Blog

Planify Feed

Orbis Posts Strong FY25 with Robust Revenue and Profit Growth

Link copied

Orbis Posts Strong FY25 with Robust Revenue and Profit Growth

09 September 2025

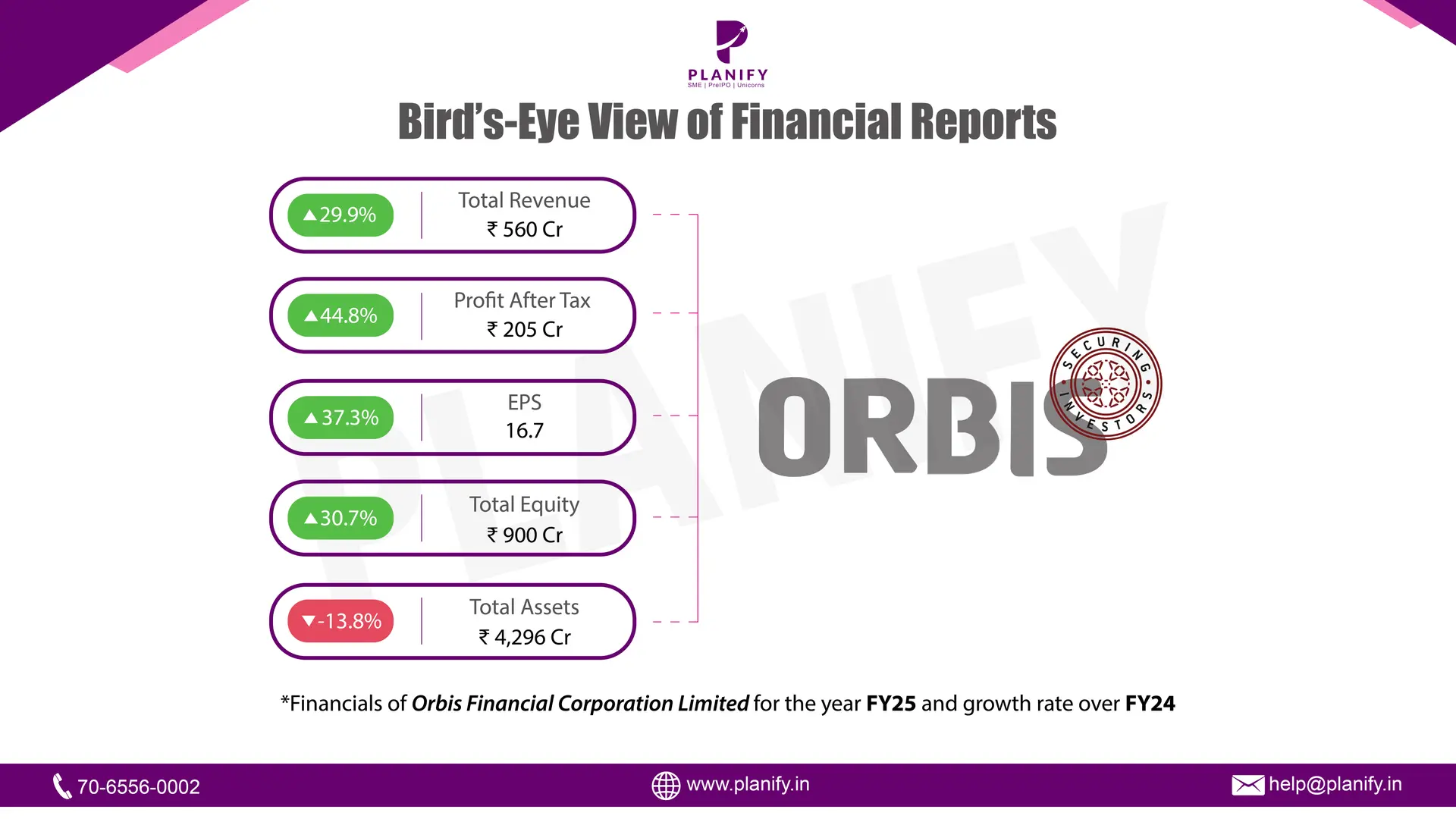

- Financial Performance (FY25 vs FY24): Orbis Financial Corporation delivered a strong performance in FY25. Total income rose 29.9% to ₹560 Cr, compared with ₹431 Cr in FY24. This was led by higher revenue from operations across custodial, clearing, and fund accounting services. Profit Before Tax (PBT) increased 46.9%, reaching ₹275 Cr, versus ₹187 Cr last year. Net Profit (PAT) grew 44.8% to ₹205 Cr from ₹141 Cr. Earnings per share (EPS) also improved strongly, with basic EPS at ₹16.7 (vs ₹12.2 in FY24) and diluted EPS at ₹15.7 (vs ₹11.3), reflecting healthy earnings momentum.

- Operational Metrics (FY25 vs FY24): Despite the higher base, profitability strengthened. Operating profit (EBITDA) stood at ₹379 Cr, up 48.3% from ₹256 Cr in FY24. The EBITDA margin expanded to ~68% from ~59%, indicating strong cost efficiency. Net profit margin also improved to 36.5% in FY25 versus 32.8% in FY24, reflecting better leverage of fixed costs and disciplined expense management. Finance costs rose to ₹99 Cr (from ₹65 Cr) due to higher working capital needs, but were well covered by operating profits. Net worth rose to ₹900 Cr from ₹688 Cr, supported by strong profit accretion and equity issuances, while the debt-to-equity ratio improved to ~3.8x from ~6.2x, reflecting lower reliance on borrowings. Cash and bank balances stood at ₹3,984 Cr, providing ample liquidity for growth.

- Strategic Developments: Orbis Financial Corporation delivered robust double-digit growth across revenue, profits, and EPS in FY25, with margin expansion and stronger balance sheet metrics. On the business front, the company consolidated its group structure under Orbis Trusteeship Services Pvt. Ltd. and Orbis Financial Services (IFSC) Pvt. Ltd., with the latter progressing towards securing a final Finance Company license from IFSCA, opening up new avenues in GIFT City. To strengthen human capital, Orbis granted 15.1 lakh ESOPs and allotted ~25 lakh equity shares under stock option plans, while also enhancing shareholder returns with a higher dividend of ₹1.80 per share in FY25 (vs ₹1.00 in FY24).

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.