Blog

Planify Feed

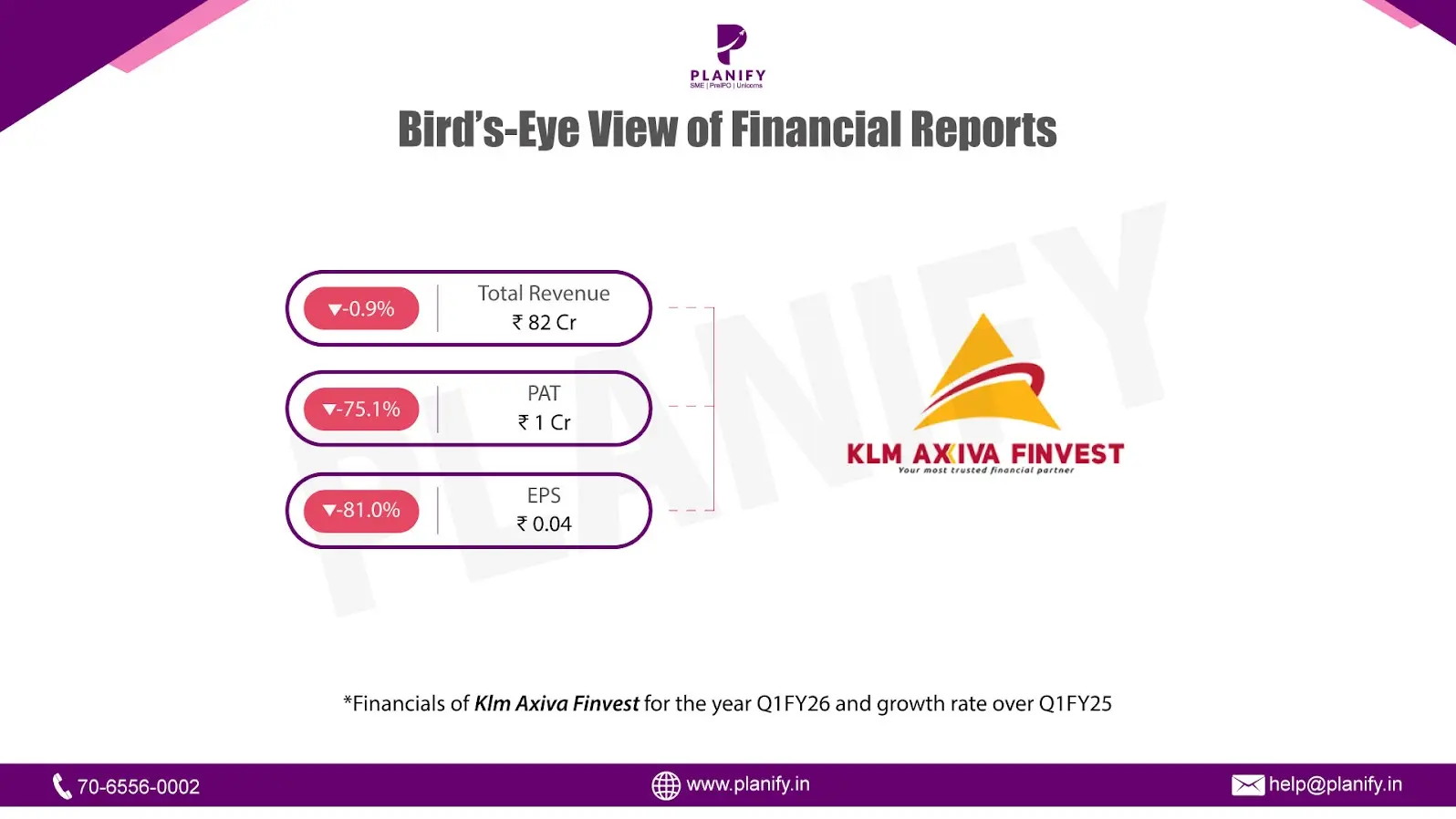

Weak Profitability in Q1FY26 for KLM Axiva

Link copied

Weak Profitability in Q1FY26 for KLM Axiva

18 August 2025

- Financial Performance (Q1FY26 vs Q1FY25): KLM Axiva reported a 0.9% YoY decline in total income to ₹82 Cr in Q1FY26 from ₹83 Cr in Q1FY25, as interest income remained nearly flat at ₹80 Cr (vs ₹81 Cr). Other income, however, rose 22.4% YoY to ₹2 Cr from ₹1.7 Cr, partially offsetting weaker lending yields. Total expenses grew 4.9% YoY to ₹81 Cr (vs ₹77 Cr), driven mainly by higher finance costs (+12.1% YoY to ₹45 Cr). Impairment charges fell sharply to ₹0.5 Cr (vs ₹1.5 Cr), offering some relief. Profit Before Tax (PBT) declined 80.8% YoY to ₹1.1 Cr from ₹5.7 Cr, reflecting pressure from rising costs. Profit After Tax (PAT) dropped 75.1% YoY to ₹1 Cr from ₹4 Cr. Earnings per share (EPS) stood at ₹0.04 in Q1FY26, compared to ₹0.21 in Q1FY25.

- Operational Metrics (Q1FY26 vs Q1FY25): Net profit margin contracted sharply to 1.3% in Q1FY26 from 5.3% in Q1FY25, highlighting reduced profitability. Gross NPA (GNPA) rose to 2.29% from 1.90%, while Net NPA (NNPA) increased to 1.37% from 1.20%, reflecting some deterioration in asset quality. The Provision Coverage Ratio (PCR) remained moderate at around 40.2%. The loan portfolio remained largely flat at ₹1,656 Cr compared to ₹1,660 Cr in Q1FY25, indicating a cautious lending approach. The Capital Adequacy Ratio (CRAR) stood at 16.4%, comfortably above regulatory requirements.

- Strategic Developments:Q1FY26 was a steady quarter for KLM Axiva, with income growth remaining flat and profitability moderating due to higher funding costs and narrower spreads. Asset quality showed a marginal weakening, with both GNPA and NNPA rising slightly but staying within manageable levels. On the positive side, impairment charges declined significantly on a year-on-year basis, and capital adequacy remained comfortably above regulatory requirements. The loan book was largely unchanged, reflecting a cautious and selective approach to disbursements in a tighter credit environment. Looking ahead, the company aims to focus on optimizing funding costs, improving lending margins, strengthening credit underwriting practices, and gradually accelerating loan growth while maintaining asset quality.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.