Motilal Oswal Financial Services Limited Q2 FY26 performance

23 December 2025

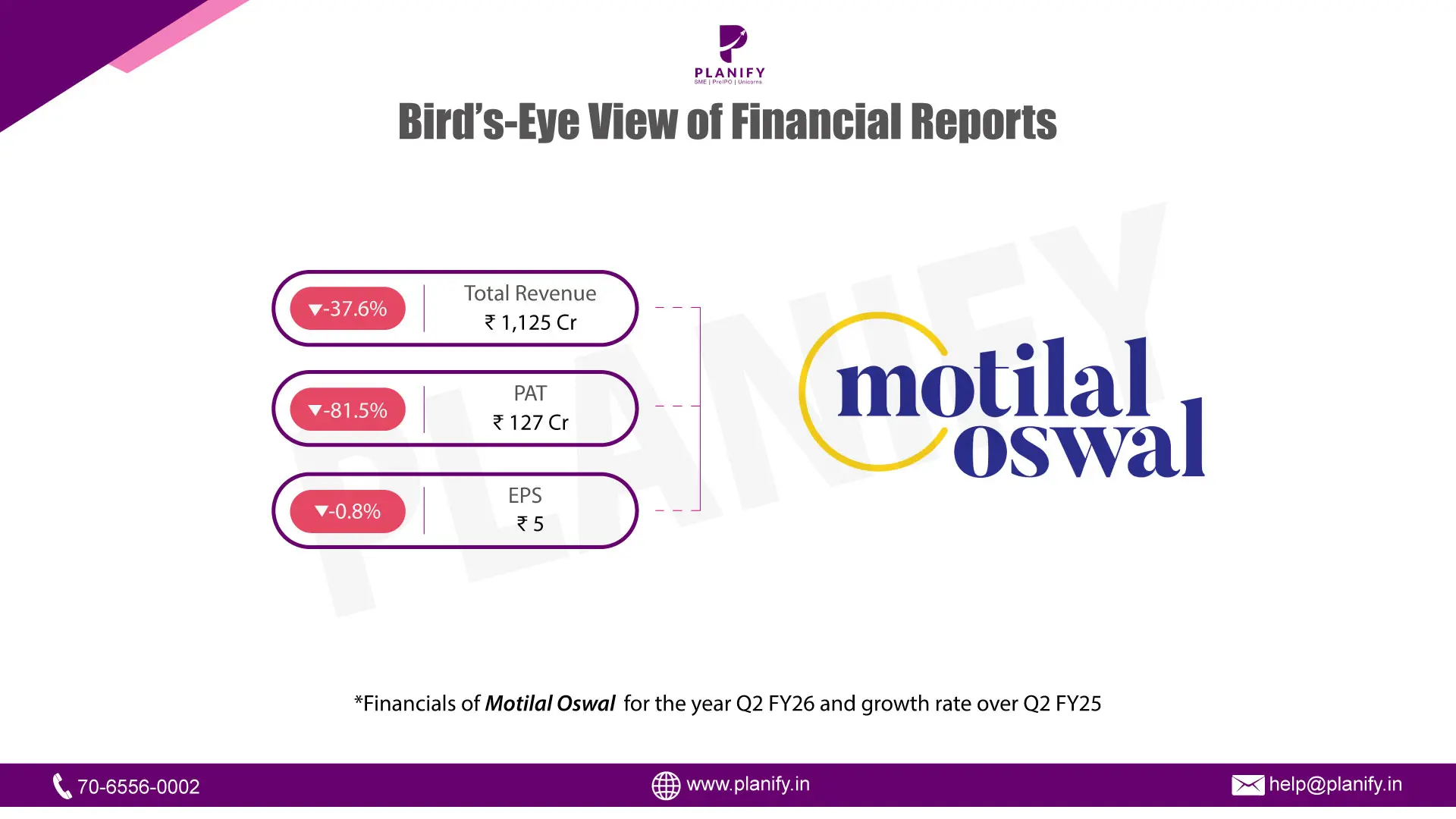

Financial Performance (Q2 FY26 vs Q2 FY25): Motilal Oswal Financial Services Limited reported a weaker financial performance in Q2 FY26, with total revenue declining by 37.6% year-on-year (YoY) to ₹1,125 crore, compared to ₹1,803 crore in Q2 FY25. The decline was mainly due to a sharp reduction in brokerage and fees income along with a loss on fair value changes of ₹40 crore, compared to a gain of ₹443 crore in the same quarter last year. Profit After Tax (PAT) declined by 81.5% YoY to ₹127 crore, compared to ₹689 crore in the same quarter last year.

Operational Metrics (Q2 FY26 vs Q2 FY25):Operational performance saw pressure on margins during the quarter due to the volatility in fair value gains and lower revenue. Operating margin declined to 22.5% in Q2 FY26 from 43.1% in Q2 FY25, while net profit margin reduced to 17.8% from 33.2% last year. The interest service coverage ratio stood at 2.78 times for the half-year ended September 2025, slightly lower than 2.92 times in the previous corresponding period. The debt-to-equity ratio improved to 1.15 times from 1.22 times, while the debtors turnover ratio slowed to 0.87 times from 1.04 times, indicating changes in collection velocity.

Strategic Developments: During the quarter, the company raised ₹500 crore via private placement of Non-Convertible Debentures (NCDs) to strengthen its liability profile. The company also allotted 9,98,550 equity shares under employee stock option schemes, continuing its focus on employee retention. A significant positive development was the upgrade of the company's long-term credit rating by ICRA to AA+ (Stable) from AA (Positive) in October 2025. The company’s net worth increased to ₹7,804 crore, up from ₹6,939 crore in the previous period. Additionally, the company voluntarily disclosed PAT excluding unrealized mark-to-market gains, which stood at ₹283 crore for the quarter, to provide a clearer view of underlying operating performance.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.