Planify Feed

Date: Fri 05 Dec, 2025

Garuda Aerospace founded by Agnishwar Jayaprakash has formally converted itself into a public company, dropping “Private” from its name as a preparatory step toward a potential IPO.

To strengthen governance ahead of a potential listing, the company has also added new independent directors to its board.

Solid FY25 Performance

- In FY25, Garuda posted ₹118 crore in revenue, up from ₹110 crore in FY24.

- Profit After Tax stood at ₹17.5 crore, continuing a streak of profitability in a typically capital-intensive industry.

- For FY26, the company targets ₹365 crore in revenue, pointing to aggressive growth plans backed by expanding manufacturing and export ambitions.

- The firm boasts India’s largest commercial drone fleet: 400+ drones and 500 trained pilots, operating across 84 cities, producing over 30 drone models and offering 50+ services.

What Makes Garuda Stand Out — Strategy & Strengths

Strong funding backing: In April 2025, Garuda raised ₹100 crore in a Series B led by Venture Catalysts; later followed by investment from Narotam Sekhsaria Family Office and existing backers, boosting firepower ahead of public listing.

Scaling manufacturing capacity: With plans to ramp up production from 8,000 drones per year to 12,000–15,000, the company is building a production base comparable to global drone manufacturers.

Regulatory get-rights and export licence: Garuda has secured DGCA certifications, and won export clearances to ship drones to markets like US, Australia, and Middle East paving way for global ambitions.

Diversified use-cases beyond agriculture: From precision agriculture and disaster relief to defence-grade drones and logistics solutions , Garuda targets multiple high-growth verticals, reducing reliance on a single segment.

These advantages place Garuda as one of the few drone-tech firms in India with a credible path to scale, export, and diversified business models.

Date: Fri 05 Dec, 2025

Wakefit Innovations, one of India’s leading home-and-sleep solutions brands, opens its IPO subscription window on December 8, 2025.

The offer comprises a fresh issue of roughly ₹377 crore plus an Offer-for-Sale, valuing the company at around ₹6,000–6,400 crore.

Backed by promoters Ankit Garg and Chaitanya Ramalingegowda, Wakefit has moved beyond mattresses and built a diversified home-furnishing portfolio; beds, sofas, wardrobes, décor, and more, sold through online, offline, and its own stores.

Over the years, the company has quietly built a vertically integrated engine:

The IPO is expected to strengthen working capital, expand manufacturing capacity, and deepen Wakefit’s presence across Tier-2/3 India, markets that now contribute more than 45% of sales.

FY25: Growth Amid Losses

- Revenue from operations rose about 29–30% in FY25 to ₹1,305 crore.

- The company remained EBITDA-positive with ₹90.8 crore EBITDA in FY25.

- However, net loss widened to ₹35 crore, compared with ₹15 crore loss in FY24, driven by higher operating expenses including material, marketing and store expansion costs.

- In H1 FY26 alone (six months through Sept 2025), Wakefit reported ₹741 crore revenue and a small profit after tax of ₹35.5 crore, suggesting early signs of turnaround post-IPO filing.

With its tightly integrated manufacturing engine, expanding omni-channel footprint, and a growing home solutions portfolio, Wakefit enters the public markets with the fundamentals of a business built for scale, a mix that makes the IPO worth watching.

Date: Tue 02 Dec, 2025

OYO’s parent company, PRISM, is finally putting its long-awaited public-listing story back on track.

PRISM, the parent company behind OYO, is making its most serious IPO push yet. It has called an Extraordinary General Meeting (EGM) on 20 December 2025 to seek shareholder approval for a ₹6,650-crore fresh equity raise. At the same time, it has proposed a 1:19 bonus share issue, with December 5 set as the record date.

Alongside the IPO, shareholders will vote to increase authorised share capital to ₹2,491 crore, a structural move signaling readiness for significant public-market commitments.

A Company Built for Scale, Now Rebuilt for Discipline

OYO founded by Ritesh Agarwal, scaled faster than any Indian hospitality startup, branding thousands of hotels, homestays, and vacation homes across India, Europe, and Southeast Asia.

But hyper-expansion came with high burn, lease obligations, and inconsistent property economics.

The last two years have been about repair, not expansion.

- PRISM has reduced costs, tightened compliance, improved hotel partner incentives, and focused on profitable geographies.

- The company’s shift back to a franchise-first, asset-light model has improved cash flows and reduced volatility.

- PRISM is cleaning up governance, revising authorized share capital, and simplifying shareholder tiers.

All this, signals the first meaningful step toward that future. Can the Hospitality Giant Finally Earn Public-Market Trust?

OYO’s rebound will ultimately be judged by its ability to turn improving occupancy into steady, year-round margins only then will public markets may reward it with a valuation grounded in fundamentals rather than optimism.

