Blog

Planify Feed

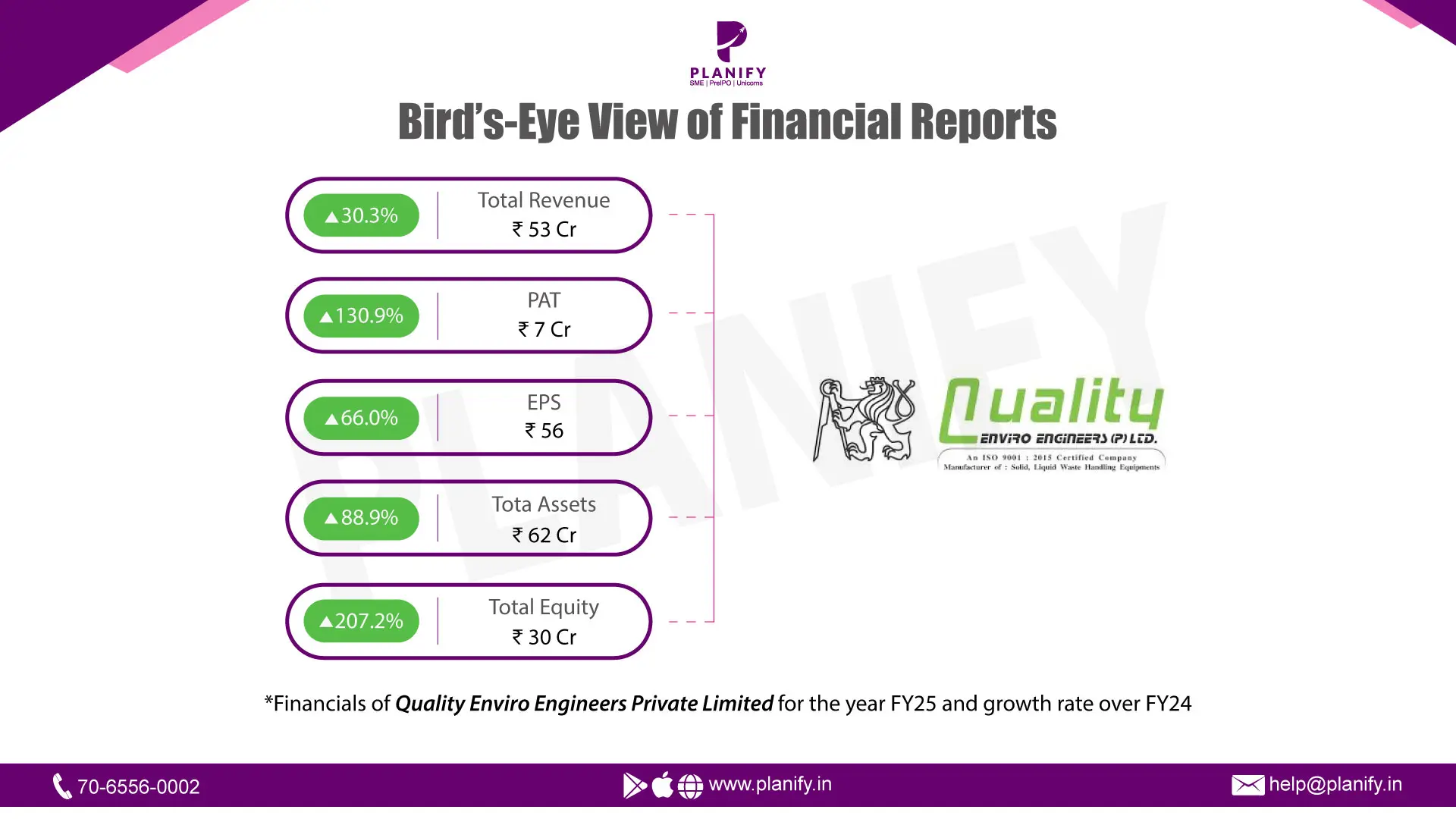

Quality Enviro Emgineers Announces Robust FY25 Results

Link copied

Quality Enviro Emgineers Announces Robust FY25 Results

17 October 2025

Financial Performance (FY25 vs FY24)

- In FY25, Quality Enviro Engineers Private Limited delivered exceptional growth momentum. Total Income surged 30.3% YoY to ₹52.89 Cr in FY25 from ₹40.51 Cr in FY24, driven by strong growth in both product sales and service revenue. Profitability improved dramatically — Profit Before Tax (PBT) increased 116.4% YoY to ₹8.91 Cr versus ₹4.14 Cr last year.

- Net Profit (PAT) jumped 130.3% YoY to ₹6.57 Cr, compared to ₹2.86 Cr in FY24, reflecting superior operational execution and significant revenue scaling.

- Quality Enviro Engineers demonstrated remarkable operational efficiency and financial health. EBITDA (calculated as PBT + Depreciation + Finance Cost) grew to ₹9.89 Cr, implying an EBITDA margin of ~18.7%, a substantial improvement from ~12.8% in FY24.

- Net Profit Margin more than doubled, improving to 12.5% from 7.0%, highlighting powerful operating leverage and cost management. The company’s liquidity strengthened significantly, with Cash & Cash Equivalents growing to ₹13.15 Cr from ₹3.44 Cr. However, Return on Capital Employed (ROCE) requires a detailed calculation from the notes for a precise YoY comparison.

Strategic Developments

- Capital & Ownership Restructuring: The company significantly bolstered its equity base, increasing its Subscribed Capital by 38.7% through a fresh issuance of shares. This was complemented by a massive infusion into Reserves & Surplus, which grew from ₹8.98 Cr to ₹29.01 Cr, enhancing the company's net worth and financial stability.

- Strategic Capacity & Asset Building: A major investment was made in Property, Plant & Equipment, which increased nearly fourfold from ₹0.99 Cr to ₹3.67 Cr. This includes a substantial Capital Work-in-Progress (Building of ₹231.37 Lakhs), indicating strategic expansion of physical infrastructure and production capacity.

- Business Mix Diversification: The company successfully diversified its revenue streams, with Revenue from Services more than doubling to ₹10.49 Cr from ₹5.0 Cr. This strategic shift towards high-margin services alongside product sales contributed significantly to the improved profitability.

- Strengthened Lender Confidence: The company secured a large Cash Credit facility (₹834.88 Lakhs), indicating strong banking relationships and confidence in its business model and growth prospects.

Outlook

- Quality Enviro Engineers closed FY25 with its highest-ever profit and revenue, underpinned by strategic capital infusion, asset expansion, and a successful diversification of its business model.

- The company is exceptionally well-positioned to leverage its strengthened balance sheet and expanded operational capacity.

- With a sharp focus on scaling both its product and high-margin service segments, Quality Enviro Engineers is poised for sustained growth while maintaining a disciplined and highly profitable operational framework.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.