Blog

Planify Feed

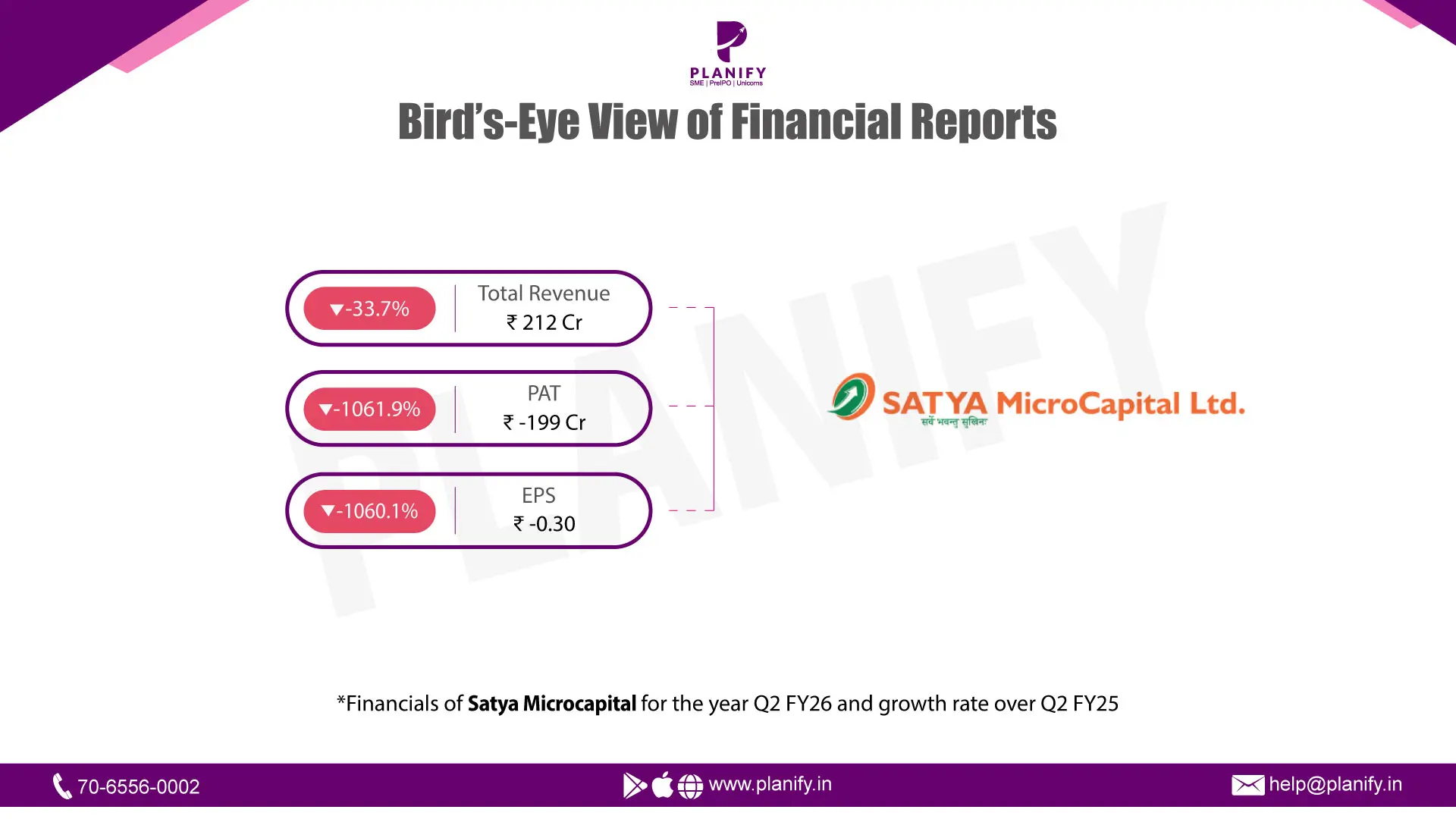

Satya Microcapital Suffers Heavy Q2FY26 Losses

Link copied

Satya Microcapital Suffers Heavy Q2FY26 Losses

29 November 2025

- Financial Performance (Q2 FY26 vs Q2 FY25): In Q2 FY26, Satya Microcapital reported total income of ₹212 crore, down 33.7% YoY from ₹320 crore in Q2 FY25. Interest income dropped to ₹182 crore, down 34.4% YoY from ₹277 crore, while fee/commission income also fell significantly. Though Finance costs decreased sharply to ₹121 crore, down 18.3% YoY from ₹148 crore, Impairment on financial instruments remained high at ₹92 crore, up 364.6% YoY (vs ₹19.7 crore last year), driven by higher expected credit losses. As a result, Profit Before Tax (PBT) came in at a steep loss of ₹156 crore, compared to a profit of ₹28 crore in Q2 FY25 — a deterioration of 662.5% YoY. Profit After Tax (PAT) stood at a loss of ₹199 crore, significantly worse than the ₹21 crore profit in Q2 FY25. Basic EPS for the quarter was ₹(30.34) compared to ₹3.16 a year earlier.

- Operational Metrics (Q2 FY26 vs Q2 FY25): Gross NPA (GNPA) ratio stood at 12.51%, worsening from ~1.2% a year ago, while Net NPA (NNPA) was 6.56% (vs 0.42% in FY25), reflecting severe portfolio stress. The Provision Coverage Ratio (PCR) was 50.94%, lower than the previous year’s 65% level, suggesting a reduced buffer against potential portfolio risks. Capital adequacy remained weak at 11.16%, below the RBI requirement of 15%, though it improves to 15.92% post the November 2025 equity infusion as disclosed. The loan book on the balance sheet was ₹2,938 crore as of Sept 30, 2025, down sharply from ₹3,535 crore in FY25, reflecting portfolio contraction amid elevated credit costs. Total assets were ₹4,439 crore, lower than March 31, 2025 levels (₹5,599 crore), driven by reduced disbursements and deleveraging. Net worth stood at ₹597 crore, significantly lower due to accumulated losses, compared to ₹959 crore as of March 31, 2025.

- Strategic Developments: Satya Microcapital’s Q2 FY26 results indicate a period of acute financial stress. The business reported a steep fall in revenue combined with a surge in credit costs, leading to heavy losses. Asset quality weakened sharply, with GNPA jumping to over 12% and NNPA crossing 6%, pressuring provisioning and capital ratios. The company also breached key regulatory thresholds — CRAR fell to 11.16% and qualifying asset ratio dropped below 60%, both highlighted by auditors. However, Satya undertook corrective steps: a ₹101.9 crore equity infusion in November 2025 improved CRAR to 15.92%, and management has stated that discussions with investors and lenders are ongoing for further capital support. The loan book contraction and decline in total assets show that Satya is operating in a risk-containment mode, prioritizing recoveries and liquidity over growth. Going forward, stabilizing asset quality, rebuilding capital buffers, improving recoveries, and restoring lender confidence are essential for operational continuity. The next few quarters remain crucial as the company attempts to regain regulatory compliance, strengthen collections, and gradually normalize disbursements.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.