Blog

Planify Feed

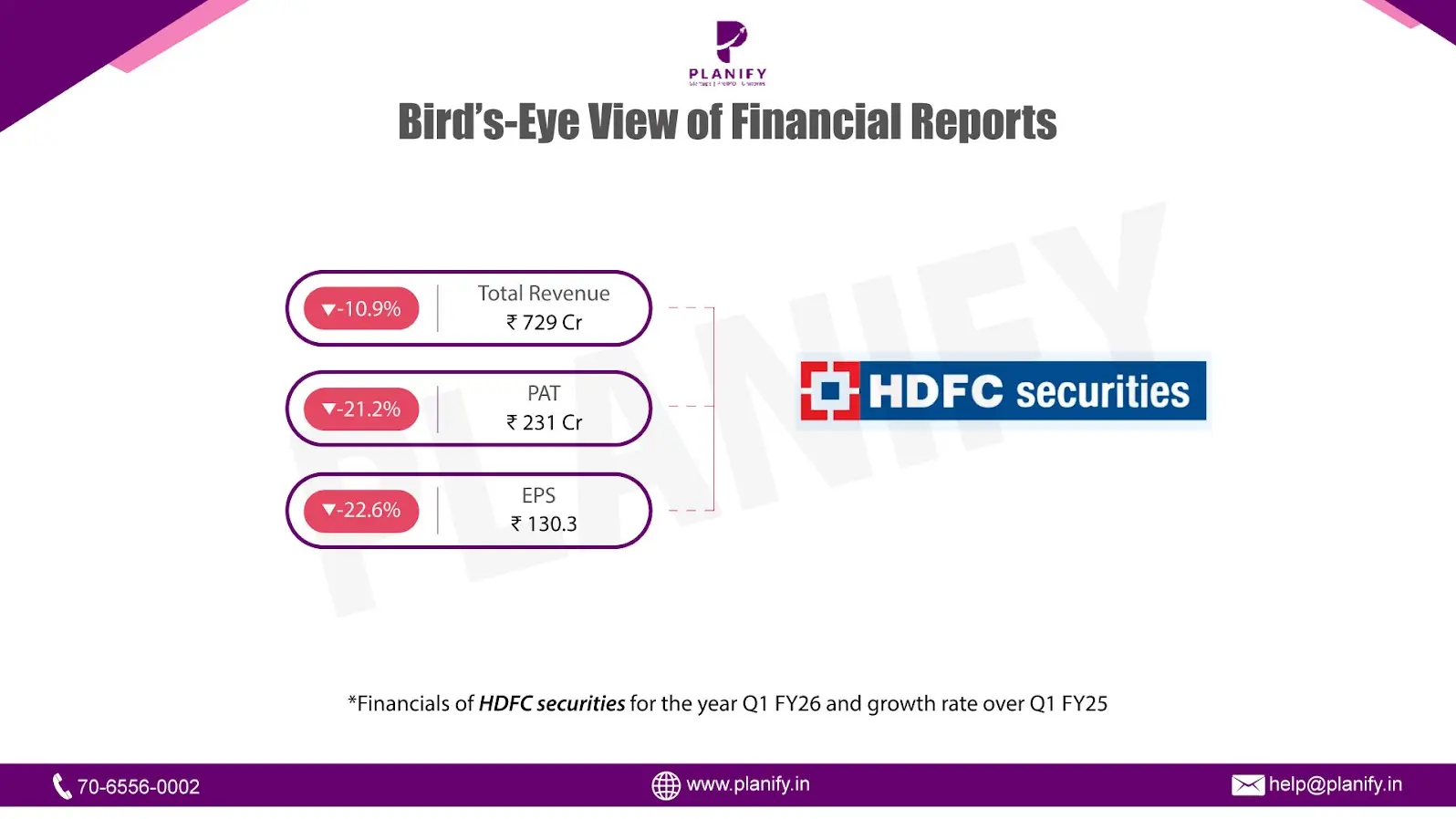

HDFC Securities Reports Lower Profit in Q1 FY26

Link copied

HDFC Securities Reports Lower Profit in Q1 FY26

31 July 2025

- Financial Performance (Q1 FY26 vs Q1 FY25): HDFC Securities reported a muted financial performance in Q1 FY26, with total revenue declining by 10.9% year-on-year (YoY) to ₹729 Cr from ₹818 Cr in Q1 FY25. This drop reflects softer market volumes and a decrease in transactional revenue. Profit Before Tax (PBT) decreased by 22.3% YoY to ₹304 Cr from ₹391 Cr in the same period last year, primarily due to higher employee and finance costs. Profit After Tax (PAT) stood at ₹231 Cr, down 21.1% YoY from ₹293 Cr, impacting overall profitability. Earnings Per Share (EPS) also dropped by 22.6% YoY, falling to ₹130.3 from ₹168.3 in Q1 FY25.

- Operational Metrics (Q1 FY26 vs Q1 FY25): Operationally, the company faced headwinds. Operating margin compressed to 42% from 48% in Q1 FY25, while Net Profit margin declined to 32% from 36%. The company maintained a healthy Interest Service Coverage Ratio at 3.09x, relatively flat YoY. The debt-to-equity ratio improved to 2.59x from 3.40x, indicating better leverage management. However, the debtors turnover ratio remained subdued at 0.54x vs 0.49x in the same period last year, pointing to working capital pressure.

- Strategic Developments: During the quarter, HDFC Securities allotted 32,262 equity shares under ESOPs and granted 17,250 stock options, reinforcing its employee retention strategy. The company paid an interim dividend of ₹100 per share, amounting to ₹177.7 Cr. A noteworthy event was the contribution from its wholly-owned GIFT City subsidiary (HDFC Securities IFSC Ltd), although the subsidiary posted a minor loss of ₹0.6 Cr this quarter. Despite the drop in revenue and profit, HDFC Securities remains financially stable. Its net worth increased to ₹3,432.5 crore, which is 11.4% higher than the same quarter last year, showing that the company has a strong financial base. It continues to manage its risks carefully, borrow responsibly, and retain a steady client base. These factors should help the company grow over the long term, although lower trading volumes and fee income may impact performance in the near future.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.