Blog

Planify Feed

InCred Delivers Robust FY25 Growth, Margins Moderate on Higher Costs

Link copied

InCred Delivers Robust FY25 Growth, Margins Moderate on Higher Costs

20 August 2025

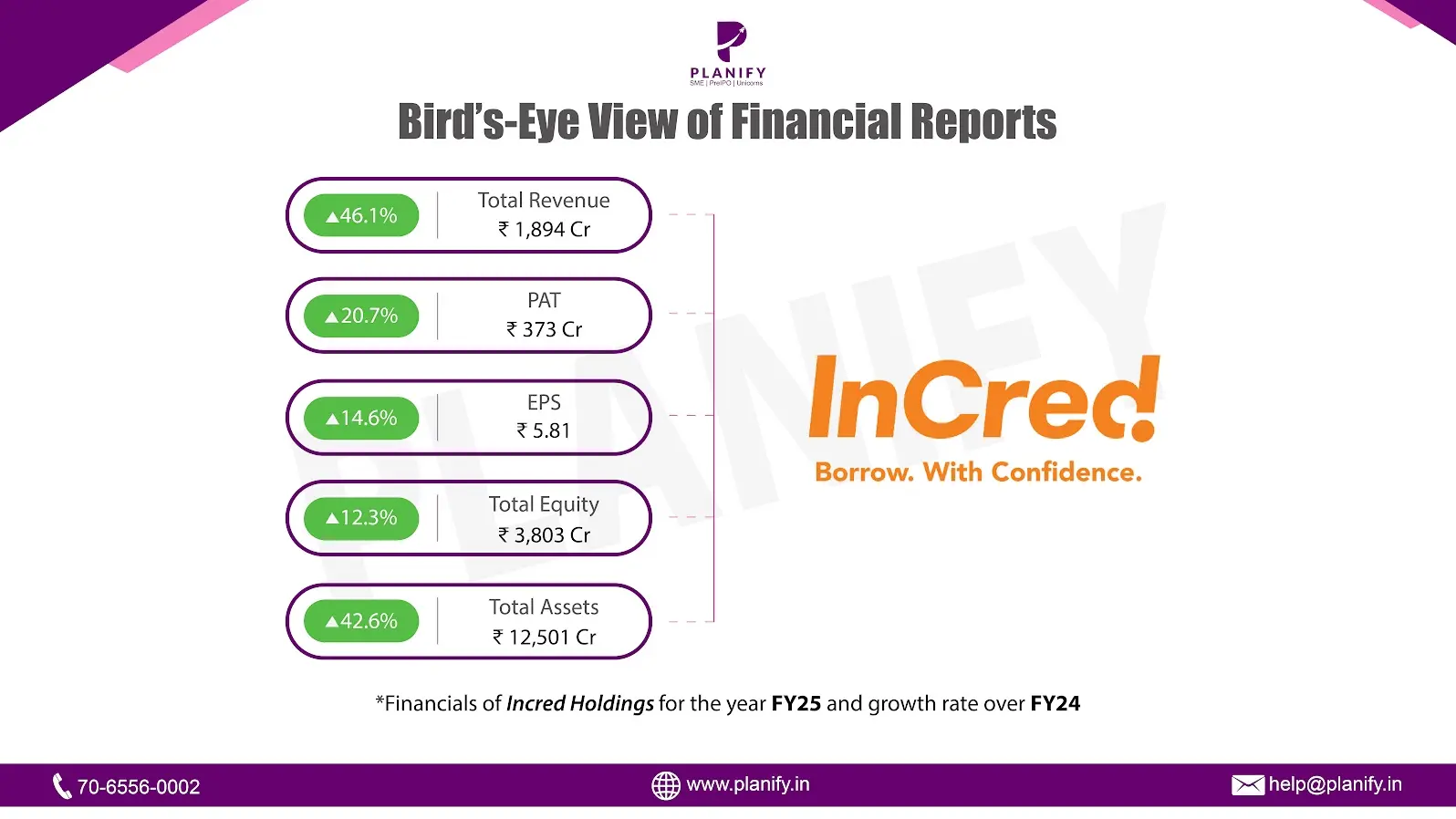

- Financial Performance (FY25 vs FY24): InCred Holdings reported a strong financial performance in FY25, with consolidated total income increasing by 46.1% to ₹1,894 Cr, compared with ₹1,296 Cr in FY24. This growth was supported by higher revenue from operations, including strong interest income and improved other income streams. Profit Before Tax (PBT) for the year rose 27.0% to ₹507 Cr, up from ₹400 Cr in the previous year. Net Profit After Tax (PAT) grew 20.7%, reaching ₹373 Cr from ₹309 Cr in FY24, reflecting improved operating efficiency and lower provisioning costs. Earnings per share also moved higher in line with profit growth, underlining the company’s ability to deliver stronger shareholder returns.

- Operational Metrics (FY25 vs FY24): The company delivered strong growth in its lending franchise during the year. The consolidated loan book (AUM) expanded by 39.2%, rising to ₹12,585 Cr in FY25 from ₹9,039 Cr in FY24, with healthy traction across retail and MSME segments. The balance sheet also strengthened, with total assets increasing by 42.6% year-on-year to ₹12,501 Cr in FY25 compared to ₹8,768 Cr in FY24. However, profitability ratios moderated during the year, as the net profit margin declined to 19.7% in FY25 from 23.8% in the previous year, largely on account of higher finance costs and impairment charges on financial instruments. Despite this, the company maintained a stable balance sheet position, supported by prudent leverage management and fresh capital infusion.

- Strategic Developments: FY25 was an important year of consolidation and growth for InCred Holdings. The company completed a composite scheme of arrangement with B Singh Tech Services Pvt. Ltd., approved by the NCLT, which helped simplify its structure and align shareholder interests. It also strengthened its capital base through equity issued under employee stock option plans, adding about 57 lakh new shares. The lending business expanded across consumer, education, healthcare, and MSME segments, creating a well-diversified loan portfolio. On the leadership front, a new CFO and Whole-Time Director were appointed, further strengthening management oversight. The company also maintained a stable balance sheet with controlled leverage, a mix of funding sources, and strong internal controls, ensuring that growth was achieved with sound risk management and compliance.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.