IKF Finance Ltd.

22 December 2025

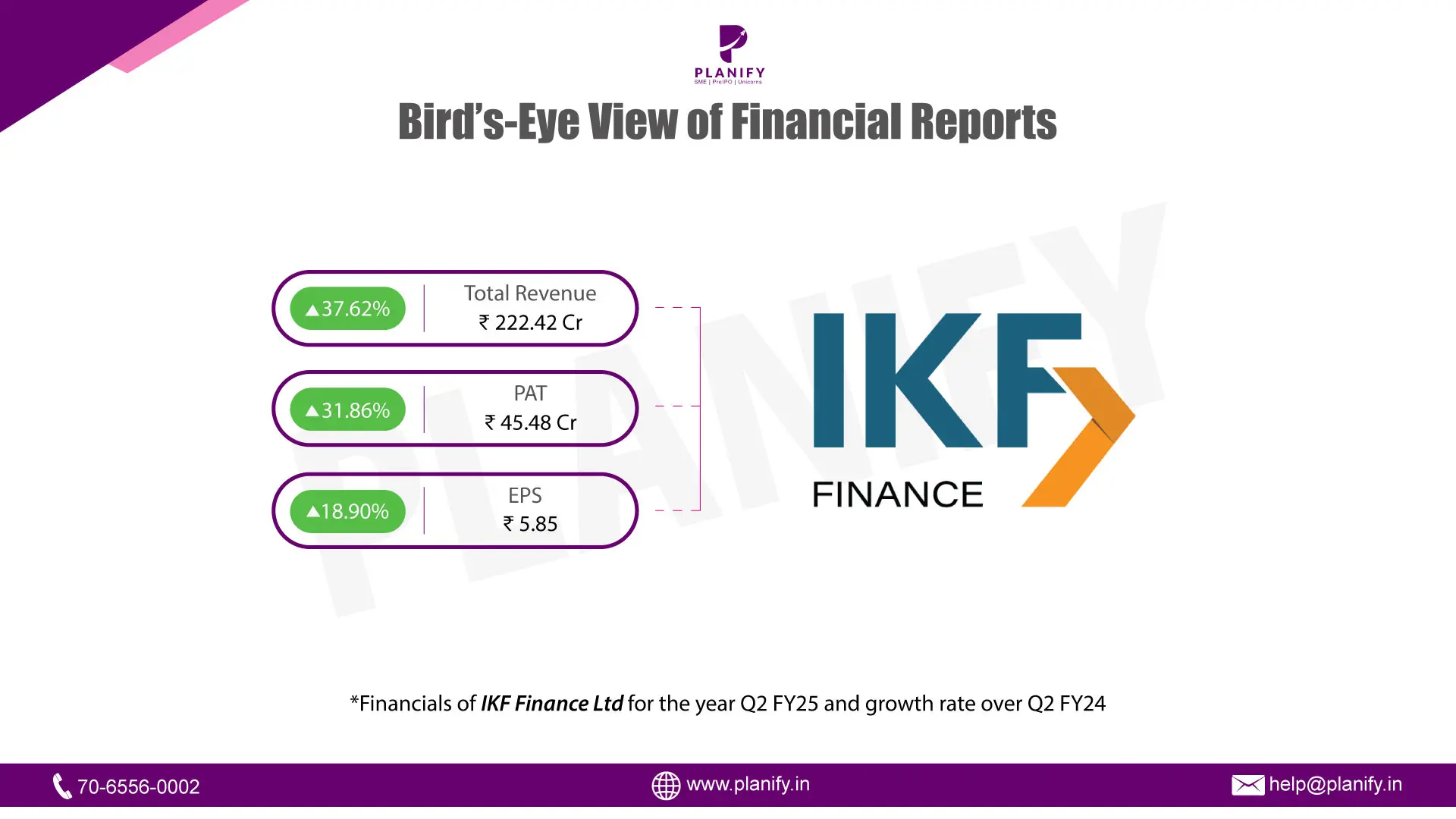

Financial Performance (Q2 FY26 vs Q2 FY25): IKF Finance reported a strong set of consolidated results for Q2 FY26, with total income rising to ₹225.0 crore, marking a 37.0% year-on-year increase compared to ₹164.3 crore in Q2 FY25. The growth was primarily driven by a sharp increase in interest income, which rose 39.4% YoY to ₹207.2 crore, reflecting continued expansion of the loan book and stable yields. Profit before tax stood at ₹61.0 crore, up 31.8% YoY from ₹46.3 crore, despite elevated credit costs during the quarter. Profit after tax came in at ₹45.5 crore, registering a 31.9% YoY growth over ₹34.5 crore in the corresponding quarter last year. Net profit margin remained healthy at 20.2%, broadly stable on a YoY basis, indicating that operating leverage and cost control offset the rise in provisioning.

Asset Quality and Credit Cost Analysis: Asset quality remained largely stable during the quarter. Gross Stage-3 assets stood at 2.48%, marginally higher compared to 2.33% in the previous quarter but still well within internal and covenant thresholds. Net Stage-3 assets improved to 1.66%, declining from 1.75% YoY, supported by stronger provisioning. Provision coverage ratio increased materially to 33.6%, compared to 22.6% in Q2 FY25, reflecting a more conservative stance on credit risk. Impairment expenses rose sharply to ₹19.9 crore, driven largely by portfolio seasoning and proactive credit buffers rather than any sharp deterioration in borrower quality.

Loan Book Growth and Balance Sheet Position: The gross loan book expanded to ₹4,946.3 crore, reflecting 9.6% YoY growth and approximately 6.0% QoQ growth, indicating steady disbursement momentum. Net worth strengthened significantly to ₹1,798.8 crore, up 92.6% YoY, aided by retained earnings and equity infusion during the period. Leverage improved meaningfully, with the debt-to-equity ratio moderating to 2.31x from 3.54x YoY, highlighting balance sheet strengthening.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.