Blog

Planify Feed

ICL Fincorp Delivers Strong FY25 Turnaround with Profit Surge

Link copied

ICL Fincorp Delivers Strong FY25 Turnaround with Profit Surge

14 August 2025

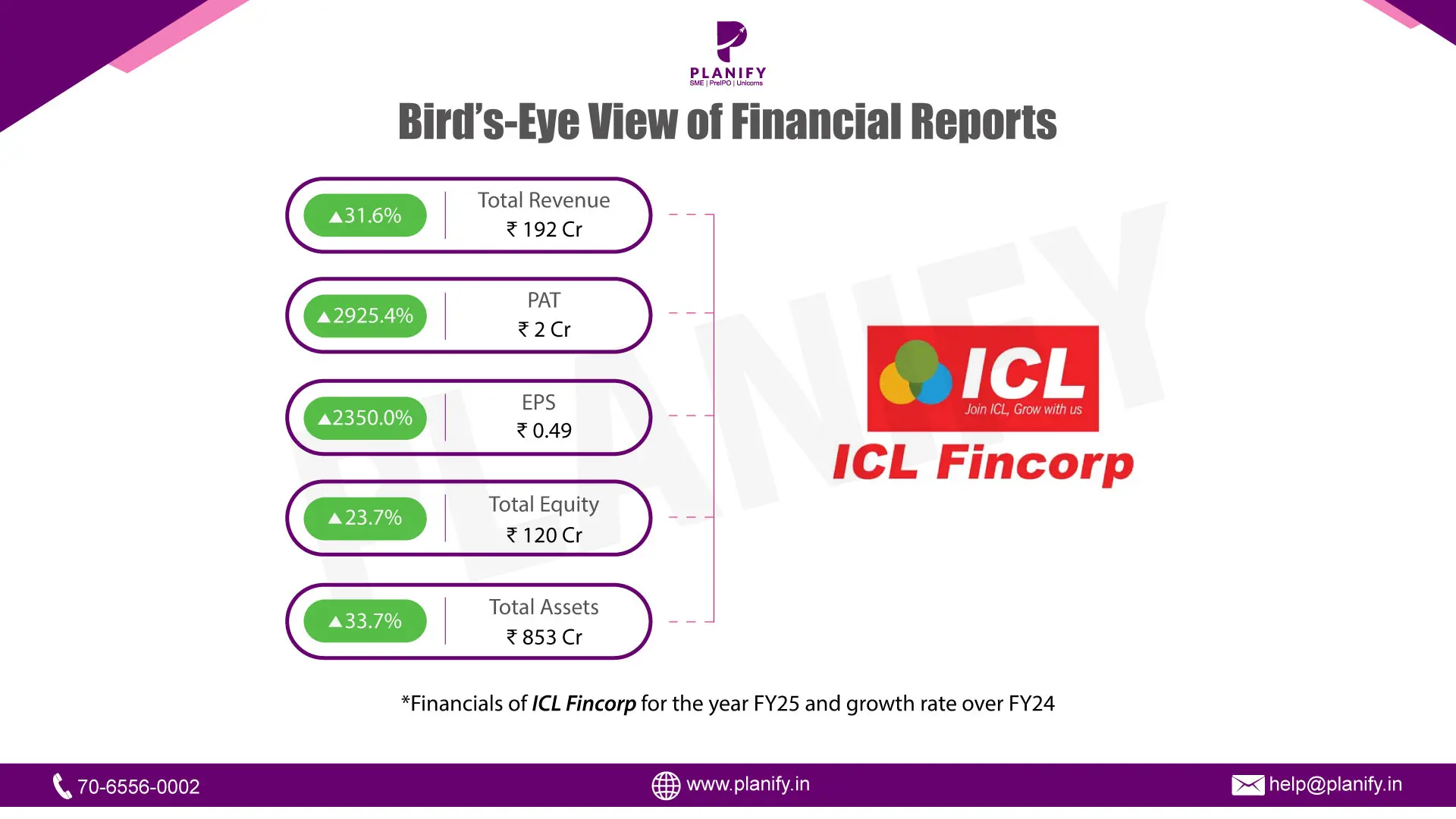

- Financial Performance (FY25 vs FY24): ICL Fincorp posted a strong performance in FY25, recovering sharply from the previous year’s subdued profitability. Total income rose 31.6% to ₹192 Cr from ₹146 Cr in FY24, driven by higher loan disbursements, stronger interest income, and stable fee income. Profit Before Tax (PBT) surged 385.9% to ₹5 Cr from ₹1 Cr, aided by lower impairment costs and operational efficiencies. Net Profit (PAT) surged to ₹2.4 Cr versus ₹8 lakhs last year. Earnings per share (EPS) improved to ₹0.49 from ₹0.02, reflecting a robust earnings rebound.

- Operational Metrics (FY25 vs FY24): The Net Profit Margin jumped to 1.3% from just 0.06%, reflecting a sharp improvement in overall profitability. The loan book expanded by 37.5%, with total assets rising to ₹853 Cr from ₹638 Cr in FY24. Asset quality showed marked improvement – Gross Stage 3 Loan Assets ratio dropped to 1.03% (from 1.51%), and Net Stage 3 Loan Assets ratio improved to 0.88% (from 1.33%). The Capital Adequacy Ratio strengthened to 19.34% (vs 14.99%), while Provision Coverage Ratio increased to 14.17% (vs 12.19%).

- Strategic Developments: In FY25, ICL Fincorp expanded its funding base through multiple secured, redeemable, non-convertible debenture (NCD) issuances via public and private placements, with proceeds fully utilised for business expansion. The company maintained a full asset cover for these NCDs, ensuring strong security for investors. Prudent underwriting standards, better recovery mechanisms, and disciplined cost control supported profitability improvement. Growth was further aided by a stronger capital base, higher borrowings, and increased subordinated liabilities, providing both liquidity and leverage capacity for future expansion.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.