Blog

Planify Feed

Hero FinCorp Q2FY26: Profitability Hit by Elevated Impairments

Link copied

Hero FinCorp Q2FY26: Profitability Hit by Elevated Impairments

04 November 2025

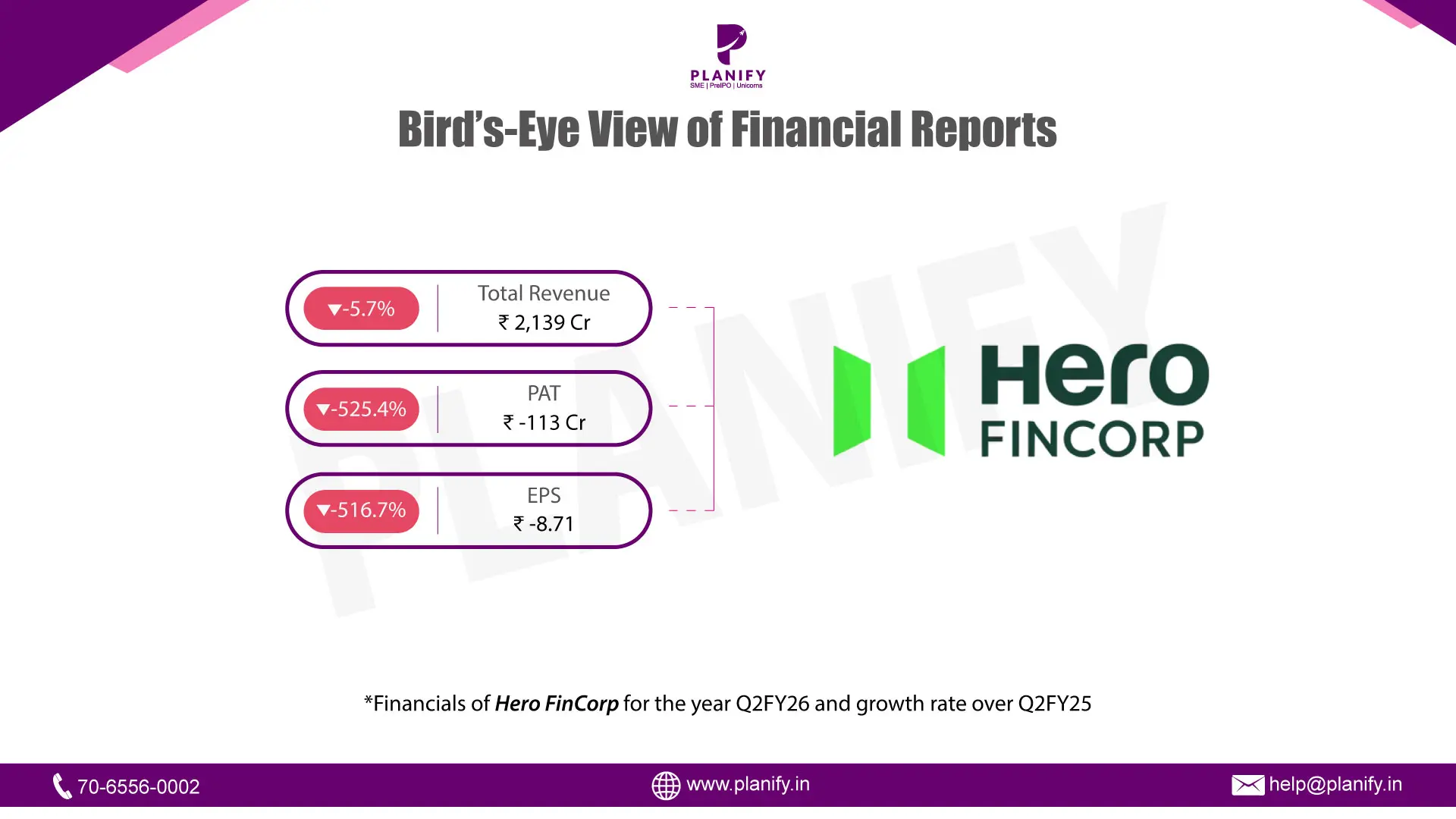

- Financial Performance (Q2FY26 vs Q2FY25): In Q2FY26, Hero FinCorp reported a 5.7% YoY decline in total income to ₹2,139 Cr, compared with ₹2,268 Cr in Q2FY25, primarily due to lower interest income (-4.5% YoY to ₹1,868 Cr). Total revenue from operations stood at ₹2,137 Cr versus ₹2,265 Cr a year ago. Operating performance weakened sharply, with Profit Before Tax (PBT) turning into a loss of ₹100.0 Cr against a profit of ₹62.6 Cr in Q2FY25, largely driven by higher impairment on financial instruments (+11.7% YoY to ₹644.8 Cr) and elevated finance costs (+0.9% YoY to ₹835.2 Cr). After tax, the company reported a Net Loss of ₹112.8 Cr, compared to a profit of ₹26.5 Cr in Q2FY25. Consequently, Earnings Per Share (EPS) fell to ₹(8.71) from ₹2.09 in the same quarter last year. For H1FY26, total income declined 1.2% YoY to ₹4,474.1 Cr (vs ₹4,529.6 Cr in H1FY25), while Net Loss stood at ₹162.5 Cr, compared with a profit of ₹66.0 Cr in H1FY25.

- Operational Metrics (Q2FY26 vs Q2FY25): Hero FinCorp’s net profit margin stood at -5.3%, down from 1.2% in Q2FY25, reflecting rising funding and credit costs. Asset quality deteriorated — Gross NPA (GNPA) increased to 5.41% (vs 4.63% YoY) and Net NPA (NNPA) rose to 2.41% (vs 2.22% YoY). However, the Provision Coverage Ratio (PCR) improved to 56.83% from 53.27%, providing a stronger cushion against stressed assets. The company maintained a healthy capital position, with the Capital to Risk Weighted Assets Ratio (CRAR) at 17.41% (vs 16.67% YoY) and the Liquidity Coverage Ratio (LCR) improving sharply to 145.7% (from 105.4% last year), indicating ample liquidity reserves. Total debt to total assets remained stable at 86.5%, while Net Worth increased 2.3% YoY to ₹5,846.6 Cr (vs ₹5,714.8 Cr in Q2FY25).

- Strategic Developments: During H1FY26, Hero FinCorp acquired 2,148 loan accounts worth ₹117.8 Cr and transferred 1,01,161 loan accounts worth ₹1,475.3 Cr, reflecting continued portfolio churn and balance sheet optimization. Q2FY26 was a challenging quarter for Hero FinCorp, with profitability hit by elevated credit provisions and higher finance costs amid a tight interest rate environment. However, the company maintained robust capital adequacy (17.4%), improved liquidity coverage, and strengthened provisioning buffers. Portfolio stress remains concentrated in the MSME and personal loan segments, though the resolution book continues to decline — an encouraging sign. The planned Hero Fincorp IPO and potential reclassification of CCPS as equity are expected to enhance net worth and reduce leverage.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.