KLM Axiva

22 December 2025

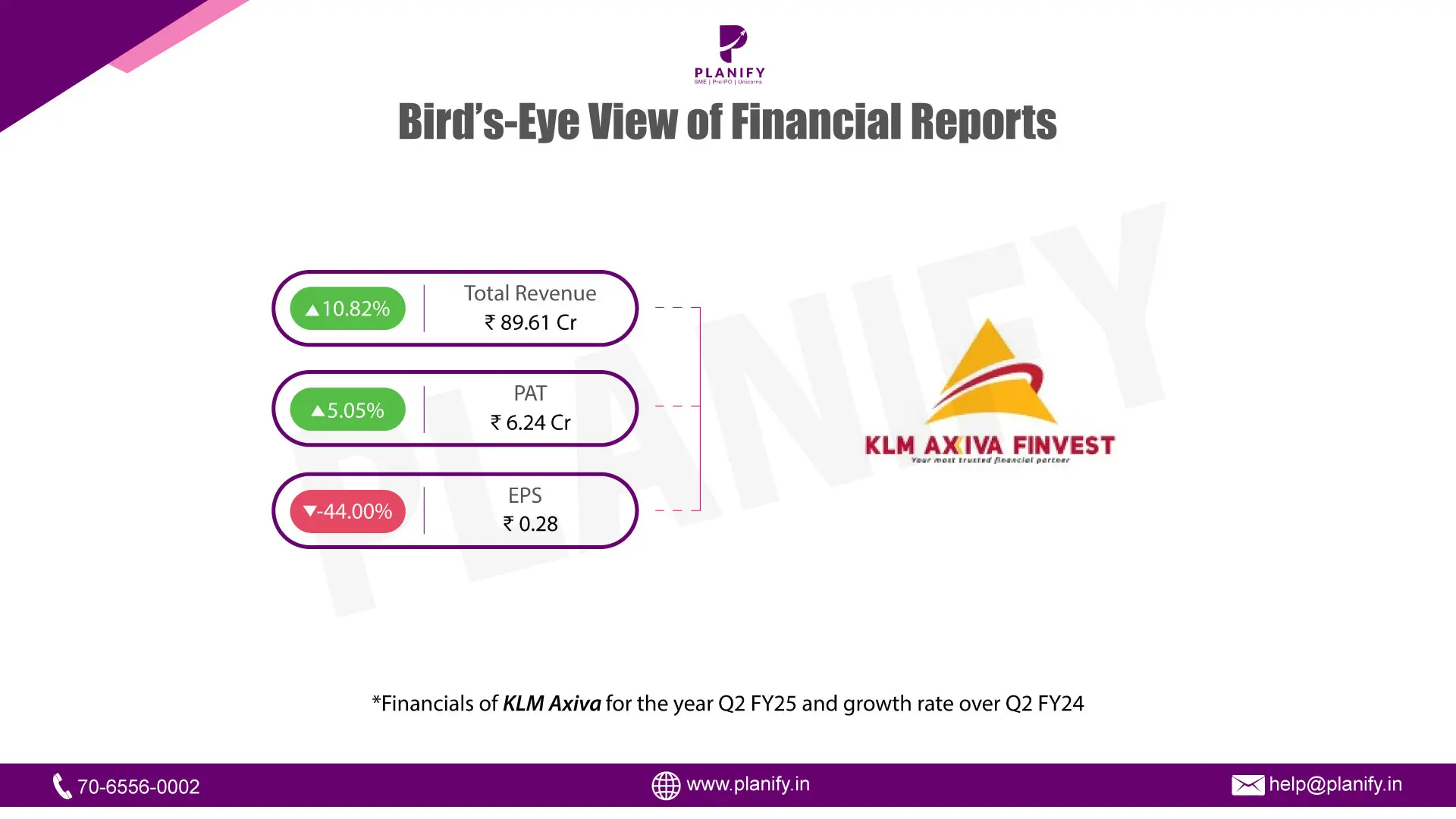

Financial Performance(Q2 FY26 vs Q2 FY25): KLM Axiva Finvest reported a mixed financial performance in Q2 FY26, with total income increasing marginally by 2.2% year-on-year (YoY) to ₹91.9 crore, compared to ₹82.5 crore in Q2 FY25. The modest growth was primarily supported by stable interest income, while other income also contributed during the quarter. Profit Before Tax (PBT) declined by 8.2% YoY to ₹6.2 crore, from ₹6.8 crore in the corresponding quarter last year, impacted by higher operating and finance costs. Profit After Tax (PAT) decreased by 5.0% YoY to ₹6.2 crore, compared to ₹5.9 crore in Q2 FY25. Earnings Per Share (EPS) stood at ₹0.28, lower than ₹0.50 reported in the same quarter last year.

Operational Metrics (Q2 FY26 vs Q2 FY25): Operational performance during the quarter reflected pressure on profitability metrics. Operating margin declined to 4.2% in Q2 FY26 from 7.6% in Q2 FY25, while net profit margin moderated to 1.2% from 3.6% in the previous year. The interest service coverage ratio stood at 1.08 times, indicating tighter coverage compared to historical levels due to higher finance costs. The debt-to-equity ratio remained elevated at 5.4 times, reflecting the leveraged nature of the balance sheet. Asset quality indicators remained stable, with Gross NPA at 2.21% and Net NPA at 1.19% for the quarter.

Strategic Developments: Net worth stood at ₹291.1 crore as of September 2025, providing capital support for ongoing operations. The company continues to focus on its core lending activities, with no material changes in business segments or strategy during the quarter. Overall performance in Q2 FY26 reflects stable loan growth and asset quality, while profitability remained under pressure due to higher costs and leverage. Near-term performance is expected to remain linked to funding costs and credit conditions, with balance sheet strength and asset quality being key monitorables.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.