Blog

Planify Feed

IKF Finance Posts Robust FY25 Earnings Amid Higher Impairments

Link copied

IKF Finance Posts Robust FY25 Earnings Amid Higher Impairments

13 August 2025

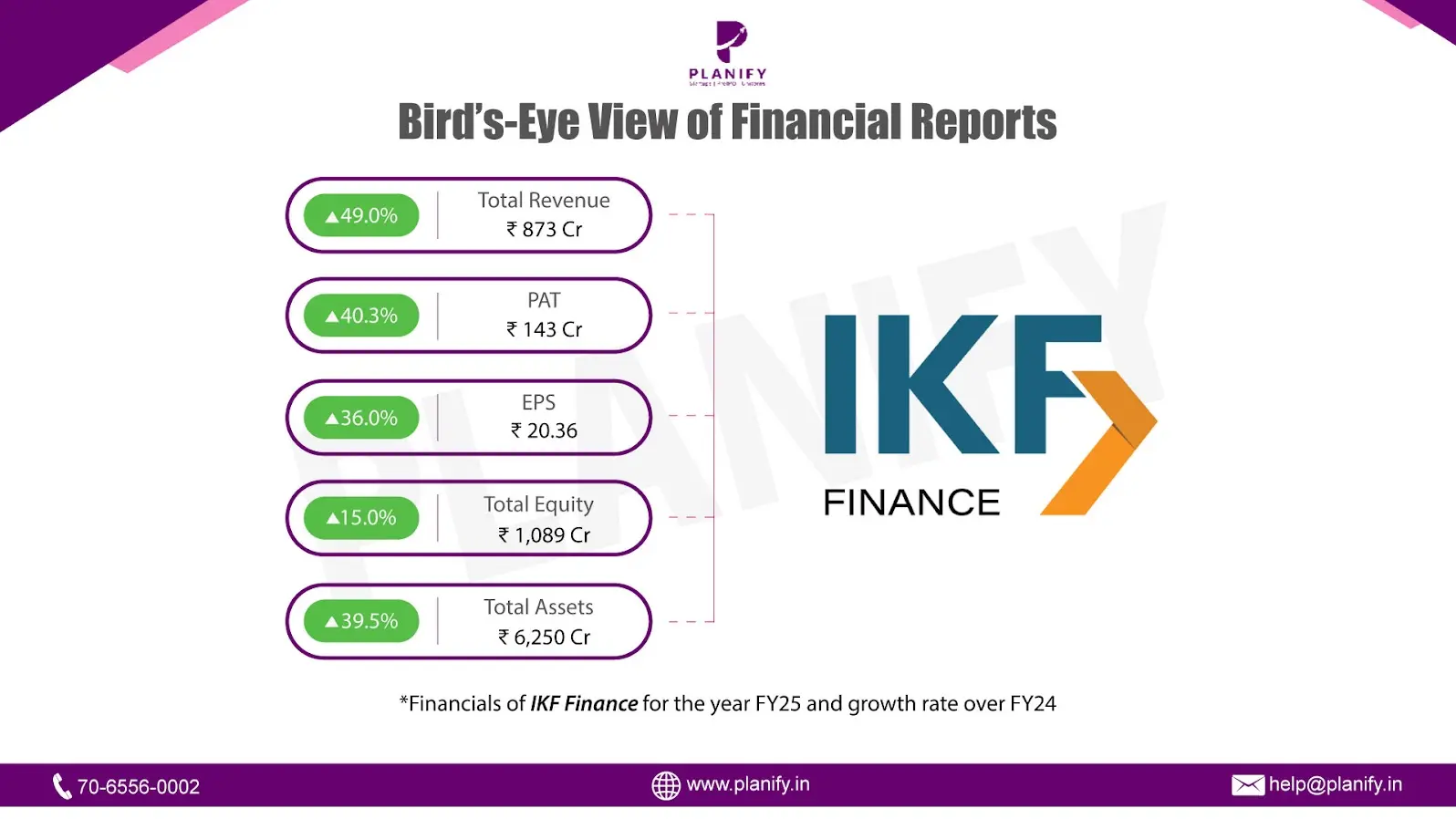

- Financial Performance (FY25 vs FY24): IKF Finance delivered strong growth in FY25 despite higher costs. Total income rose 49.0% to ₹873 Cr from ₹586 Cr in FY24, driven by a sharp 44.3% jump in interest income to ₹775 Cr and a 131% rise in gains on financial instruments under amortised cost to ₹54 Cr. Profit Before Tax (PBT) grew 39.5% to ₹191 Cr from ₹137 Cr last year, supported by revenue growth and Net Profit (PAT) increased 40.3% to ₹143 Cr from ₹102 Cr. Earnings per share (EPS) rose to ₹20.36 (basic) from ₹14.97, a 35.9% improvement YoY, reflecting healthy earnings momentum.

- Operational Metrics (FY25 vs FY24): Net Profit Margin stood at 16.36% vs 17.37% last year, showing a slight dip due to higher finance and impairment costs. Loan book expanded sharply by 37.4% to ₹5,694 Cr from ₹4,143 Cr, reflecting aggressive lending growth. Total debt-to-total assets ratio rose to 80.33% from 76.96%. The sharp 143.7% YoY increase in impairment on financial instruments to ₹49 Cr suggests rising stress in certain loan segments, indicating some pressure on asset quality despite overall portfolio growth.

- Strategic Developments: In FY25, IKF Finance pursued strong growth, expanding its loan book significantly with the help of higher borrowings and a stronger cash reserve. Profits saw healthy growth, but the increase in impairment costs points to some early signs of stress in parts of the loan portfolio. The rise in equity and improved liquidity show that the company is building a solid financial base to support future expansion while keeping stability in focus.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.