Date: Sat 29 Nov, 2025

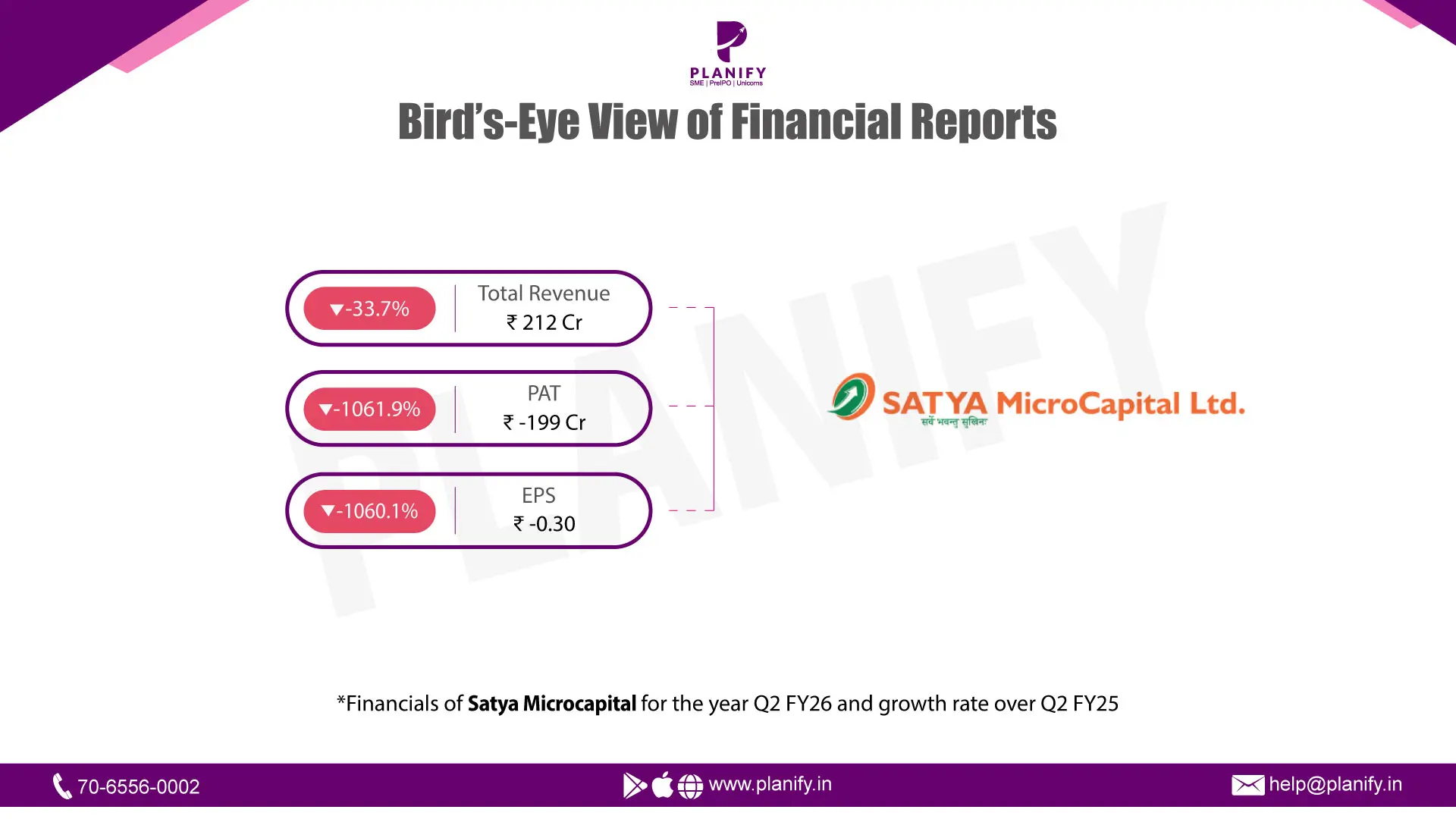

- Financial Performance (Q2 FY26 vs Q2 FY25): In Q2 FY26, Satya Microcapital reported total income of ₹212 crore, down 33.7% YoY from ₹320 crore in Q2 FY25. Interest income dropped to ₹182 crore, down 34.4% YoY from ₹277 crore, while fee/commission income also fell significantly. Though Finance costs decreased sharply to ₹121 crore, down 18.3% YoY from ₹148 crore, Impairment on financial instruments remained high at ₹92 crore, up 364.6% YoY (vs ₹19.7 crore last year), driven by higher expected credit losses. As a result, Profit Before Tax (PBT) came in at a steep loss of ₹156 crore, compared to a profit of ₹28 crore in Q2 FY25 — a deterioration of 662.5% YoY. Profit After Tax (PAT) stood at a loss of ₹199 crore, significantly worse than the ₹21 crore profit in Q2 FY25. Basic EPS for the quarter was ₹(30.34) compared to ₹3.16 a year earlier.

