Blog

Planify Feed

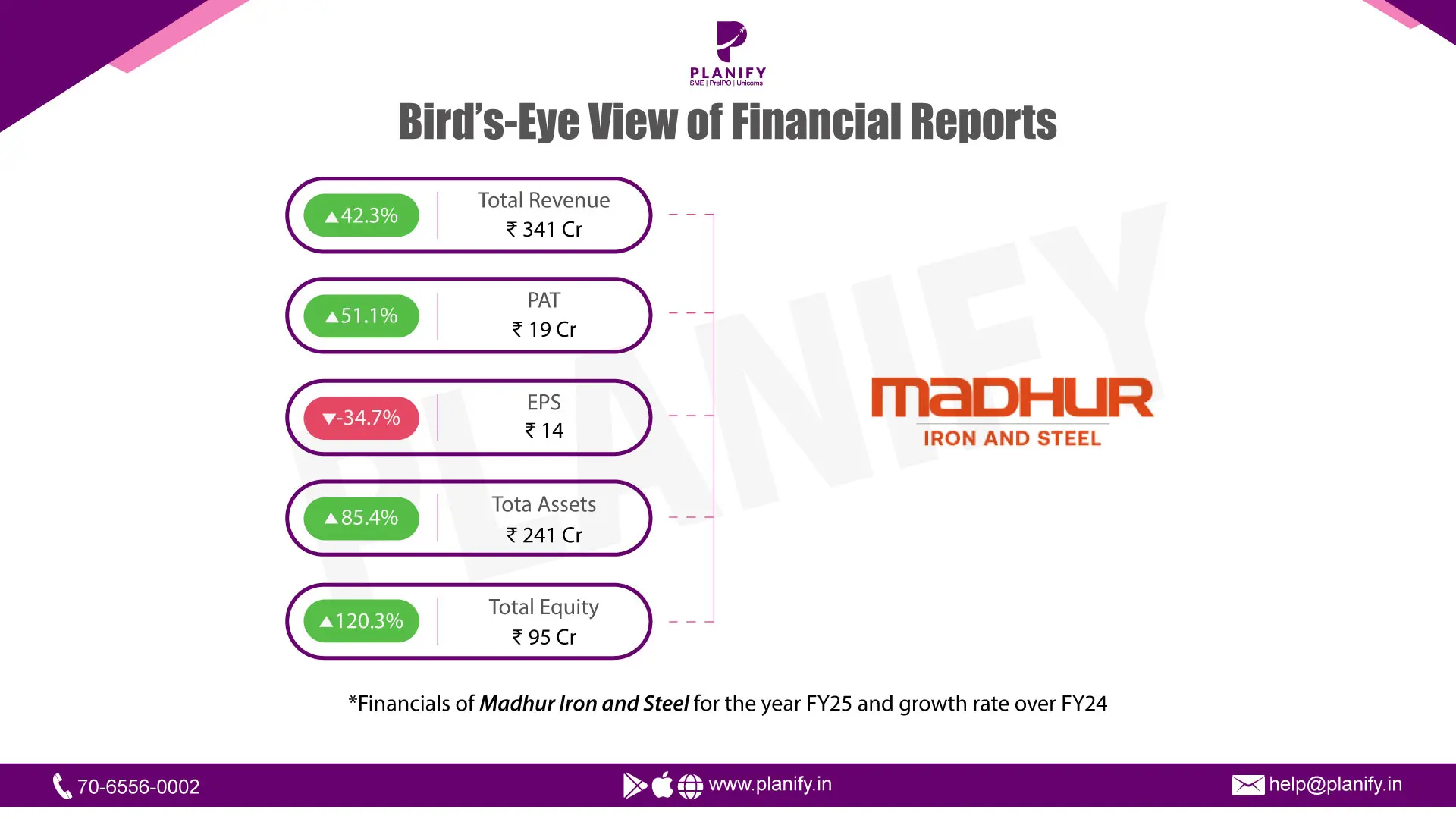

Madhur Iron Delivers Robust FY25 Results

Link copied

Madhur Iron Delivers Robust FY25 Results

17 October 2025

Financial Performance (FY25 vs FY24)

- In FY25, Madhur Iron & Steel (India) Limited demonstrated strong growth and improved profitability. Total Income rose 42.3% YoY to ₹341.42 Cr in FY25 from ₹239.94 Cr in FY24, driven by increased sales of both manufactured and traded goods. Profitability improved significantly — Profit Before Tax (PBT) increased 45.2% YoY to ₹25.14 Cr versus ₹17.27 Cr last year.

- Net Profit (PAT) jumped 51.1% YoY to ₹18.53 Cr, compared to ₹12.23 Cr in FY24, reflecting robust operational execution and effective cost management.

- Madhur Iron & Steel sustained operational efficiency during its expansion phase. EBITDA (calculated as PBT + Depreciation + Finance Cost) grew to ₹33.72 Cr, implying an EBITDA margin of ~9.9%, compared to ~9.5% in FY24.

- Net Profit Margin improved to 5.4% from 5.1%, highlighting better cost control and operational leverage. The company’s Return on Capital Employed (ROCE) stood at 34.09% in FY25, down from 50.63% in FY24, primarily due to increased capital deployment in ongoing expansion projects.

Strategic Developments

- Corporate Restructuring: The company transitioned from a Private Limited to a Public Limited entity in July 2024, enhancing its corporate governance and market presence.

- Capital Expansion: The company significantly bolstered its equity base through a 1:1 bonus issue and fresh equity issuance, increasing paid-up capital from ₹6.62 Cr to ₹14.89 Cr.

- Product & Market Diversification: Revenue from traded goods saw a substantial increase, contributing ₹99.35 Cr in FY25 compared to ₹29.94 Cr in FY24, indicating a strategic shift toward trading alongside manufacturing.

- Capacity Enhancement: Continued investment in Property, Plant & Equipment (PPE) and Capital Work-in-Progress (CWIP) reflects ongoing capacity expansion and modernization efforts.

Outlook

- Madhur Iron & Steel closed FY25 with its highest-ever profit, supported by increased production, trading activities, and strategic capital infusion. The company is well-positioned to leverage its expanded capital base and ongoing capacity enhancements.

- With a focus on scaling both manufacturing and trading operations, Madhur Iron & Steel aims to strengthen its market presence while maintaining a disciplined approach to profitability and financial stability.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.