Blog

Planify Feed

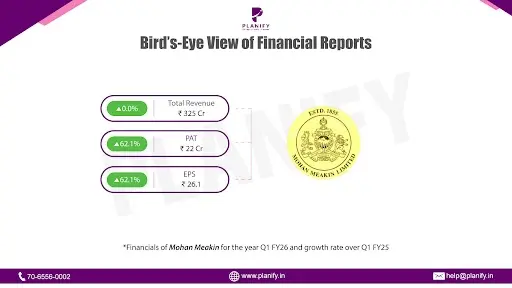

Mohan Meakin Q1 Profit Jumps 62% Despite Flat Sales

Link copied

Mohan Meakin Q1 Profit Jumps 62% Despite Flat Sales

12 August 2025

- Financial Performance (Q1FY26 vs Q1FY25): Mohan Meakin reported a marginal decline in Q1FY26, with consolidated revenue from operations slipping 0.8% YoY to ₹319 Cr (vs. ₹322 Cr in Q1FY25). The core alcoholic segment also fell 0.8% YoY to ₹316 Cr (vs. ₹318 Cr), while the non‐alcoholic segment eased 0.7% to ₹3.82 Cr (vs. ₹3.84 Cr), reducing its contribution to 1.2% of operating revenue (vs. 1.3% last year). Total income, including other income, was broadly stable at ₹325.0 Cr (vs. ₹325.1 Cr), supported by a rise in other income to ₹5.6 Cr (from ₹3.3 Cr in Q1FY25), which helped offset the slight drop in operating revenue.

- Operational Metrics (Q1FY26 vs Q1FY25): In Q1FY26, total expenses eased 2.9% YoY to ₹297.5 Cr (vs. ₹306.5 Cr), reflecting effective cost control. Finance costs declined to ₹0.17 Cr (vs. ₹0.20 Cr), further supporting profitability. Profit before tax jumped 59.2% YoY to ₹30 Cr (vs. ₹19 Cr), aided by a one‐time gain of ₹2 Cr from the sale of land. After a tax outgo of ₹7.45 Cr (vs. ₹4.93 Cr), net profit surged 62.0% YoY to ₹22.2 Cr (vs. ₹13.7 Cr), lifting net margins to 6.9% (vs. 4.3% a year ago). Basic EPS rose sharply to ₹26.06 from ₹16.08 in Q1FY25.

- Growth Outlook:Mohan Meakin starts FY26 in a stronger position, with better profits, lower costs, and a solid balance sheet. The alcoholic drinks business will continue to be the main growth engine, and the company can build on this by launching premium products, adding new variants, and reaching more markets. The non‐alcoholic segment, though small, needs fresh ideas or selective cuts to stop its slow decline. While the one‐time land sale helped boost Q1 profits, the main focus will be on keeping operations efficient and improving margins. With very little debt, steady cash flow, and strong assets, the company is in a good place to spend on expanding capacity, promoting its brands, and improving its distribution network, which should support steady and profitable growth ahead.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.