TRL Krosaki Refractories Ltd Releases its FY25 Results

24 September 2025

Financial Performance

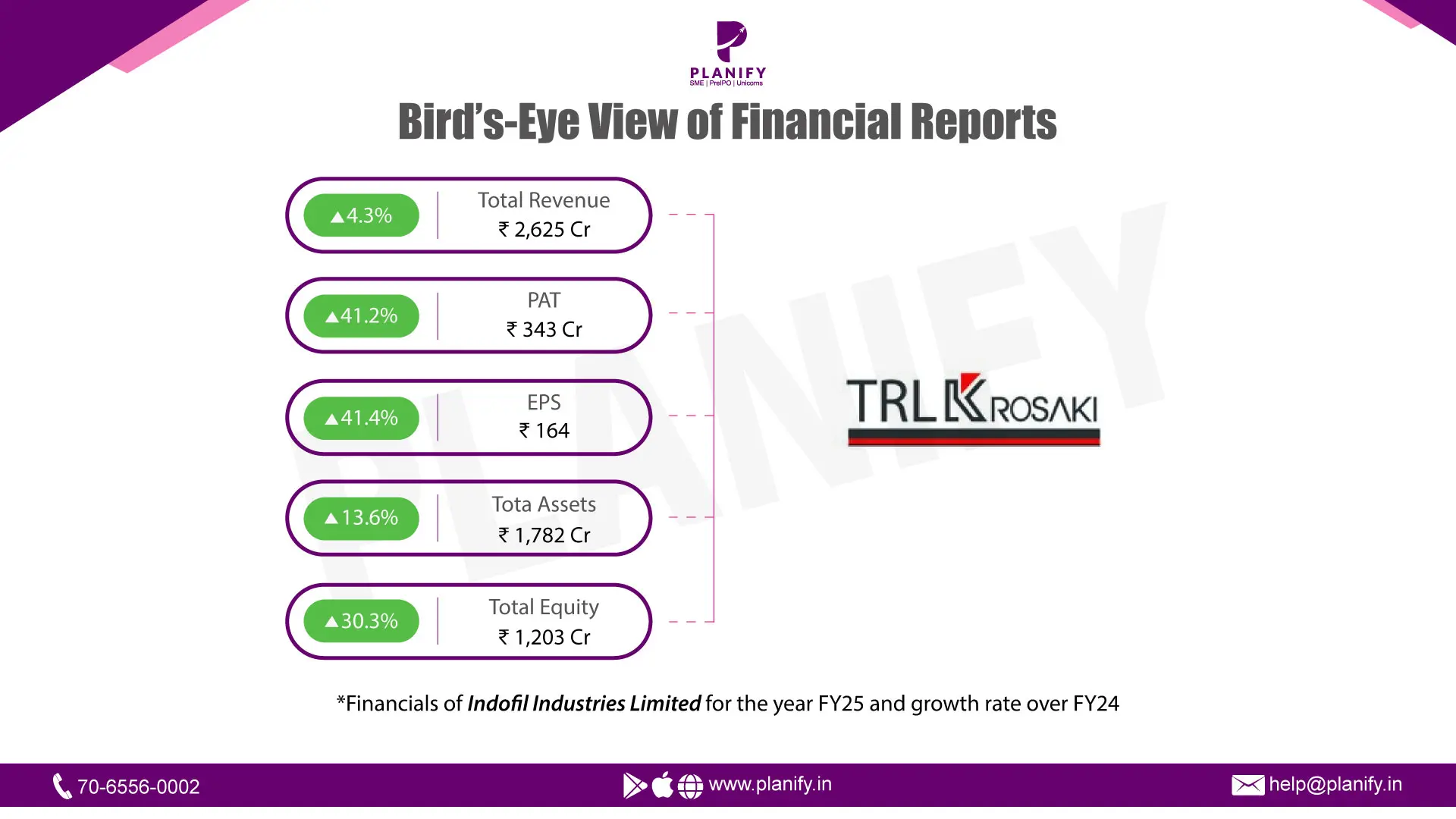

TRL Krosaki Refractories delivered record results, with Total Income rising 4.3% YoY to ₹2,625 Cr in FY25 from ₹2,516 Cr in FY24, driven by higher domestic demand and efficiency gains despite softer exports. Profitability accelerated sharply — Profit Before Tax (PBT) grew 40% YoY to ₹433 Cr versus ₹309 Cr last year. Net Profit (PAT) jumped 42% YoY to ₹342 Cr from ₹241 Cr in FY24, marking the highest-ever profit in the company’s history.

Operational Metrics

Operational performance was resilient. EBITDA improved to ₹363 Cr, reflecting a margin of 13.8%, up from 13.1% in FY24, aided by cost control and product mix optimization. Net Profit Margin rose to 13.0% from 9.6%, underscoring efficiency gains. Contribution from value-added segments like Flow Control (+12% YoY) and Dolomite refractories remained strong. Export revenue softened (₹297 Cr vs ₹321 Cr in FY24), but domestic growth offset the decline

Strategic Developments

FY25 was transformational for TRL Krosaki:

- Completed Phase II expansion of the Taphole Clay Plant and capacity expansion of the RH Snorkel Plant, reducing import dependency

- Modernised the Monolithics Plant at Belpahar, boosting automation and efficiency .

- Strengthened international presence in Europe, North America, Africa, and Southeast Asia, with 30% YoY growth overseas

- Retail MSME & Channel Business touched ₹431 Cr sales (+18% YoY), emerging as a key growth driver

- Maintained market dominance in Dolomite refractories (70% share) and expanded into cement rotary kilns from its Gujarat operations.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.