- Operational Metrics (Q2 FY26 vs Q2 FY25): Gross NPA (GNPA) ratio stood at 12.51%, worsening from ~1.2% a year ago, while Net NPA (NNPA) was 6.56% (vs 0.42% in FY25), reflecting severe portfolio stress. The Provision Coverage Ratio (PCR) was 50.94%, lower than the previous year’s 65% level, suggesting a reduced buffer against potential portfolio risks. Capital adequacy remained weak at 11.16%, below the RBI requirement of 15%, though it improves to 15.92% post the November 2025 equity infusion as disclosed. The loan book on the balance sheet was ₹2,938 crore as of Sept 30, 2025, down sharply from ₹3,535 crore in FY25, reflecting portfolio contraction amid elevated credit costs. Total assets were ₹4,439 crore, lower than March 31, 2025 levels (₹5,599 crore), driven by reduced disbursements and deleveraging. Net worth stood at ₹597 crore, significantly lower due to accumulated losses, compared to ₹959 crore as of March 31, 2025.

- Strategic Developments: Satya Microcapital’s Q2 FY26 results indicate a period of acute financial stress. The business reported a steep fall in revenue combined with a surge in credit costs, leading to heavy losses. Asset quality weakened sharply, with GNPA jumping to over 12% and NNPA crossing 6%, pressuring provisioning and capital ratios. The company also breached key regulatory thresholds — CRAR fell to 11.16% and qualifying asset ratio dropped below 60%, both highlighted by auditors. However, Satya undertook corrective steps: a ₹101.9 crore equity infusion in November 2025 improved CRAR to 15.92%, and management has stated that discussions with investors and lenders are ongoing for further capital support. The loan book contraction and decline in total assets show that Satya is operating in a risk-containment mode, prioritizing recoveries and liquidity over growth. Going forward, stabilizing asset quality, rebuilding capital buffers, improving recoveries, and restoring lender confidence are essential for operational continuity. The next few quarters remain crucial as the company attempts to regain regulatory compliance, strengthen collections, and gradually normalize disbursements.

Date: Sat 29 Nov, 2025

PharmEasy was once heralded as India’s health-tech unicorn, a one-stop digital pharmacy + diagnostics + tele-health platform.

But by 2024, heavy losses, falling valuations and management changes had shaken investor confidence.

API Holdings (the parent) had grown aggressively through acquisitions like Thyrocare, but the integration was messy and cash burn worsened.

Now, under its new CEO Rahul Guha, PharmEasy is making bold moves to shift from “growth at any cost” to “profitable, sustainable scale.

And the numbers now reflect a business that is finally pulling itself back.

- PharmEasy reduced its net loss by ~40% in FY25, even with flat revenue of ₹5,872 crore, showing meaningful operating discipline.

- Procurement efficiency jumped from ~40% to nearly 85%, sharply reducing cost leakages and improving margins.

- High-cost loans were refinanced, lowering interest burden and stabilizing API Holdings’ balance sheet.

- The company shut non-core experiments and redirected capital to high-margin, recurrence-heavy segments chronic medication, diagnostics, and in-house procurement.

- Thyrocare’s diagnostics arm showed a turnaround too, giving the group a profitable anchor and smoother cash flows.

- Monthly burn dropped from ~₹50 crore to under ₹2 crore, marking one of the fastest burn reductions in Indian health-tech.

So, while top-line growth is modest, bottom-line stress has eased and that’s a critical first step for any turnaround.

It’s fair to say, based on the latest data that PharmEasy is showing margin improvement and financial stabilization. The internal procurement, cost control, and debt / expense rationalization have helped reduce burn and shrink losses.

But the business remains loss-making as of FY25. Until EBITDA turns positive and the core pharmacy business becomes cash-flow positive, the margin story remains cautiously optimistic.

Now, PharmEasy is no longer the high-burn startup chasing growth at any cost. It’s trying to become a lean, recurring-revenue healthcare services engine with scale, sustainability, and clarity.

Date: Thu 27 Nov, 2025

In India’s value-commerce universe, Meesho founded by Vidit Aatrey, began as a modest WhatsApp-reseller marketplace, serving tier-2 and tier-3 consumers.

Meesho is now targeting a post-money valuation of around ₹52,500 crore (~US$5.93 billion) for its upcoming IPO, slated for early December.

The company plans to raise ₹4,250 crore via a fresh issue and additional shares through offer-for-sale (OFS) by early-stage investors.

Where Meesho Stands Today: FY25 Performance Snapshot

In FY25, Meesho reported a significant narrowing of losses.

