Blog

Planify Feed

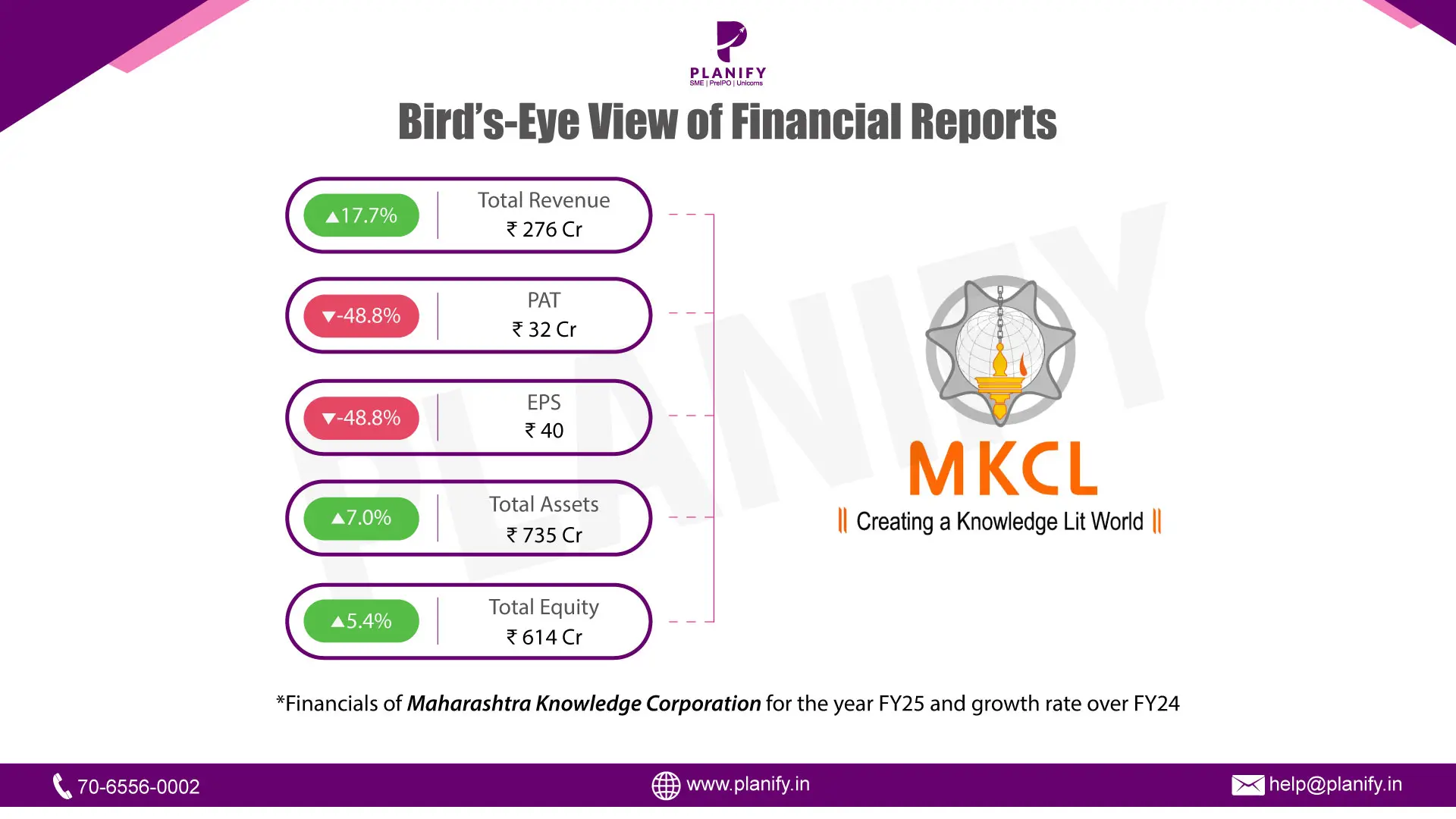

Maharashtra Knowledge Corporation released its financials for FY25

Link copied

Maharashtra Knowledge Corporation released its financials for FY25

23 August 2025

- Revenue and Profitability: MKCL delivered strong topline momentum in FY25: Revenue from operations rose 17.7% YoY to ₹276 crore (₹276 crore vs ₹235 crore), but PAT declined to ₹32 crore (-48.8% YoY). Reported profitability, however, was impacted by a one-time GST Amnesty charge of ₹46 crore. Growth was supported by higher learner volumes across MS-CIT, DEEP/SARTHI and KYP programs.

- Financial Position:The group remains debt-free with healthy liquidity with lease liability of ~₹4 crore. Cash & cash equivalents increased to ₹24 crore (₹24 crore vs ₹17 crore). Operating cash inflow (pre-exceptional) was ~₹10 crore, and investing activities generated ₹47 crore. Retained earnings (balance carried forward) stood at ₹488.0 crore.

- Future Prospects: Underlying demand drivers remain intact: expanding digital literacy & employability programs (MS-CIT enrollments ~7.99 lakh; KLiC and DEEP upticks; KYP traction), and scaling education/governance platforms (Digital University/CampusLive; ExamLive; RecruitLive/TenderLive). International footprints (e.g., Saudi Arabia ExamLive and first KLiC center in Uganda) broaden addressable markets. With one-off GST impact behind, a debt-free balance sheet, rising learner volumes, and AI-enabled product stack position the company for continued growth and margin normalization in FY26, supported by state partnerships and HE digitization.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.