Blog

Planify Feed

PPFAS announced FY25 results

Link copied

PPFAS announced FY25 results

21 July 2025

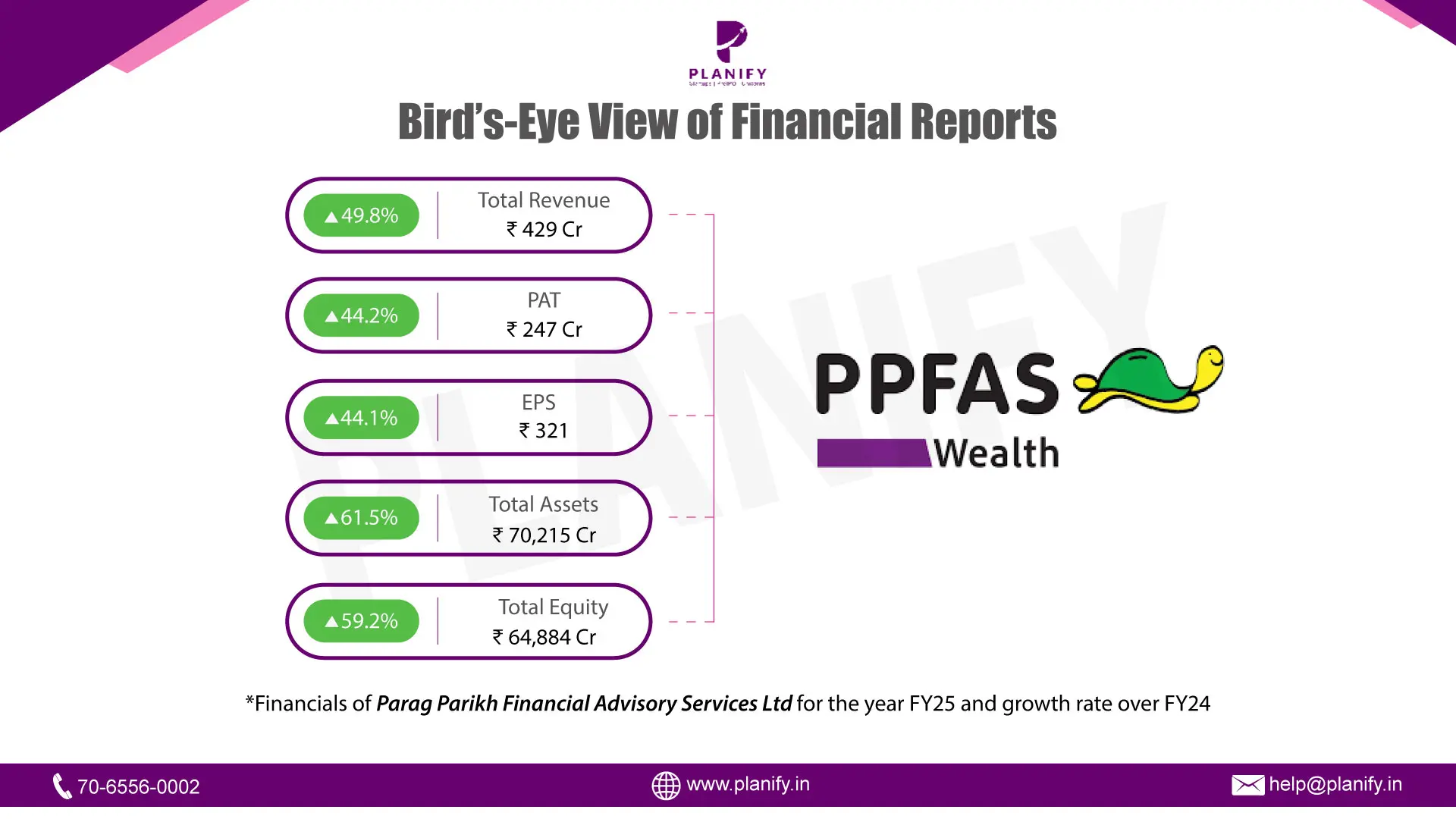

- Financial Highlights: PPFAS delivered a strong consolidated performance in FY25 with gross income increasing to ₹429.09 Cr, marking a significant YoY growth of 49.8% over ₹286.43 Cr in FY24. This robust growth was largely driven by higher management fees and rising AUM across mutual fund and PMS businesses. Total expenses increased moderately by 34% to ₹93.33 Cr, indicating operating leverage at play. Profit before tax rose to ₹335.76 Cr (up 54.8% YoY), and PAT stood at ₹246.60 CR, reflecting a YoY growth of 44%. Net margins remained strong, underlining disciplined cost control and higher scale efficiencies. The company declared a dividend of ₹15 per equity share, and retained earnings soared to ₹622.35 Cr, suggesting ample capital for reinvestment and shareholder returns.

- Operational Developments: Operationally, PPFAS continued to build on its core strength of long-term, value-based investing across both PMS and mutual fund businesses. Assets under management (AUM) for the mutual fund arm increased significantly from ₹68,453.01 crore to ₹1,06,357.72 crore (+55% YoY), driven by healthy SIP inflows, new investor additions (from 33.75 lakh to 49.05 lakh folios), and strong performance across equity, hybrid, and liquid categories. PMS AUM also expanded from ₹67.86 crore to ₹80.67 crore, with both discretionary and non-discretionary strategies outperforming benchmarks. PPFAS also broadened its national footprint through physical branches and strengthened its technological backbone to enhance operational efficiency, cybersecurity, and investor service.

- Future Outlook: Looking ahead, the company remains focused on enhancing its research, execution, and compliance capabilities. PPFAS aims to expand its fixed income team and is evaluating differentiated passive fund strategies to complement its active offerings. The company launched a new subsidiary—PPFAS Alternate Asset Managers IFSC Pvt. Ltd.—at GIFT City to explore opportunities in alternate assets and deepen its institutional reach. Despite a volatile macro backdrop and elevated market valuations, the company maintains a disciplined capital allocation approach. Its commitment to low-cost operations, high governance standards, and focused product suite positions it for sustainable long-term growth in India’s evolving asset management landscape.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.