- Revenue: ~₹9,900 crore (strong YoY growth)

- Net Loss: Adjusted Loss reduced to ₹108 crore excluding exceptional items

- Orders Processed: 1.3 billion+ orders

- Transacting Users: 187 million

- Market Share: ~23–25% in Home, Kitchen & Furnishings category

- Operating Model: Zero-commission + high-volume + low AOV strategy

- Profitability Move: Contribution margins improved, and cash burn reduced substantially

The company claims FY25 to be its “most efficient year ever,” supported by scale-led efficiencies

What the IPO proceeds will fuel: cloud-infrastructure upgrades, AI/ML teams, brand building, inorganic growth and expansion of its logistics arm.

Still, this is no low-risk play. Fast growth, thin margins, fierce competition, logistics costs, and execution risk all loom large. Investors will watch if Meesho can turn its scale into sustainable, profitable growth rather than just top-line headline numbers.

Date: Thu 27 Nov, 2025

InCred Holdings (parent of InCred Financial Services) founded by Bhupinder Singh has filed draft papers with SEBI through the confidential route as it prepares for an IPO likely in the ₹3,000–4,000 crore range. The move follows fresh private investments and strategic deals that position the group for faster AUM growth and product diversification.

- Profitability: InCred reported ~₹372 crore PAT in FY25, an improvement year-on-year, reflecting better core margins and scale.

- Loan book / AUM: The group’s loan book/AUM has been growing rapidly — AUM crossed ~₹11,000–12,000 crore in FY25 (36–49% growth indicators in FY24–FY25).

- Asset quality & capital: Reported GNPA / NNPA metrics remain modest and capital adequacy appears healthy (CRAR and investor backing have been highlighted in ratings notes).

InCred is a tech-embedded NBFC that has diversified across consumer, education, SME and institutional lending, plus fee businesses (syndication, asset management).

It is moving from a growth-funded private model to public capital markets just as its unit economics have strengthened, a classic IPO moment for an NBFC scaling profitably. The recent strategic investments (including a ₹250 crore minority stake by Zerodha founders) add credibility and market visibility.

Strengths: strong AUM momentum, improving PAT, product diversification (including recent acquisitions/portfolio additions), healthy investor interest, and ratings agency acknowledgement of disciplined underwriting. These give InCred a shot at a smooth IPO if valuation and use-of-proceeds align with growth plans.

Date: Thu 27 Nov, 2025

InSolare Energy is no longer just a solar EPC—it’s quietly moving up the energy value chain. The Jaipur-headquartered company now boasts 1+ GW of executed solar EPC projects and a multi-city presence, signalling steady execution capability across India’s biggest renewable markets.

- Recently InSolare as part of an SCC Infrastructure–InSolare consortium won a 70,000 tonnes per annum green-ammonia supply contract under SECI’s SIGHT scheme — a major win that positions the company into green hydrogen derivatives and industrial off-take. The consortium quoted ~₹53.05/kg for the project, and this award gives InSolare access to PLI incentives for indigenous electrolyser manufacturing and green-hydrogen value chains.

- Growth has been backed by capital and market interest. The firm raised roughly ₹66.5 crore in a pre-IPO round (Feb 2024) from names such as Mukul Agarwal and Negen Capital.

- India’s renewable landscape is evolving fast — from solar EPC to integrated clean-energy models.

InSolare is positioning itself right in the middle of this transition.

The opportunity is massive:

India targets 5 million tonnes of green hydrogen by 2030, and early SECI allocations could define long-term winners.

But risks remain: EPC margins, hydrogen project financing, and execution quality will determine how far this momentum carries.

EPC markets remain competitive and margin-sensitive; scaling into electrolysers and green-ammonia requires capex, partner coordination, and supply-chain depth.

Can a 1-GW EPC player successfully scale into green hydrogen — or is this leap too early?

Date: Thu 27 Nov, 2025

In India’s logistics ecosystem, some companies build empires without ever making noise.

Skyways Air Services is one of them.

For nearly four decades, Skyways has been the behind-the-scenes force powering India’s export engines, manufacturing hubs, D2C brands, and global freight corridors. And now, as the company gears up for a potential IPO in the coming quarters, the market is waking up to what Skyways has quietly built.

Most people know India’s aviation story.

Very few know the air-cargo story — and Skyways sits right at the center of it.

About Skyways Air Services

Skyways started as a modest air-cargo forwarding company in 1984 and has grown into one of India’s top freight forwarders, trusted by airlines and exporters alike. It handles air, ocean, road and value-added logistics services—covering import-export, warehousing, custom-broking and technology-driven express cargo.

