Blog

Planify Feed

Utkarsh CoreInvest Reports Weak Earnings in FY25

Link copied

Utkarsh CoreInvest Reports Weak Earnings in FY25

19 September 2025

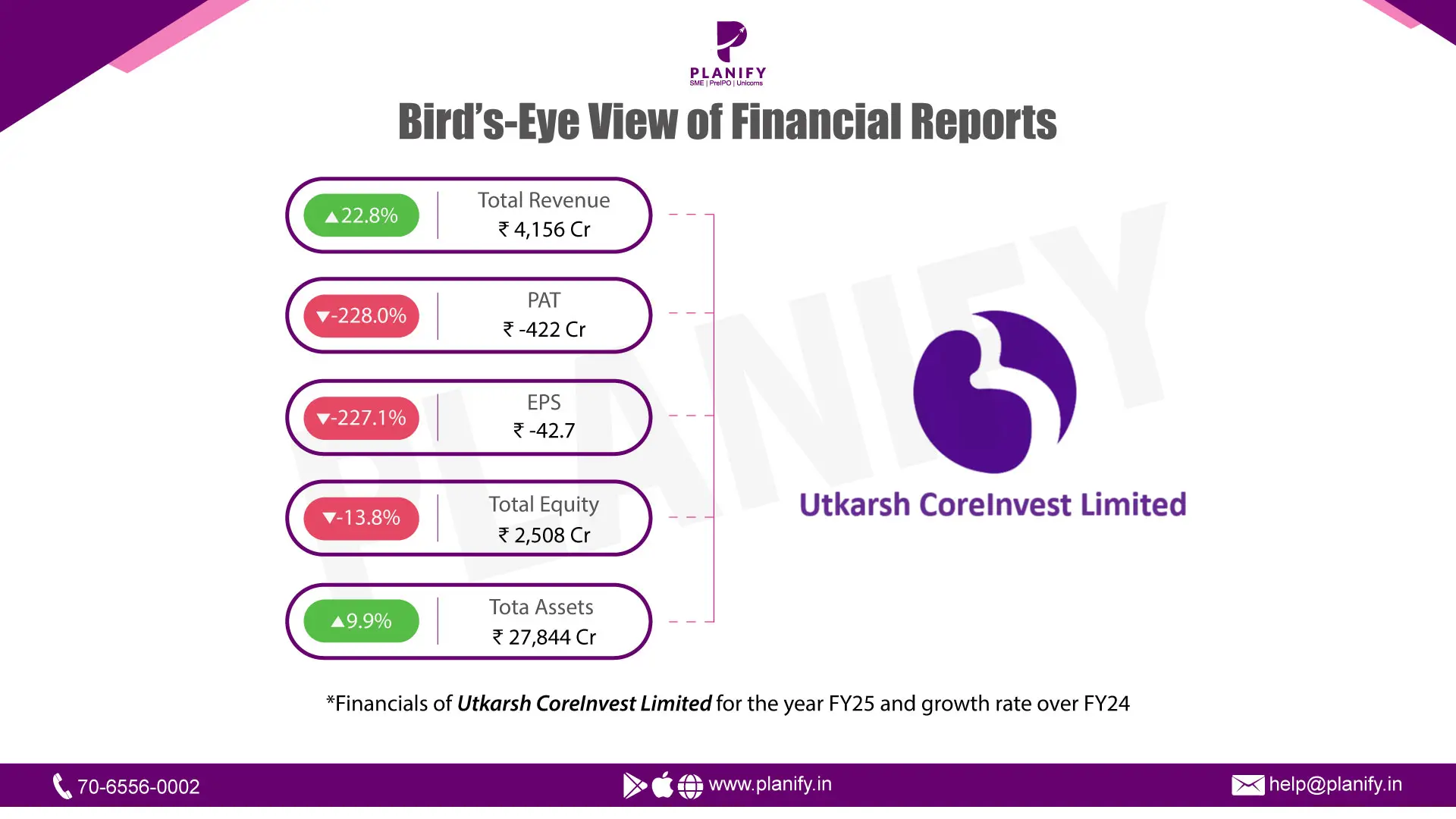

- Financial Performance (FY25 vs FY24): FY25 turned out to be a challenging year for Utkarsh CoreInvest. On a consolidated basis, total income rose by 22.8% YoY to ₹4,156 Cr (vs ₹3,384 Cr in FY24). However, due to significantly higher impairments and operating costs, the company posted a loss before tax (LBT) of ₹556 Cr in FY25 compared to a profit of ₹439 Cr in FY24. Consequently, the company slipped into a net loss of ₹422 Cr in FY25, versus a profit of ₹330 Cr last year. EPS also turned negative at ₹ (42.7) compared to ₹33.6 in FY24. This reversal highlights the severe stress on earnings, largely driven by asset quality issues in its banking subsidiary. On a standalone basis, the holding company remained profitable, posting a PAT of ₹30.3 Cr in FY25, up sharply from ₹1.4 Cr in FY24.

- Operational Metrics (FY25 vs FY24): Despite income growth, profitability metrics worsened. The net profit margin dropped to (10.2%) in FY25 from a healthy 9.8% in FY24, reflecting a combination of higher credit costs and weaker operating leverage. Operating margins also contracted as provisions for impairment surged to ₹1,370 Cr in FY25 (vs ₹378 Cr in FY24), a nearly 3.6x increase. On the balance sheet side, consolidated net worth stood at ₹2,508 Cr as of March 31, 2025, compared to ₹2,911 Cr in FY24. Asset quality sharply deteriorated. The Gross NPA ratio spiked to 9.4% in FY25, up from 2.5% in FY24, while the Net NPA ratio rose to 4.8%, versus just 0.03% last year. This erosion in asset quality was the key driver behind the losses and remains the most pressing risk.

- Strategic Developments: FY24, Utkarsh Small Finance Bank (the main subsidiary) got listed, expanding its visibility and capital market access. The bank grew its deposit base by 23.5% to ₹22,235 Cr in FY25 as compared to ₹17,998 Cr last year. Despite weak profitability, the company maintained a comfortable CRAR of 20.9%, though lower than 22.6% in FY24. During FY25, Utkarsh CoreInvest advanced the merger process with Utkarsh Small Finance Bank, which received final board approvals in September 2024 and RBI’s NOC in January 2025. This reverse merger is expected to streamline operations, strengthen capital, and reduce structural overlaps. Going forward, management has indicated sharper focus on improving asset quality, rebalancing towards secured lending, and leveraging technology to drive efficiency and customer acquisition.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.