NCL Holdings: Strong Profit Growth Amid Stable Balance Sheet

02 September 2025

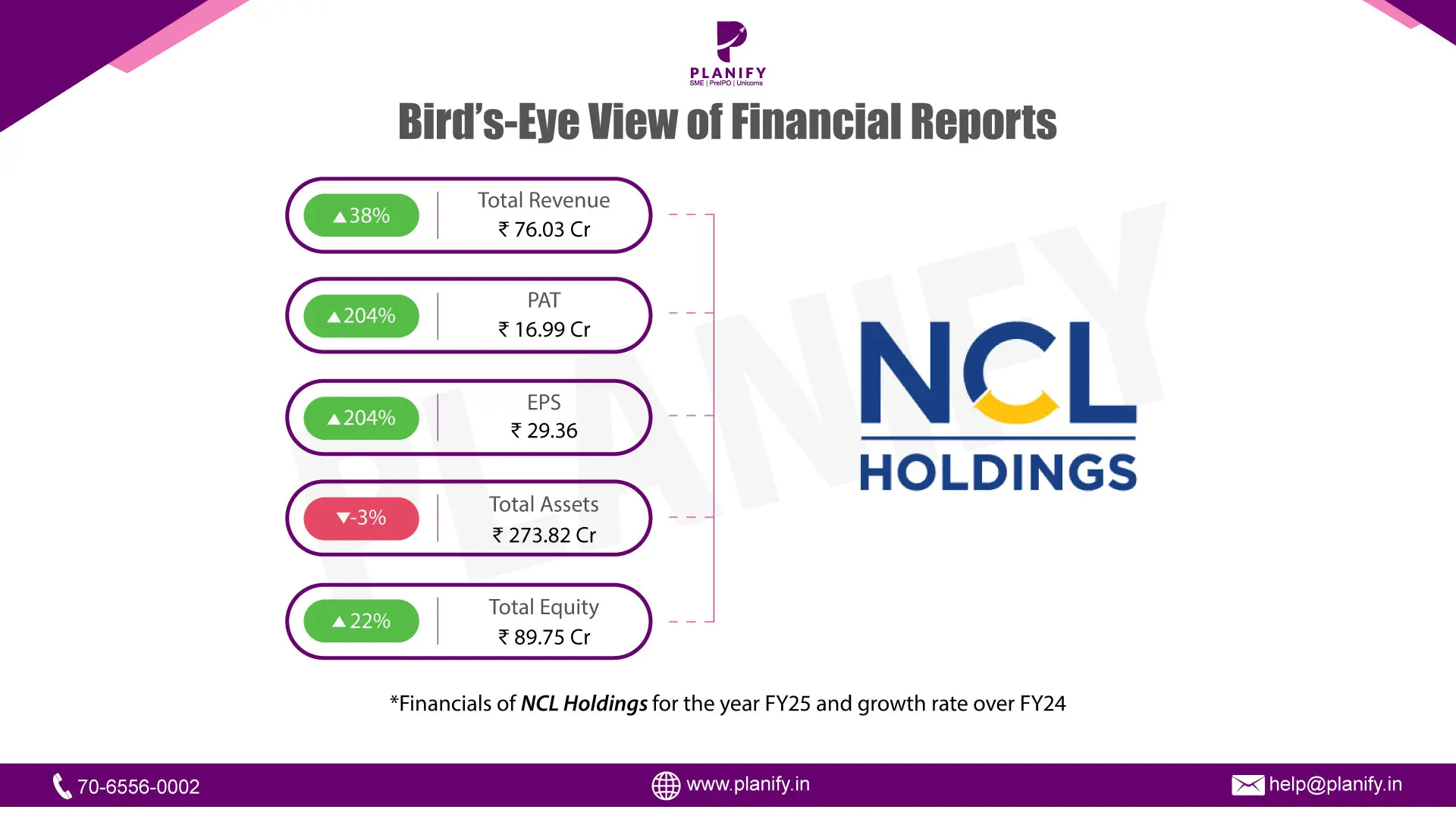

NCL Holdings Limited has delivered a solid performance in FY25, reflecting its ability to scale revenues while significantly boosting profitability. The company’s financials indicate strong operational efficiency, higher shareholder returns, and a stable capital structure, despite a marginal decline in assets.

- Revenue: In FY25, NCL Buildtek reported a total revenue of ₹76.03 crore, marking a 38% year-on-year growth over FY24. This healthy top-line expansion highlights the company’s ability to capture market opportunities and sustain momentum in its core business operations.

- Net Profit and EPS: Profitability witnessed a remarkable surge, with Profit After Tax (PAT) rising to ₹16.99 crore, representing a 204% increase year-on-year. This sharp improvement reflects stronger operational efficiency and cost management. In line with profit growth, Earnings Per Share (EPS) also rose 204%, reaching ₹29.36, underscoring enhanced returns for shareholders.

- Assets & Equity: On the balance sheet front, total assets stood at ₹273.82 crore, registering a marginal 3% decline compared to FY24. This indicates cautious asset utilization despite revenue and profit growth. Meanwhile, total equity increased by 22% to ₹89.75 crore, strengthening the company’s capital base and reflecting improved shareholder value.

NCL Holdings delivered an outstanding financial performance in FY25, with robust revenue growth and a sharp rise in profitability, translating into significantly higher EPS. Although total assets saw a minor dip, the improvement in equity signals financial resilience. Overall, the company is on a strong growth trajectory, balancing profitability with capital strength, which positions it well for future expansion.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.