Blog

Planify Feed

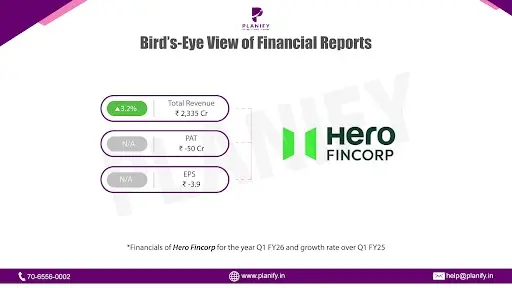

Hero FinCorp Slips Into Loss in Q1FY26 as NPAs Rise

Link copied

Hero FinCorp Slips Into Loss in Q1FY26 as NPAs Rise

12 August 2025

- Financial Performance (Q1FY26 vs Q1FY25): In Q1FY26, Hero FinCorp reported a 3.2% YoY increase in total income to ₹2,335 Cr, up from ₹2,262 Cr in Q1FY25, driven by higher interest income (+1.1% YoY) and other operating charges. However, profitability slipped sharply — Profit Before Tax (PBT) declined to a loss of ₹24 Cr from a profit of ₹89 Cr in Q1FY25, primarily due to higher finance costs (+10.0% YoY to ₹891.1 Cr) and increased impairment on financial instruments (+5.3% YoY to ₹740.3 Cr). Profit After Tax (PAT) fell to a loss of ₹50 Cr from a profit of ₹40 Cr in Q1FY25, weighed down by higher tax expense. EPS dropped to ₹(3.89) from ₹3.10 last year.

- Operational Metrics (Q1FY26 vs Q1FY25): The net loss margin stood at -2.1%, compared to a net profit margin of 1.8% in Q1FY25, reflecting cost pressures. Gross NPA (GNPA) increased to 5.65% from 4.44%, while Net NPA (NNPA) rose to 2.50% from 2.15%, indicating deteriorating asset quality. The Provision Coverage Ratio (PCR) improved to 57.17% from 52.82%, offering a slightly stronger buffer against stressed assets. The capital-to-risk weighted assets ratio (CRAR) rose to 17.67% from 16.93% YoY. The liquidity coverage ratio also improved to 142.46% from 127.93%. Total debts to total assets stood at 86.48% vs 85.81% last year. Net worth declined 1.4% YoY to ₹5,931.7 Cr.

- Strategic Developments: Q1FY26 marked a weak start to the fiscal year for Hero FinCorp, with pressure on margins, rising NPAs, and negative profitability. Higher borrowing costs and provisioning requirements continue to weigh on earnings. The company maintained a healthy liquidity coverage ratio and strengthened its PCR, but sustained improvement in recoveries and tighter credit underwriting will be crucial to reversing the profitability trend. During the quarter, the company completed a private placement of 18,57,135 equity shares at a premium of ₹1,390 per share (face value ₹10), raising ₹1,390 Cr in capital, which will support future growth and balance sheet strength.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.