Skyways group founded by S.L. Sharma has consistently ranked among India’s top air-freight forwarders, handling large export volumes for industries like pharma, electronics, retail, and fast-moving manufacturing. Mr. Yashpal Sharma is now the Chairman and Managing Director and has played a significant role in the company's growth.

- Around 75% of its revenue comes from air freight, a rarity in India’s logistics sector where road freight dominates.

- The company has expanded into ocean freight, warehousing, trucking, customs brokerage, and supply-chain tech- transforming from a forwarding company into an end-to-end logistics platform.

- It operates across major airports and ports, supported by a strong PAN-India presence and overseas partners.

With 75 % of revenue from air freight, a decade-plus track record, and expansion into full-spectrum logistics, Skyways looks like a logistics engine ready to be re-rated. The IPO of this legacy player could be the chance to tap beat-the-index returns in a sector many overlook.

Date: Sat 22 Nov, 2025

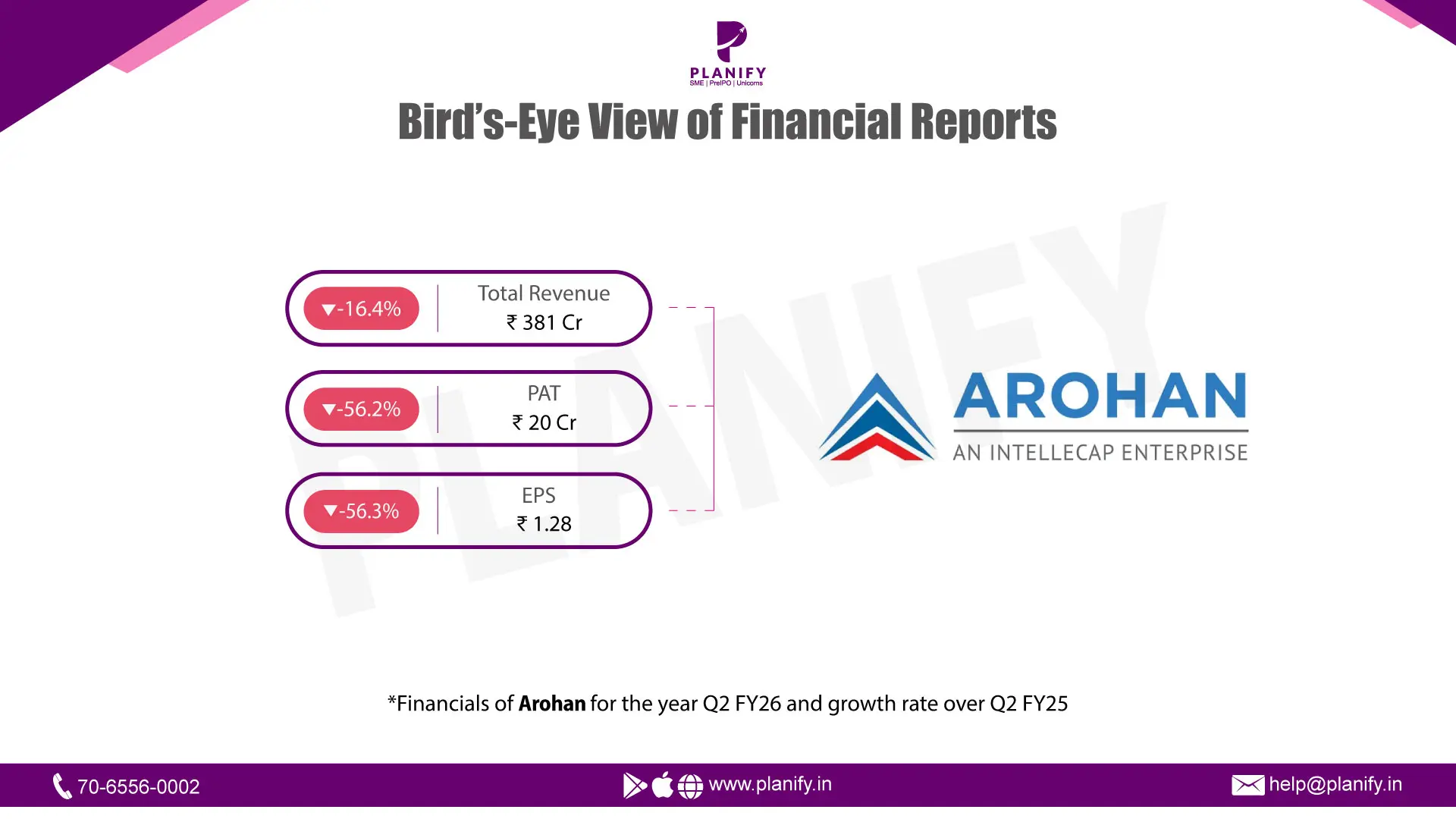

- Financial Performance (Q2FY26 vs Q2FY25): In Q2 FY26 Arohan Financial reported total revenue of ₹381 crore, down 16.4% YoY from ₹456 crore in Q2 FY25. Interest income fell to ₹342 crore, down 19.4% YoY from ₹424 crore, while fees and other non-interest income also moderated. Finance costs declined to ₹128 crore, down 23.6% YoY, offering some relief, but impairment on financial instruments remained elevated at ₹95 crore (down 4.2% YoY). Profit before tax (PBT) came in at ₹26 crore, down 56.6% YoY from ₹59 crore, and profit after tax (PAT) was ₹20 crore, down 56.2% YoY from ₹45 crore. Basic EPS for the quarter fell to ₹1.28 from ₹2.93 a year earlier (down 56.3%).

- Operational Metrics (Q2FY26 vs Q2FY25): Gross Stage-3 (GNPA) ratio was 2.0%, up from ~1.5% a year ago, and Net Stage-3 (NNPA) ratio was 0.52% (vs 0%), indicating a deterioration in asset quality. Provision Coverage Ratio (PCR) stood at 74.5%, lower than earlier peak levels but still providing a material cushion. Capital adequacy remained strong at 34.5%. Loan book (loans on balance sheet) was ₹5,622 crore as at Sept 30, 2025, marginally down 1.5% versus Mar 31, 2025 (₹5,705 crore), while total assets rose to ₹7,117 crore (up 3.3% vs Mar 31, 2025). Net worth was ₹2,054 crore, up 1.4% sequentially.

- Strategic Developments: Arohan’s Q2 results show weaker revenue and sharply lower profitability driven by sustained credit costs and softer interest/fee income. The moderation in finance costs helps, but elevated impairments keep returns depressed. The slightly higher GNPA and lower PCR versus prior peaks mean asset-quality improvement must be watched closely. On the positive side, the company’s capital adequacy is strong and total assets are steady; with RBI’s earlier lifting of lending restrictions, Arohan can normalize disbursements — this should support loan-book recovery and revenue traction over coming quarters, provided underwriting and collections are tightened and operating costs are managed.

