Blog

Planify Feed

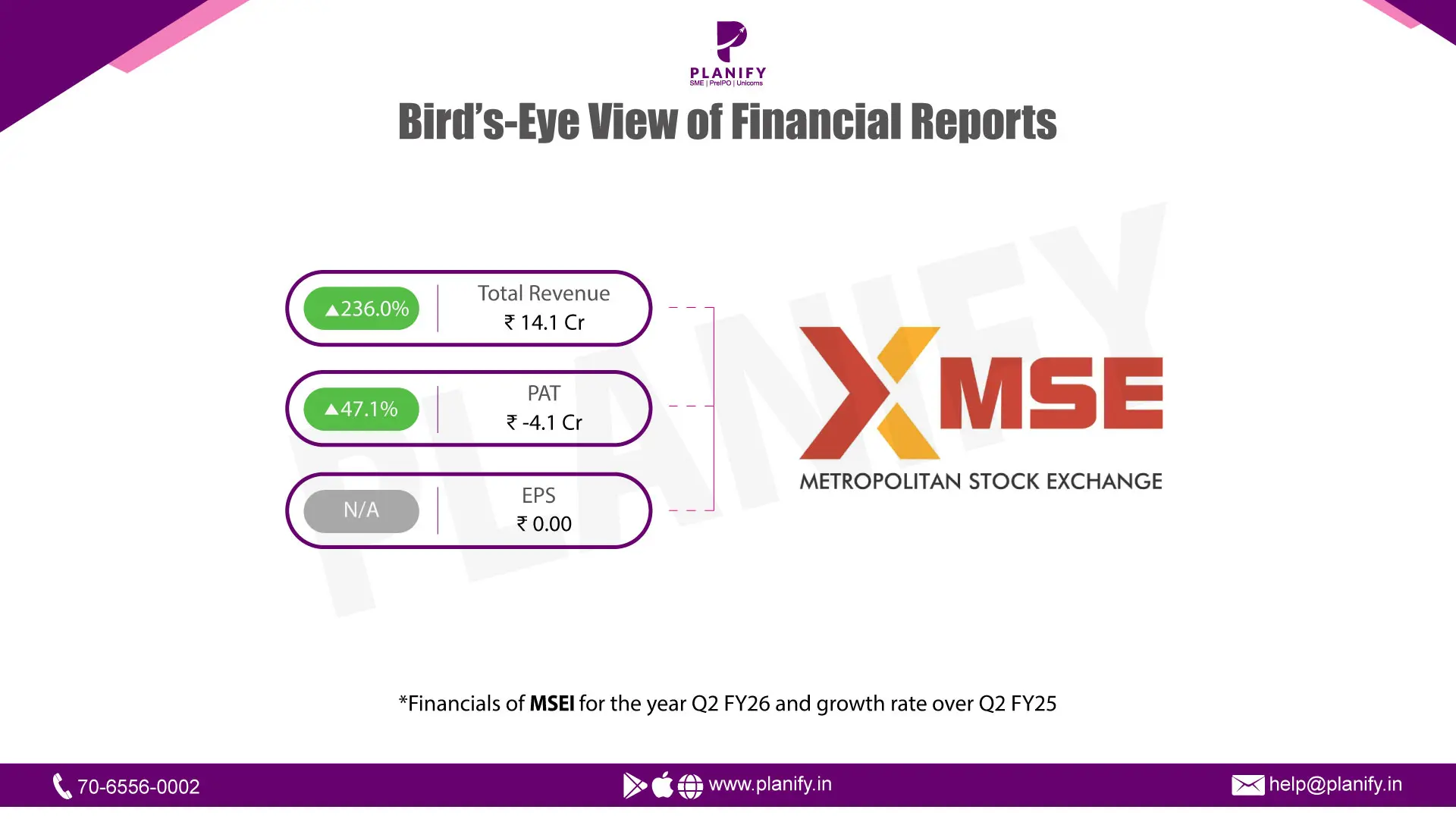

MSEI Narrows Losses Sharply in Q2FY26 on Strong Treasury Gains

Link copied

MSEI Narrows Losses Sharply in Q2FY26 on Strong Treasury Gains

22 November 2025

- Financial Performance (Q2FY26 vs Q2FY25): In Q2FY26, MSEI reported a sharp 236.0% YoY increase in total income to ₹14.1 Cr, compared with ₹4.2 Cr in Q2FY25, driven primarily by a steep rise in other income, which surged to ₹13.2 Cr from ₹3.3 Cr last year. Revenue from operations remained weak, declining 3.4% YoY to ₹0.86 Cr versus ₹0.89 Cr in Q2FY25. Operating performance improved significantly as the loss before tax narrowed to ₹4.1 Cr, an improvement of 47.1% YoY compared with a loss of ₹7.7 Cr in the prior year. At the net level, the company also recorded a lower loss of ₹4.1 Cr, compared with ₹7.7 Cr in Q2FY25. Earnings Per Share (EPS) improved to ₹(0.00) from ₹(0.02) last year, supported by both reduced losses and a substantially higher equity base.

- Operational Metrics (Q2FY26 vs Q2FY25): Net loss margin improved sharply to (29.0%) in Q2FY26 from (184.0%) in Q2FY25, primarily due to higher other income offsetting elevated operating costs. Employee expenses rose 65.8% YoY to ₹5.8 Cr, reflecting cost pressures and scaling of operations, while administration and other expenses increased 152.7% YoY to ₹4.7 Cr. Finance costs increased to ₹0.17 Cr from ₹0.01 Cr, though still negligible as a proportion of the cost base.

- Strategic Developments: Q2FY26 was marked by a significant strengthening of the balance sheet driven by large-scale equity issuance, with the paid-up capital rising to ₹1,099.5 Cr, enabling the company to substantially expand its investment portfolio. Despite persistent operating losses, the quarter demonstrated meaningful progress in reducing net losses, supported by strong treasury income. The continued revival effort is supported by major investor participation through private placements and the reappointment of the MD & CEO, ensuring leadership continuity. However, core trading activity remains subdued, reflected in weak operational revenue, underscoring the need to rebuild volumes and platform activity for sustainable financial turnaround. Overall, the quarter reflected material improvement in financial stability, narrowing losses, and enhanced liquidity, although with continued dependence on non-operating income.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.