Blog

Planify Feed

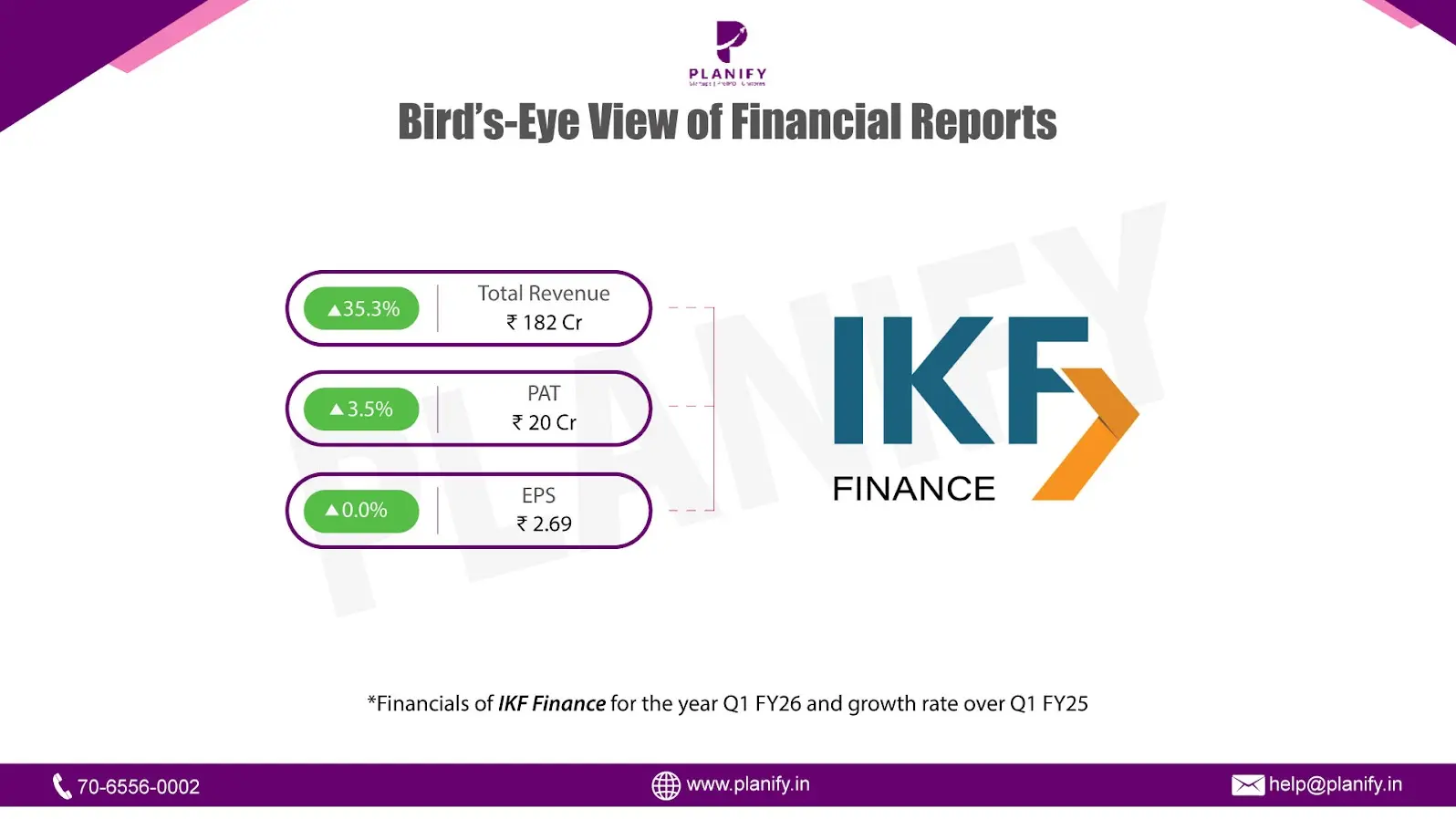

IKF Finance Posts Moderate Profit Growth in Q1FY26

Link copied

IKF Finance Posts Moderate Profit Growth in Q1FY26

14 August 2025

- Financial Performance (Q1FY26 vs Q1FY25): In Q1FY26, IKF Finance reported a 35.3% YoY increase in total income to ₹182 Cr, up from ₹134 Cr in Q1FY25, driven primarily by strong growth in interest income and higher fee-based revenues. Profit Before Tax (PBT) rose 4.5% to ₹263.3 Cr from ₹252.0 Cr, indicating stable operational performance despite higher finance costs and provisions. Profit After Tax (PAT) increased 3.5% to ₹20 Cr, compared to ₹19 Cr a year earlier. Earnings Per Share (EPS) remained flat at ₹2.69, reflecting the recent equity issuance which diluted per-share earnings growth.

- Operational Metrics (Q1FY26 vs Q1FY25): The net profit margin moderated to 10.8% from 14.1%, reflecting margin pressure from higher funding and credit costs. Gross Stage-3 Assets (GNPA) improved marginally to 2.33% from 2.38%, while Net Stage-3 Assets (NNPA) improved to 1.56% from 1.85%, indicating better provisioning and recoveries. The Provision Coverage Ratio (PCR) for Stage-3 assets rose sharply to 33.6% from 22.7%, strengthening the balance sheet buffer. The Capital Adequacy Ratio (CAR) surged to 33.48% from 25.64%, aided by equity infusion of ₹700.3 Cr during the quarter.

- Strategic Developments: In Q1FY26, IKF Finance raised ₹700 Cr through private placement and preferential allotment, which increased its capital base and lowered leverage levels. Asset quality metrics showed marginal improvement, supported by higher provisioning and stable recoveries. Profitability growth during the quarter remained moderate, as higher finance costs and impairment charges offset some of the benefits from revenue growth. The increase in the Capital Adequacy Ratio (CAR) and Provision Coverage Ratio (PCR) provides additional capacity for future lending and risk management.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.