Date: Sat 22 Nov, 2025

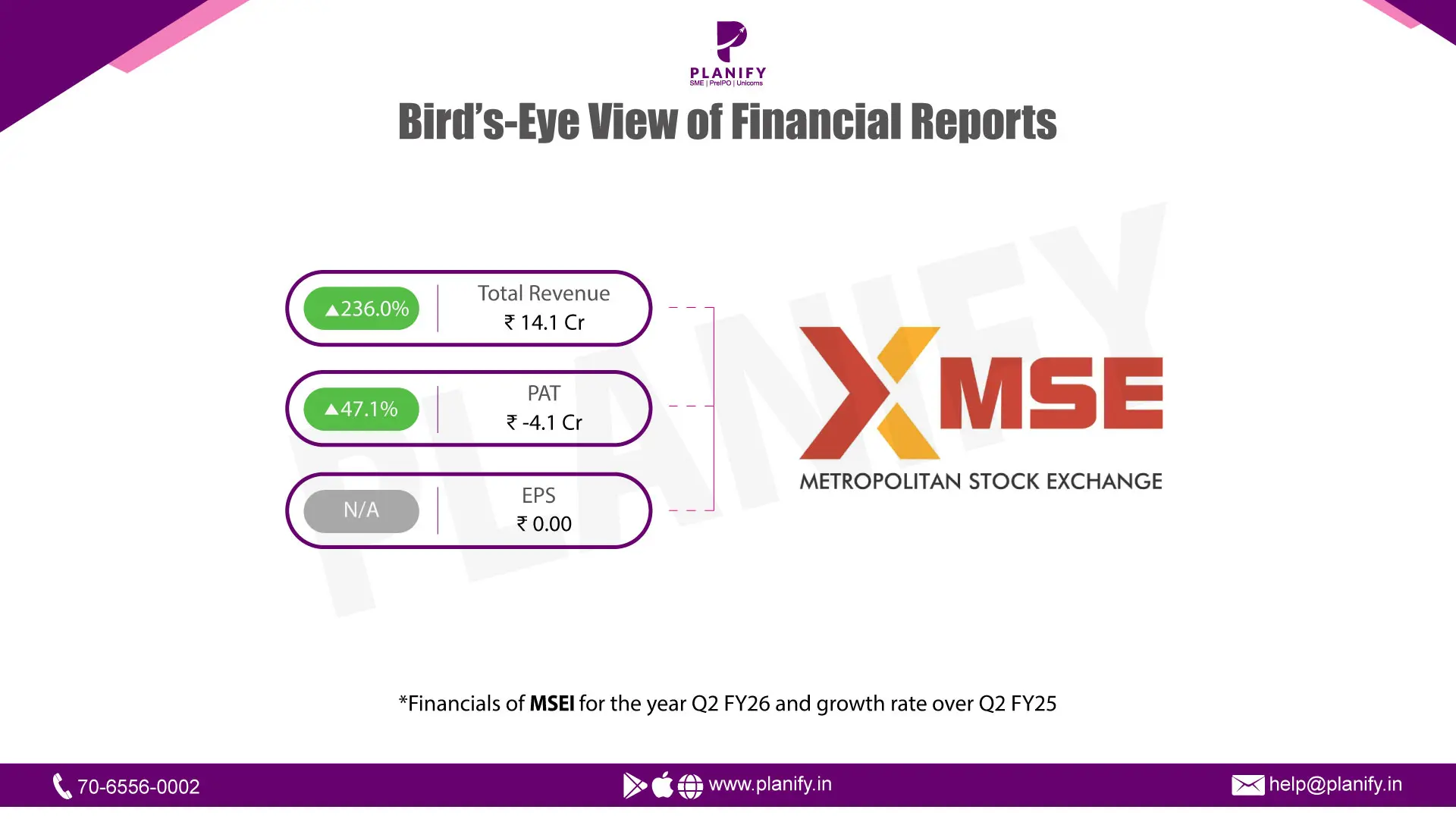

- Financial Performance (Q2FY26 vs Q2FY25): In Q2FY26, MSEI reported a sharp 236.0% YoY increase in total income to ₹14.1 Cr, compared with ₹4.2 Cr in Q2FY25, driven primarily by a steep rise in other income, which surged to ₹13.2 Cr from ₹3.3 Cr last year. Revenue from operations remained weak, declining 3.4% YoY to ₹0.86 Cr versus ₹0.89 Cr in Q2FY25. Operating performance improved significantly as the loss before tax narrowed to ₹4.1 Cr, an improvement of 47.1% YoY compared with a loss of ₹7.7 Cr in the prior year. At the net level, the company also recorded a lower loss of ₹4.1 Cr, compared with ₹7.7 Cr in Q2FY25. Earnings Per Share (EPS) improved to ₹(0.00) from ₹(0.02) last year, supported by both reduced losses and a substantially higher equity base.

- Operational Metrics (Q2FY26 vs Q2FY25): Net loss margin improved sharply to (29.0%) in Q2FY26 from (184.0%) in Q2FY25, primarily due to higher other income offsetting elevated operating costs. Employee expenses rose 65.8% YoY to ₹5.8 Cr, reflecting cost pressures and scaling of operations, while administration and other expenses increased 152.7% YoY to ₹4.7 Cr. Finance costs increased to ₹0.17 Cr from ₹0.01 Cr, though still negligible as a proportion of the cost base.

- Strategic Developments: Q2FY26 was marked by a significant strengthening of the balance sheet driven by large-scale equity issuance, with the paid-up capital rising to ₹1,099.5 Cr, enabling the company to substantially expand its investment portfolio. Despite persistent operating losses, the quarter demonstrated meaningful progress in reducing net losses, supported by strong treasury income. The continued revival effort is supported by major investor participation through private placements and the reappointment