Pace Digitek’s ₹819.15 crore IPO

07 October 2025

From the telecom towers that keep us connected to the energy storage systems powering India’s green ambitions — Pace Digitek Limited has quietly built the invisible backbone of modern infrastructure. Now, the Bengaluru-based engineering and technology company is taking a bold step into the public markets with its initial public offering (IPO), aiming to fuel its next phase of growth.

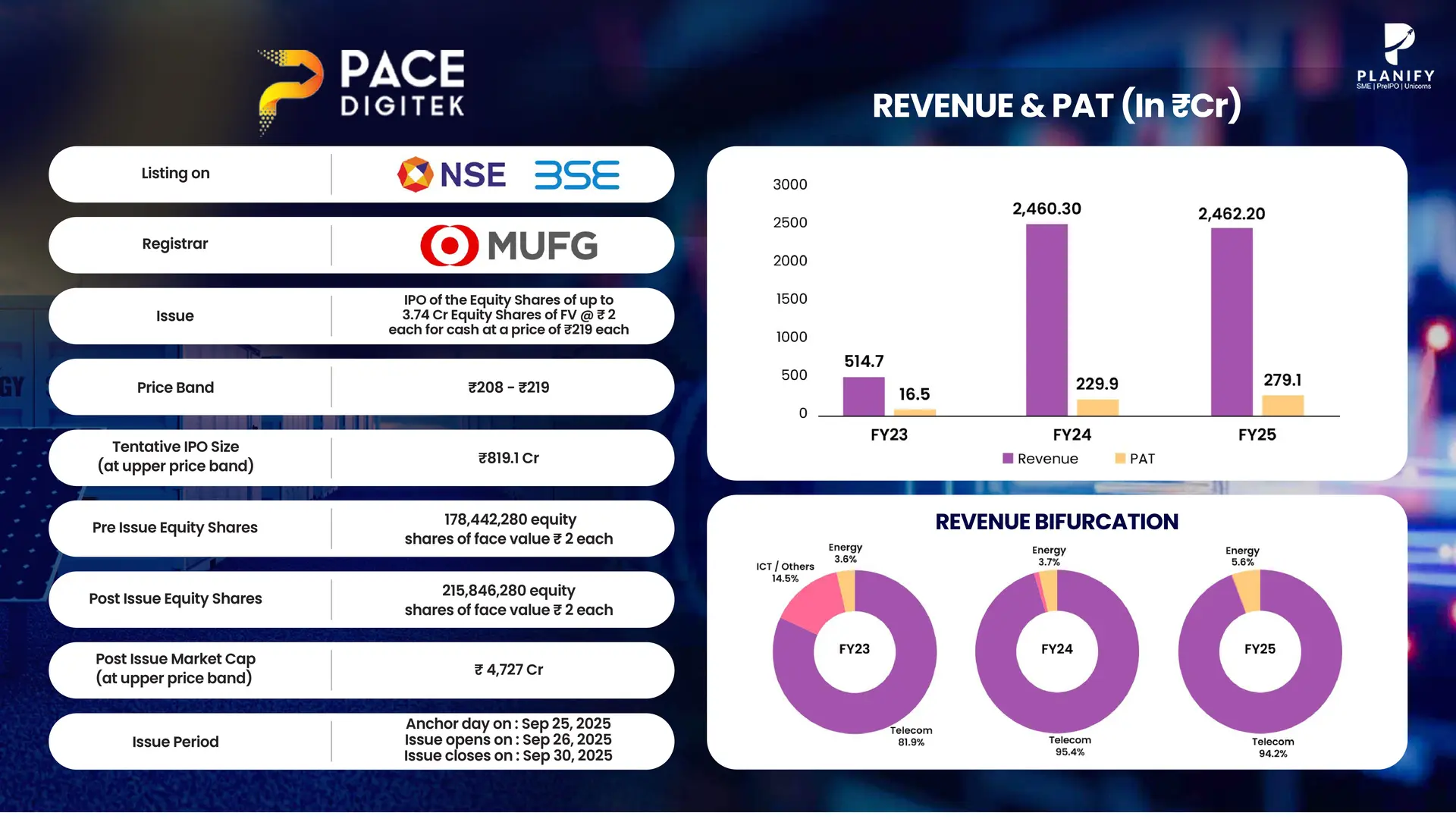

Pace Digitek Ltd, a leading multi-disciplinary solutions provider in telecom, ICT, and renewable energy infrastructure, is set to raise ₹819.15 crore through its IPO. The offering consists entirely of a fresh issue of up to 3.74 crore equity shares, priced in the band of ₹208–₹219 per share. The issue opens on September 26, 2025, and closes on September 30, 2025.

At the upper price band, Pace Digitek will command a post-issue market capitalization of ~₹4,727 crore. The proceeds will primarily fund capital expenditure for subsidiary Pace Renewable Energies Pvt. Ltd., which is developing Battery Energy Storage Systems (BESS) for a 750 MW / 1,500 MWh project awarded by MSEDCL, along with general corporate purposes.

Investors can bid for a minimum of 68 shares, with retail and institutional categories structured in line with SEBI norms:

QIBs: up to 50%

NIIs: at least 15%

Retail: at least 35%

Employee reservation: ₹20 million with a ₹20 discount per share

Founded in 2007 by technocrat Maddisetty Venugopal Rao, Pace Digitek began as a telecom power systems firm and has since evolved into a diversified engineering group with operations spanning India, Africa, and Myanmar. The company provides turnkey telecom tower and fiber network solutions, ICT infrastructure, solarization, and grid-scale energy storage systems.

Through its subsidiary Lineage Power Pvt. Ltd., the company operates a 5 GWh/year Battery Energy Storage manufacturing plant — among India’s largest — marking its strong push into the renewable energy sector.

As of July 2025, the company’s order book stood at ₹7,633.6 crore, with ₹3,570 crore from telecom and ₹4,063 crore from energy projects, giving it multi-year revenue visibility.

Financial Highlights

Pace Digitek’s numbers underscore its growth momentum:

FY25 Revenue: ₹2,438.8 crore (up 385% vs FY23)

FY25 EBITDA: ₹505.1 crore (EBITDA margin 20.7%)

FY25 PAT: ₹279.1 crore (PAT margin 11.4%)

ROCE: 37.9% | ROE: 23.1%

Debt-to-Equity: 0.13x

The company’s earnings have grown rapidly — PAT CAGR of 310% between FY23–FY25 — reflecting strong operational leverage and efficient capital allocation.

Sector Tailwinds

India’s telecom and renewable energy sectors are witnessing unprecedented growth:

Massive 4G and 5G rollout across India, driving demand for telecom infrastructure and fiber networks

Government-backed push toward energy storage and solarization, with national BESS capacity expected to reach 38.6 GW (201.5 GWh) by 2032

Rising need for grid stability and decentralized energy bolstering demand for advanced BESS solutions

With its dual focus on telecom modernization and green energy transformation, Pace Digitek aims to bridge the digital divide and energize India’s renewable transition — inviting investors to be part of a company that literally powers connectivity and sustainability.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.