Blog

Planify Feed

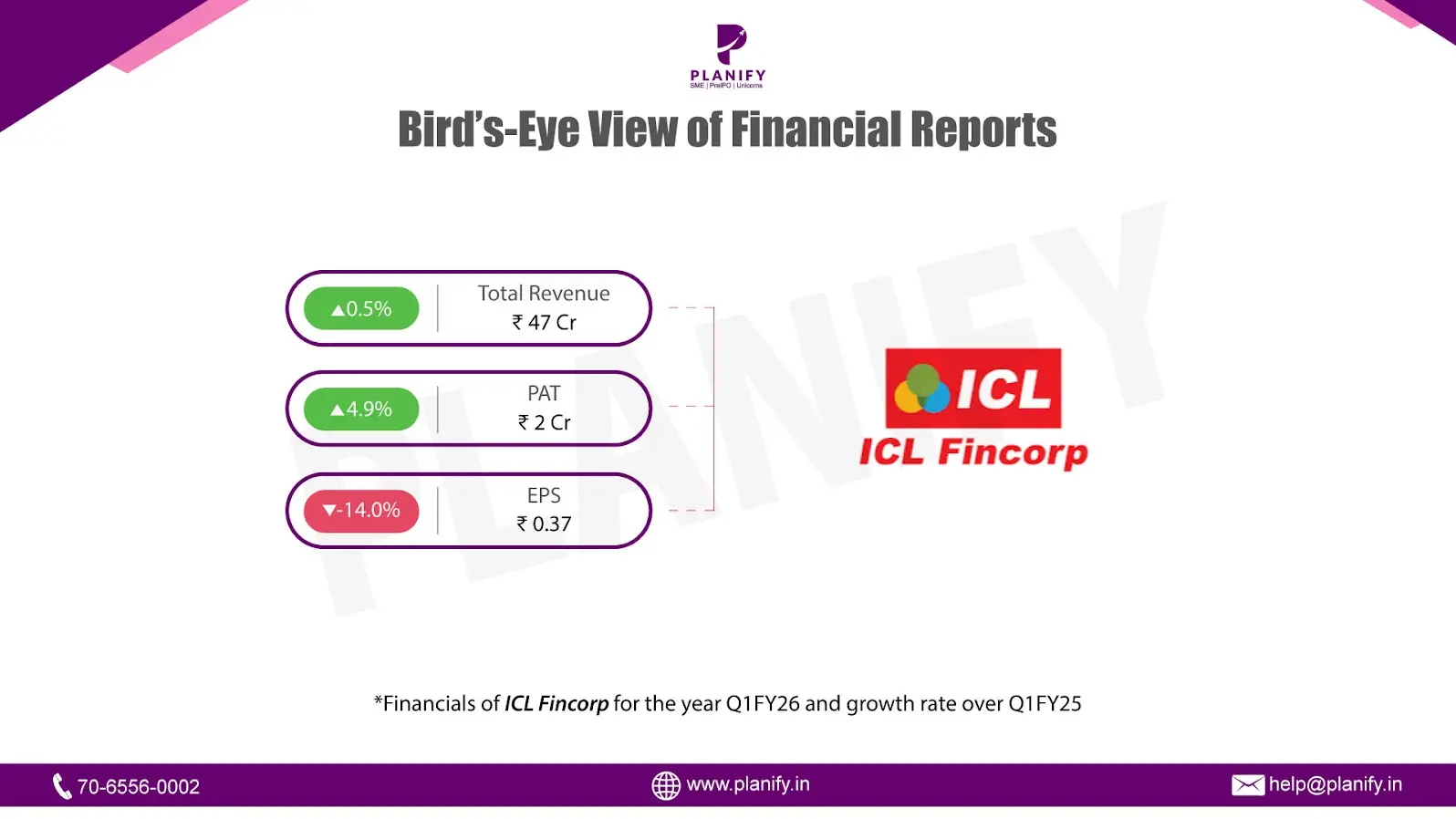

ICL Fincorp Delivers Stable Q1FY26 with Better Recoveries

Link copied

ICL Fincorp Delivers Stable Q1FY26 with Better Recoveries

19 August 2025

- Financial Performance (Q1FY26 vs Q1FY25): In Q1FY26, ICL Fincorp reported a modest 0.5% YoY growth in total income to ₹47.2 Cr, compared with ₹47.0 Cr in Q1FY25, aided by higher revenue from operations. Operating performance remained largely flat, with Profit Before Tax (PBT) rising marginally by 1.2% YoY to ₹2.88 Cr, against ₹2.86 Cr in the prior year. At the net level, profitability showed a slight improvement, as Profit After Tax (PAT) increased 4.9% YoY to ₹2.1 Cr, versus ₹2.0 Cr in Q1FY25, supported by lower tax outgo. However, Earnings Per Share (EPS) declined to ₹0.37, compared with ₹0.43 a year earlier, reflecting weaker per-share earnings growth.

- Operational Metrics (Q1FY26 vs Q1FY25): Net Profit Margin improved slightly to 4.5% from 4.3% last year, due to tax savings despite flat PBT. Asset Quality: Gross Stage 3 Loan Assets (GNPA) improved to 0.60% from 1.06% in Q4FY25, while Net Stage 3 Loan Assets (NNPA) declined to 0.51% from 0.94%, indicating strengthening collections. Provision Coverage Ratio (PCR) rose to 15.5% from 11.4%. Capital Adequacy Ratio (CAR) declined to 18.0% from 19.3%, but remains comfortably above regulatory requirements.

- Strategic Developments: Q1FY26 was a quarter of stable revenue and marginal profit growth for ICL Fincorp. While income growth remained marginal and PBT was nearly flat, the bottom line saw modest improvement due to lower tax expenses. On the positive side, asset quality strengthened, with both GNPA and NNPA ratios improving and provision coverage increasing, reflecting better recoveries and risk management. However, the decline in capital adequacy and higher leverage highlight increased reliance on borrowings to support growth. Overall, the quarter underscored steady topline performance with thin margins, partly cushioned by encouraging improvements in asset quality.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.