of the MD & CEO, ensuring leadership continuity. However, core trading activity remains subdued, reflected in weak operational revenue, underscoring the need to rebuild volumes and platform activity for sustainable financial turnaround. Overall, the quarter reflected material improvement in financial stability, narrowing losses, and enhanced liquidity, although with continued dependence on non-operating income.

Date: Tue 11 Nov, 2025

Royal Challengers Bengaluru (RCB), one of the marquee teams of the Indian Premier League (IPL), is now reportedly set to be sold, with its owner United Spirits Ltd (USL) having initiated a strategic review of the franchise ahead of March 31, 2026.

Nikhil Kamath, co-founder of Zerodha is among the top contenders to buy RCB. And when one franchise changes hands at a premium, the ripple travels across the league.

All eyes are now on Chennai Super Kings (CSK)

Unlike RCB, which has changed hands before, CSK’s promoters, led by N. Srinivasan’s group recently increased their stake in the holding company, signaling confidence in its long-term value.

CSK’s strong profitability, consistent fan engagement, and historic performance have made its unlisted shares

Beyond the Game: The Business of IPL

The IPL’s total brand value now stands at $18.5 billion, according to reports, with franchises evolving into global sporting assets, much like NBA or Premier League clubs.

- For investors, these teams are no longer “entertainment bets” — they’re cash-generating media properties with scalable sponsorship and digital rights potential.

- RCB’s exit has triggered a valuation reset across the league positioning CSK as the credible benchmark for sustainable profitability and fan engagement.

The current CSK share price in the unlisted market stands around ₹208–₹210 per share.

