Blog

Planify Feed

Motilal Oswal Home Finance FY25 results

Link copied

Motilal Oswal Home Finance FY25 results

12 August 2025

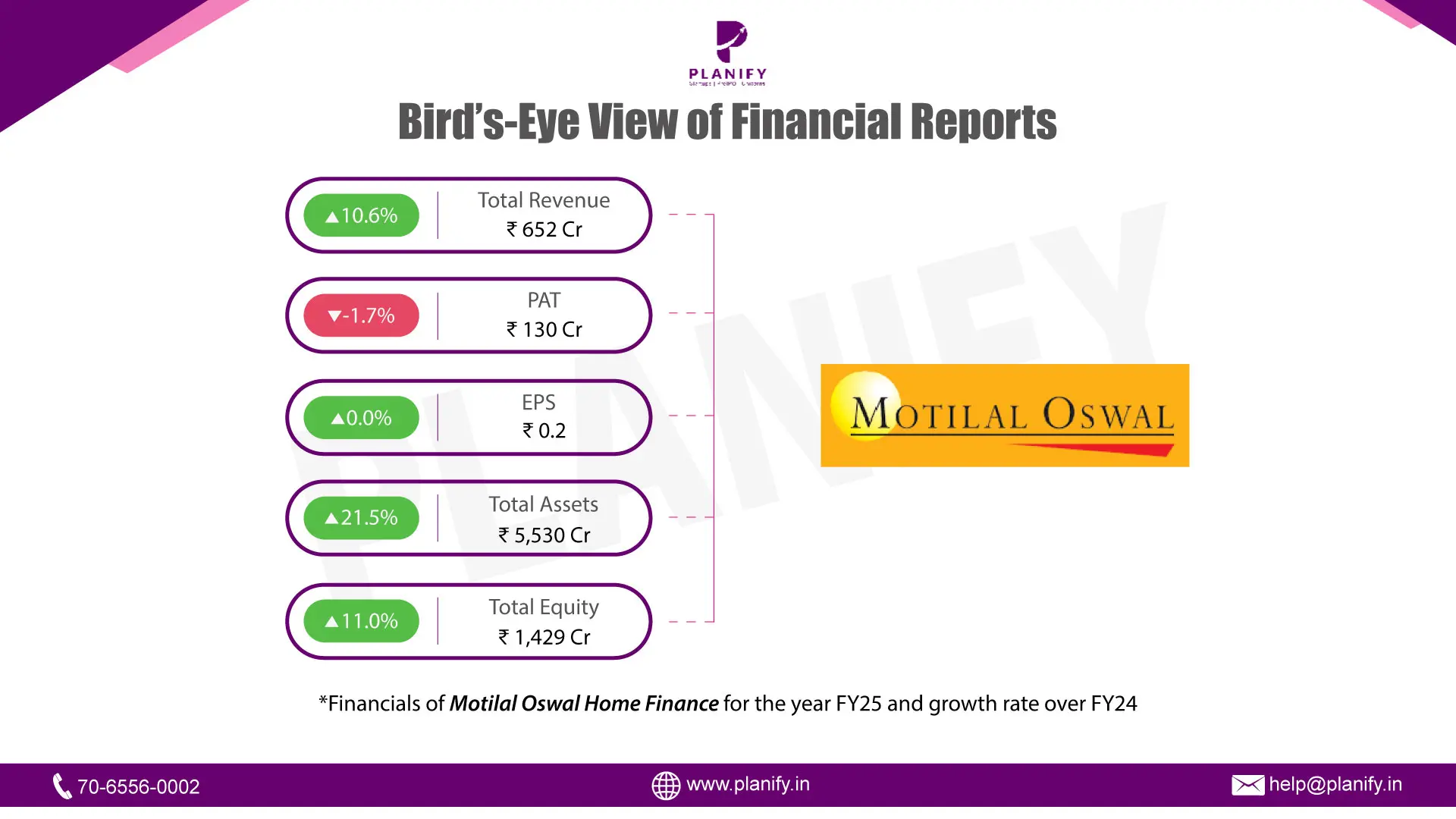

- Financial Highlights: Motilal Oswal Home Finance Ltd. (MOHFL) delivered a strong operational performance in FY25, underpinned by robust disbursement growth of 78% YoY to ₹1,794 crore and a 19% expansion in the loan book to ₹4,878 crore. The company maintained healthy asset quality, with industry-leading GNPA/NNPA ratios of 0.8%/0.4% and a provision coverage ratio of 157%. Profit after tax stood at ₹130 crore, broadly flat due to conscious investments in sales expansion and talent acquisition to drive sustainable growth. Net interest margin remained strong at 7.3% with cost of borrowings at 8.4%, supported by a diversified funding profile. Capital adequacy was robust at 40.8%, and the company’s branch network extended to 112 locations across 12 states, serving over 50,600 families.

- Operational Developments: Operationally, FY25 saw MOHFL strengthen its distribution and digital capabilities. Sales relationship managers grew 44% YoY to 1,329, enabling deeper penetration into Tier II and III markets. Technology investments included analytics-driven credit underwriting, process digitalization for paperless loan journeys, and enhanced mobile applications to improve customer experience and reduce turnaround time. Independent teams for sales, credit, collections, and operations ensured a balanced risk and growth approach. The company’s collection efficiency, including prepayments, was 124.3%, highlighting strong recovery processes. ESG initiatives advanced with green financing encouragement, digital documentation to cut paper use, and promotion of sustainable construction practices.

- Future Outlook: Looking ahead, MOHFL’s strategic priorities focus on disciplined, risk-calibrated growth. Plans include expanding into underpenetrated geographies, launching innovative customer-centric loan products, scaling digital initiatives to drive cost efficiency, and maintaining best-in-class asset quality through rigorous credit and monitoring frameworks. The affordable housing finance segment, buoyed by government schemes such as PMAY 2.0, rising incomes, and urbanization, offers substantial long-term growth potential. With its strong balance sheet, technology-enabled operations, and targeted market strategy, MOHFL is well-positioned to capitalize on the sector’s structural growth drivers while delivering sustainable shareholder value.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.