Blog

Planify Feed

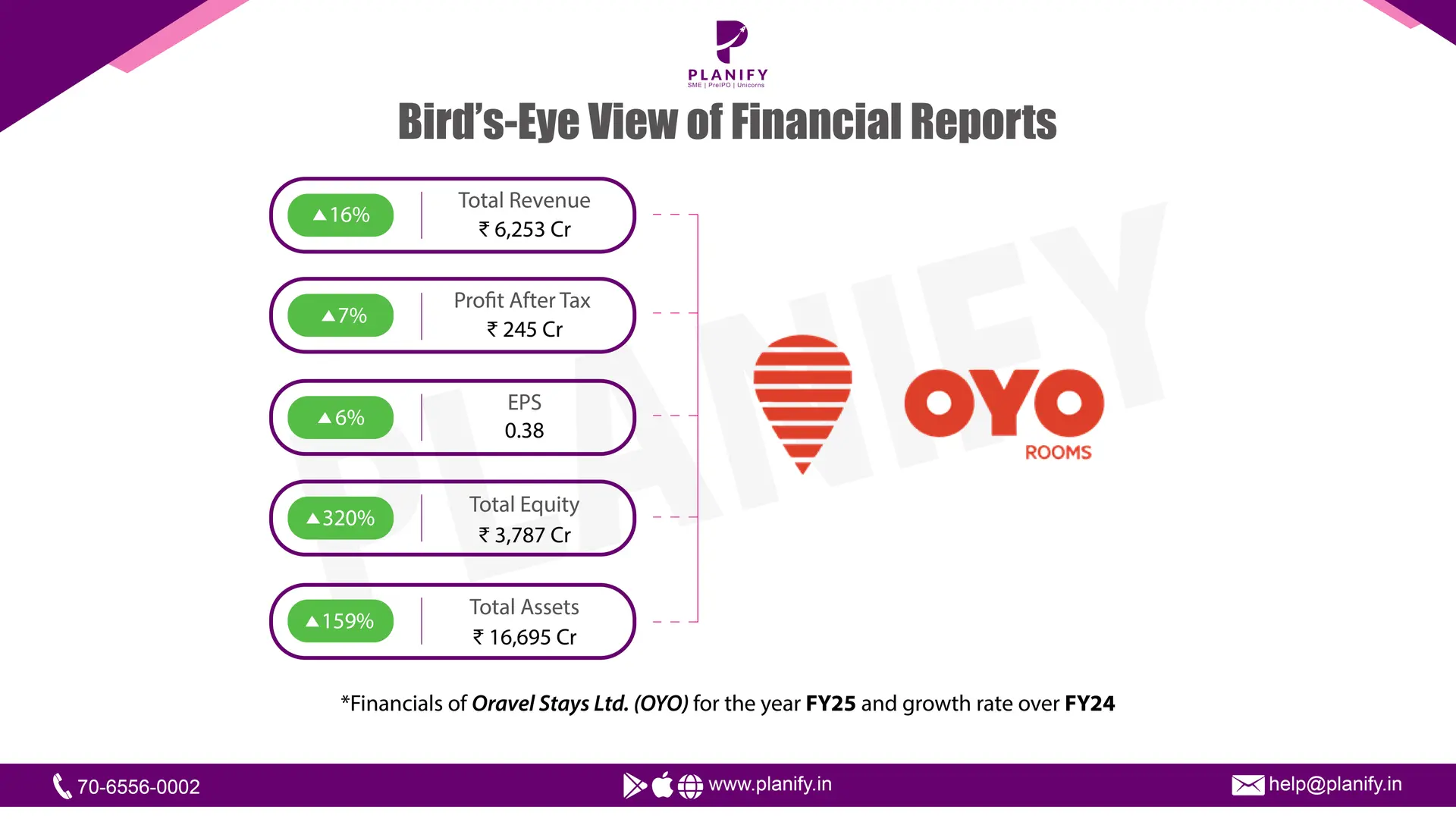

OYO has released its FY25 financial results.

Link copied

OYO has released its FY25 financial results.

10 September 2025

- Financial Performance- For FY25, the revenue of the company has increased by 16% from Rs. 5389 Cr. in FY24 to Rs. 6253 Cr. in FY25, as in recent years, the company has expanded well beyond its original budget hotel model into multiple countries, the homes segment and more. Its portfolio now includes vacation homes, luxury and experiential stays, such as Sunday Hotels and Pallette Hotels), its European brands DanCenter, CheckMyGuest and Belvilla, extended stay accommodation, such as Studio 6 through its acquisition of US hospitality giant G6 Hospitality, workspaces (such as Innov8), hospitality technology solutions and more. The Company maintained PAT positivity throughout the fiscal year, recording a profit of Rs. 245 Cr in FY25 ( 7% up from FY24), reflecting consistent performance improvements and built-in operating leverage driven by strategic expansion across premium segments, integration of acquisitions, and technology-led operations, Resulting in the increased EPS of the company by 6% from Rs. 0.36 in FY24 to Rs. 0.38 in FY25.

- Financial Position- The company’s total assets rose sharply from ₹6,443 Cr. in FY24 to ₹16,695 Cr. in FY25, supported by strong expansion across segments. Between March 2023 and March 2025, the homes portfolio grew organically from 79,000 to 1,20,000 storefronts, while hotels expanded from 13,000 to 21,000. Further scale came from the integration of CMG (2,000 storefronts) and G6 Hospitality (1,500 storefronts). Equity also surged 320% to ₹3,787 Cr. in FY25 (from ₹901 Cr. in FY24), driven by fresh issuance of equity and preference shares and an 11% rise in securities premium reserves.

- Future Outlook- The company plans to accelerate growth in the premium hospitality segment by scaling brands such as Sunday, Townhouse, Collection O, and Palette, while continuing to invest in technology, allocate capital prudently, and expand in high-potential markets like the US. It also aims to boost customer loyalty, drive operational efficiency, prepay Term Loan B opportunistically, and pursue value-accretive acquisitions to enhance its balance sheet and global presence. By March 31, 2025, the company was serving over 100 million customers across more than 35 countries, with industry trends signaling sustained global travel demand, though varying by region and segment.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.