RCB’s shake-up sparks a new innings for CSK — will legacy translate into valuation momentum?

Date: Tue 11 Nov, 2025

In a surprising move, Aman Gupta, the co-founder and the face of the brand, stepped down from active operations.

Sameer Mehta has transitioned into the role of Executive Director, while Gaurav Nayyar, the company’s COO, now takes the helm as CEO.

Leadership exits right before a listing rarely goes unnoticed.

- According to its latest DRHP, the company also disclosed a 34% employee attrition rate in FY25, up from 28% the year before. That means one in three employees left the company in a single year.

- It’s leadership churn, high attrition, and an uneasy road to the IPO.

Despite the red flags, boAt remains India’s market leader in wearables, with over 27% market share in audio and strong recall across Tier 2 and 3 cities.

Its return to profitability in FY25 shows operational discipline.

The IPO Backstory

When boAt first filed for an IPO in 2022, it was a market darling.

A ₹2,000 crore issue backed by booming D2C optimism.

But as markets cooled and losses widened, the plan was shelved.

Now, three years later, the brand is trying again with a ₹1,500 crore IPO.

- In FY25, boAt turned profitable with ₹61 crore in PAT and ₹3,100 crore in revenue, but the real question isn’t about profits—it’s about consistency.

Above all, one thing will test: Can boAt turn brand loyalty into lasting investor trust?

Date: Mon 10 Nov, 2025

In India's edtech space, too many companies grew fast without proving profit.

PhysicsWallah is shifting that narrative.

Physics Wallah: born on YouTube, built by credibility, and scaled with cash discipline.

Now, the company is preparing for its market debut with an IPO, including a fresh issue of ₹3,100 crore and a ₹380 crore offer-for-sale led by promoters.

The funds will be used to expand its offline centres, hybrid learning model, and digital platform — a play that merges tech efficiency with traditional classroom trust.

Founder Alakh Pandey and Prateek Maheshwari each hold 105.12 crore shares, translating to a 40.31 percent stake apiece in the company. At the top price band, their individual stakes are valued at Rs 11,458 crore, or about $1.29 billion each.

The IPO is set at a price band of ₹103–₹109 per share.

Here’s what the numbers say:

The total IPO issue size is about ₹3,480 crore.

PhysicsWallah boasts 1 crore+ monthly active users and 500+ offline centres across its brands.

FY25 revenue: ₹1,240 crore (up ~42% YoY)

Profit after tax: ₹130 crore

Valuation: estimated around ₹28,426 - ₹30,000 cr (~$3.6 billion)

- Use of IPO proceeds: ~₹460.5 crore for new/hybrid centres fit-outs, ~₹548.3 crore for lease payments for existing, ~₹710 crore for marketing, and ~₹200.1 crore for server and cloud infrastructure.

- Grey market premium (GMP) shows early sentiment: around +8% in the unlisted market for this IPO.

Key risks to consider: The valuation is steep for a company still in expansion mode, and profitability is yet to be fully demonstrated. Offline centre expansion is capital-intensive and competitive pressures from other edtech players, tuition chains and technology platforms remain high. Execution matters.

Date: Fri 07 Nov, 2025

For years, India’s fintech story has been about apps that make payments faster.

But the next chapter is about something deeper — how merchants grow smarter with every transaction.

Pine Labs is entering the public market with a price band of ₹210-221 per share, launching 7- 11 November, raising ~₹3,900 crore.

From enabling tap-and-pay to powering EMI financing, digital gift cards, and loyalty programs — it’s turning every swipe into data, every data point into insight, and every insight into opportunity.

Behind every QR code at a local store or POS machine at a luxury outlet, there’s a layer of Pine Labs’ technology — connecting millions of merchants to credit, commerce, and customers.

Now, with its ₹3,900 crore IPO, Pine Labs is not chasing valuation hype.

FY25 revenue surged 28.5% YoY to ₹2,274 crore, while losses narrowed sharply from FY24.

But here’s the truth: It’s not yet a legacy profit-machine, Pine Labs still posted a net loss of ~₹145 crore in FY25.

- Grey Market Premium Substantially Falls in 5 days from ₹60 to ₹12.

- Key risks remain: It is still loss-making (net loss ~₹145 crore in FY25) despite revenue growth (~28% YoY).

- Competitive pressure is high: payments & merchant commerce is crowded, both domestically and globally, and margin squeeze is possible.

- Execution/internationalisation risk: The overseas growth and high-margin adjacencies are promising, but converting them into profits will take time.

- Investor dilution/esop risk: With a sizeable fresh issue plus OFS, institutional locking, and existing shareholder exits (eg. Peak XV Partners, PayPal Pte. Ltd., Mastercard Asia/Pacific Pte. Ltd.) the market will watch shareholding dynamics closely.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.