Blog

Planify Feed

MSEI Reports Lower Operating Revenue in Q1FY26

Link copied

MSEI Reports Lower Operating Revenue in Q1FY26

19 September 2025

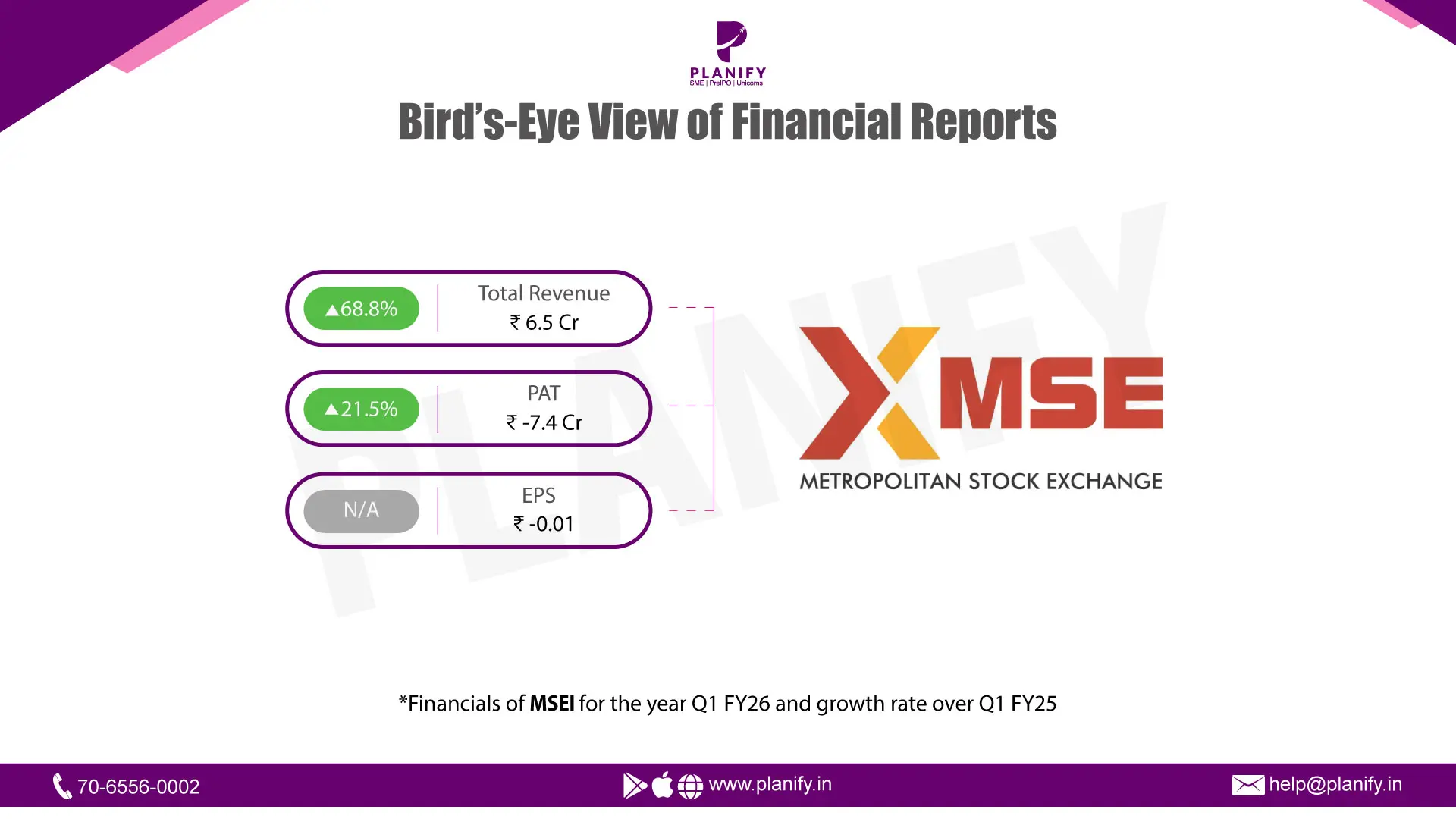

- Financial Performance (Q1FY26 vs Q1FY25): In Q1FY26, MSEI reported a 68.8% YoY increase in total income to ₹6.5 Cr, compared with ₹3.8 Cr in Q1FY25, primarily driven by higher other income (₹5.5 Cr vs ₹2.7 Cr last year). Revenue from operations, however, fell 11.2% YoY to ₹0.95 Cr against ₹1.1 Cr in Q1FY25, highlighting continued pressure in core trading volumes. Operating expenses remained elevated, resulting in a loss before tax (LBT) of ₹7.4 Cr, which narrowed by 21.5% YoY from a loss of ₹9.5 Cr in the prior year. At the net level, the company posted a loss of ₹7.4 Cr, compared with a loss of ₹9.5 Cr in Q1FY25. Earnings Per Share (EPS) improved marginally to ₹ (0.01) from ₹ (0.02) last year.

- Operational Metrics (Q1FY26 vs Q1FY25): Net loss margin improved to (115.2%) in Q1FY26 from (247.6%) in Q1FY25, aided by higher other income cushioning the bottom line. Cost pressures persisted, with employee expenses up 25.7% YoY at ₹4.7 Cr and finance costs rising sharply to ₹0.18 Cr (vs ₹0.06 Cr).

- Strategic Developments:Q1FY26 was marked by significant equity issuance and capital structure changes. The company completed a large private placement of equity shares in January 2025 and further approved an issue of up to 500 Cr shares in August 2025 to reputed investors, strengthening its capital base. Additionally, the reappointment of Ms. Latika S. Kundu as MD & CEO for a three-year term underscores continuity in leadership. While the exchange continues to post operating losses, the improvement in income mix (boost from other income), narrowing of losses, and strengthened equity position provide some stability. However, subdued operational revenue highlights the challenge of reviving core trading activity, which remains crucial for long-term sustainability.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.