31.6% YoY to ₹282 crore from ₹412 crore in the same quarter last year. Profit After Tax (PAT) declined by 33.2% YoY to ₹211 crore, compared to ₹315 crore in Q2 FY25. Earnings Per Share (EPS) also declined by 33.8% YoY to ₹118.2, from ₹178.5 last year.

- Operational Metrics (Q2 FY26 vs Q2 FY25): Operational performance saw pressure on margins during the quarter. Operating margin declined to 40% in Q2 FY26 from 45% in Q2 FY25, while net profit margin reduced to 30% from 35% last year. The interest service coverage ratio stood at 2.9 times, slightly lower than 3.0 times in Q2 FY25, reflecting higher finance costs. The debt-to-equity ratio remained elevated at 3.39 times, while debtors turnover improved to 0.9 times from 0.8 times, indicating better collection efficiency.

- Strategic Developments: During the quarter, the company allotted 83,382 equity shares under employee stock option schemes and granted 17,250 stock options, continuing its focus on employee retention. HDFC Securities also declared and paid an interim dividend of ₹90 per share, reflecting confidence in cash flows despite near-term earnings pressure. The GIFT City subsidiary remains small and had no material impact on consolidated performance. The company’s net worth increased to ₹3,520.1 crore, up 10.9% YoY, providing a strong capital base. The financial performance during the quarter reflects prevailing capital market conditions, including lower trading activity and subdued investor participation. While near-term results remain linked to market sentiment, the company’s prudent risk management and stable client base support long-term sustainability.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.