Indofil Industries Delivers Robust FY25 Results

24 September 2025

Financial Performance

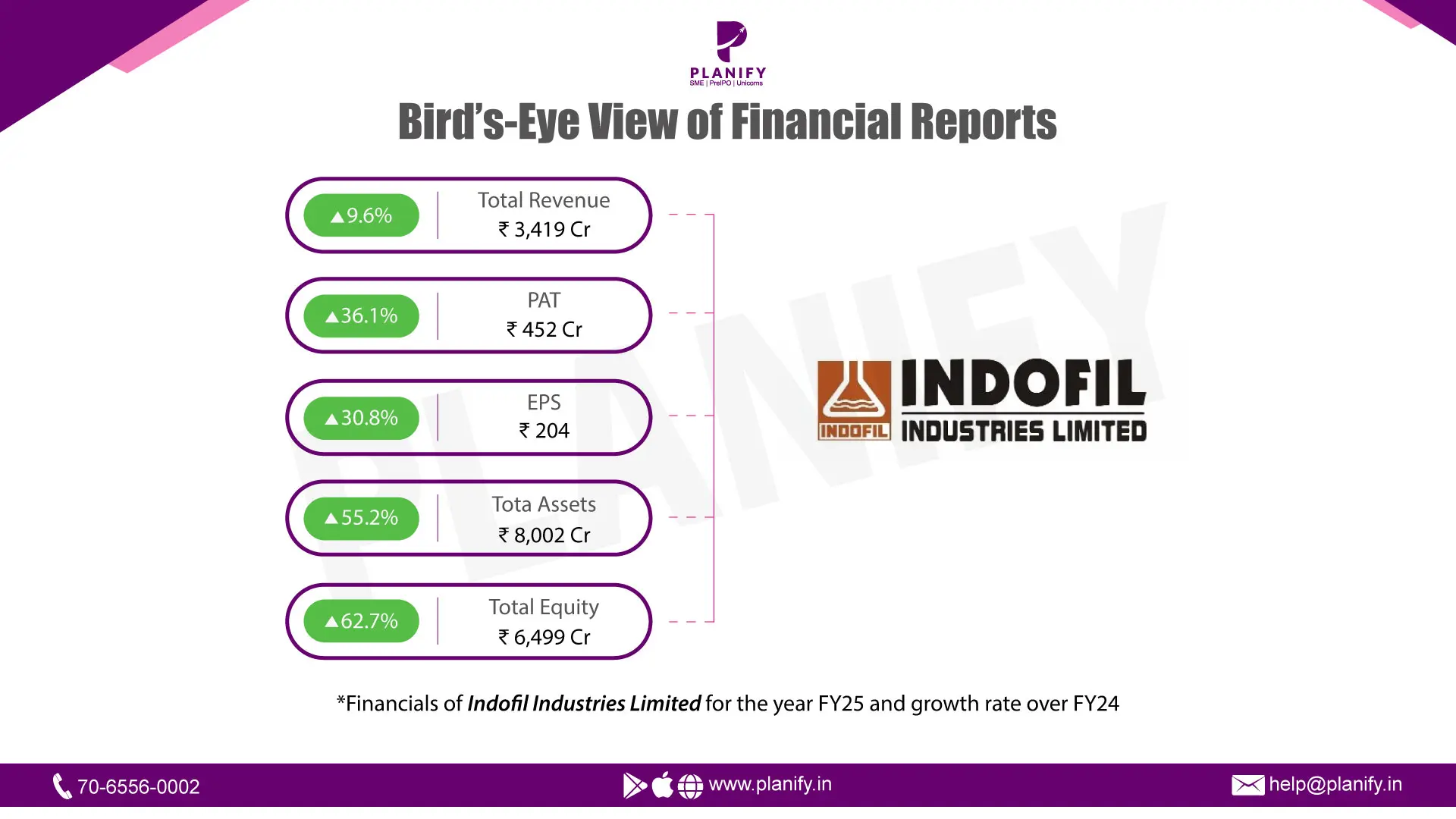

Indofil Industries delivered strong growth momentum. Consolidated Total Income rose 9.6% YoY to ₹3,419 Cr in FY25 from ₹3,119 Cr in FY24, supported by a healthy mix of domestic and international demand. Profitability improved sharply — Profit Before Tax (PBT) increased 42.6% YoY to ₹519 Cr versus ₹364 Cr last year. Net Profit (PAT) jumped 36.1% YoY to ₹382 Cr, compared to ₹281 Cr in FY24, reflecting robust operational execution and cost discipline

Operational Metrics

Indofil sustained efficiency at scale. EBITDA grew to ₹636 Cr, implying an EBITDA margin of ~18.6%, compared with ~15.8% in FY24. Net Profit Margin improved to 11.2% from 9.0%, highlighting operating leverage benefits. Contribution from overseas subsidiaries and joint ventures (notably Indo Baijin Chemicals) added strength, with JVs contributing ₹70.5 Cr profit to the consolidated bottom line. Return on Capital Employed (ROCE) improved to 19.2%, up from 14.9%, underscoring better capital efficiency

Strategic Developments

FY25 was marked by a balanced performance across geographies:

- Latin America remained the growth anchor (49% of business, +10.5% YoY).

- Europe (19% of business) and North America (+61% YoY) supported strong export momentum.

- APAC & MEA contributed 26%, aided by partnerships and specialty product traction

Product portfolio expansion continued with new launches in fungicides (e.g., Motive), insecticides (Alecto, Ceasmite), and herbicides, coupled with rising demand for non-Mancozeb molecules (Phenylamides, SDHIs, Cyanoacetamide-oxime). The company also enhanced Innovative Solutions capacity by 20,000 MT to support the specialty chemicals business

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.